The Australian market has seen mixed performance, with the ASX200 closing flat at 7,936 points. In this context, investors may find value in exploring penny stocks—an investment area that remains relevant despite its somewhat outdated terminology. These smaller or newer companies can offer unique opportunities when backed by strong financials, and we'll highlight three such stocks that stand out for their potential to deliver long-term growth.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.635 | A$127.55M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.77 | A$1B | ✅ 4 ⚠️ 1 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.56 | A$73.59M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.40 | A$371.73M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.62 | A$121.75M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.21 | A$2.52B | ✅ 4 ⚠️ 1 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.08 | A$146.15M | ✅ 3 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.41 | A$808.31M | ✅ 5 ⚠️ 3 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.79 | A$1.28B | ✅ 5 ⚠️ 1 View Analysis > |

| LaserBond (ASX:LBL) | A$0.38 | A$44.59M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 980 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Clover (ASX:CLV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Clover Corporation Limited is involved in the production, refining, and sale of natural oils and encapsulated powders across various regions including Australia, New Zealand, Asia, Europe, the Middle East, and the Americas with a market cap of A$75.98 million.

Operations: The company generates revenue primarily from its Nutritional Oil and Microencapsulated Powders segment, which accounts for A$72.49 million.

Market Cap: A$75.98M

Clover Corporation Limited, with a market cap of A$75.98 million, has demonstrated significant earnings growth over the past year, outpacing the industry average. Its short-term assets comfortably cover both short and long-term liabilities, indicating strong financial health. The company has managed to reduce its debt significantly over five years and maintains more cash than total debt. Recent dividend affirmations suggest confidence in cash flow stability. However, despite high-quality past earnings and improved profit margins, its Return on Equity remains low at 6.7%. The management team is experienced with an average tenure of three years.

- Click here to discover the nuances of Clover with our detailed analytical financial health report.

- Assess Clover's future earnings estimates with our detailed growth reports.

Praemium (ASX:PPS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Praemium Limited, with a market cap of A$332.35 million, offers advisors and wealth management solutions through a seamless digital platform in Australia and internationally.

Operations: The company's revenue segment is primarily from Australia, generating A$95.58 million.

Market Cap: A$332.35M

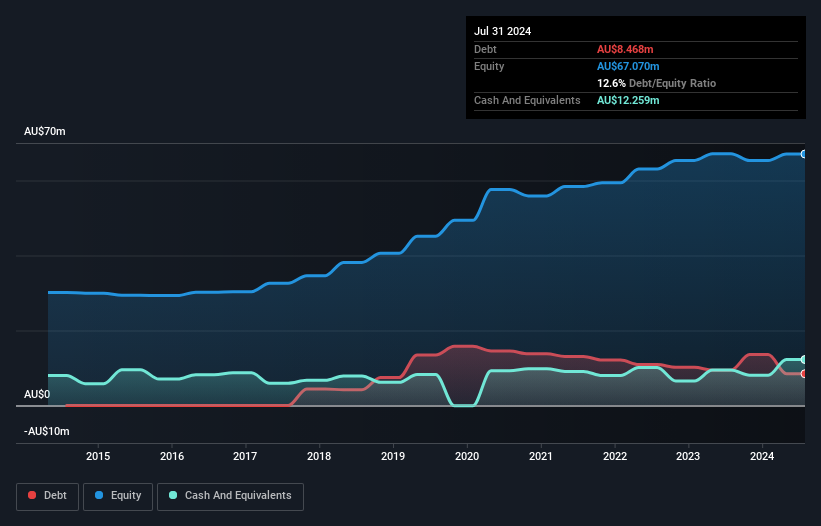

Praemium Limited, with a market cap of A$332.35 million, has shown consistent earnings growth over the past five years at 19.8% annually, though recent growth slowed to 4.9%. The company operates debt-free and maintains strong liquidity with short-term assets of A$52.2 million exceeding both short and long-term liabilities significantly. Despite a low Return on Equity of 9.8%, Praemium trades at an attractive price-to-earnings ratio compared to industry peers and analysts expect further stock price appreciation by 38.4%. Recent executive changes include Simon Moore as interim CFO following David Coulter's resignation, potentially impacting strategic direction.

- Get an in-depth perspective on Praemium's performance by reading our balance sheet health report here.

- Explore Praemium's analyst forecasts in our growth report.

Trek Metals (ASX:TKM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Trek Metals Limited, with a market cap of A$24.97 million, is involved in the exploration and development of mineral properties in Australia.

Operations: Trek Metals Limited does not report any specific revenue segments.

Market Cap: A$24.97M

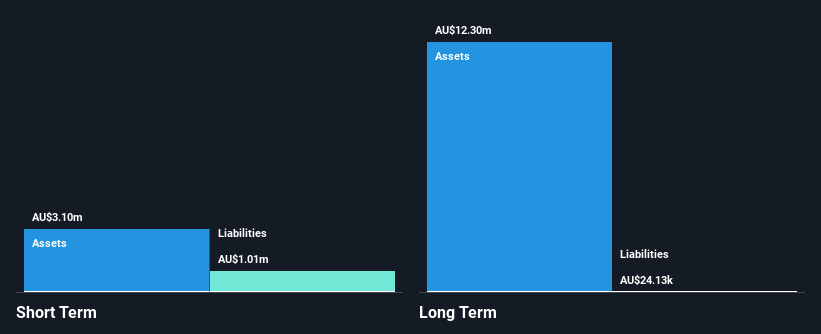

Trek Metals Limited, with a market cap of A$24.97 million, is pre-revenue and debt-free, suggesting financial prudence but also highlighting its early-stage status in mineral exploration. Despite having short-term assets of A$3.1 million covering liabilities, the company faces less than a year of cash runway at current expenditure rates. The stock's high volatility over recent months reflects investor uncertainty typical for such companies. While the board is experienced with an average tenure of 4.5 years, Trek Metals remains unprofitable with increasing losses over the past five years and a negative Return on Equity of -28.34%.

- Take a closer look at Trek Metals' potential here in our financial health report.

- Assess Trek Metals' previous results with our detailed historical performance reports.

Summing It All Up

- Navigate through the entire inventory of 980 ASX Penny Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PPS

Praemium

Provides advisors and wealth management solutions by seamless digital platform experience in Australia and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives