Reckon (ASX:RKN) Has Announced That Its Dividend Will Be Reduced To A$0.025

Reckon Limited's (ASX:RKN) dividend is being reduced from last year's payment covering the same period to A$0.025 on the 29th of September. This means the annual payment is 8.6% of the current stock price, which is above the average for the industry.

See our latest analysis for Reckon

Reckon Is Paying Out More Than It Is Earning

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Before making this announcement, Reckon was paying out quite a large proportion of both earnings and cash flow, with the dividend being 96% of cash flows. This is certainly a risk factor, as reduced cash flows could force the company to pay a lower dividend.

Looking forward, EPS could fall by 6.5% if the company can't turn things around from the last few years. If the dividend continues along recent trends, we estimate the payout ratio could reach 1,409%, which could put the dividend in jeopardy if the company's earnings don't improve.

Dividend Volatility

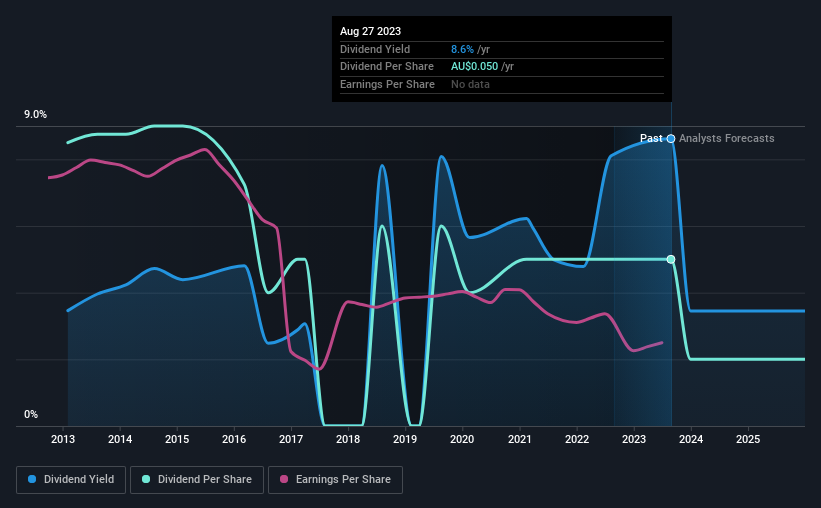

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2013, the dividend has gone from A$0.085 total annually to A$0.05. The dividend has shrunk at around 5.2% a year during that period. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

Dividend Growth May Be Hard To Come By

Given that the track record hasn't been stellar, we really want to see earnings per share growing over time. Reckon has seen earnings per share falling at 6.5% per year over the last five years. If earnings continue declining, the company may have to make the difficult choice of reducing the dividend or even stopping it completely - the opposite of dividend growth.

The Dividend Could Prove To Be Unreliable

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. The payments are bit high to be considered sustainable, and the track record isn't the best. Overall, we don't think this company has the makings of a good income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 2 warning signs for Reckon that you should be aware of before investing. Is Reckon not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:RKN

Reckon

Provides software solutions in Australia, New Zealand, the United States, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion