- Australia

- /

- Metals and Mining

- /

- ASX:PRN

ASX Highlights: 3 Penny Stocks With Market Caps Over A$400M

Reviewed by Simply Wall St

As the Australian market faces a challenging start to Week 45, with rising inflation and an anticipated RBA hold on interest rates, investors are keeping a close watch on potential opportunities. Penny stocks, often associated with smaller or newer companies, remain relevant as they can offer surprising value despite their vintage name. By focusing on those with strong financial foundations, these stocks might present growth opportunities even in uncertain times.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.49 | A$140.43M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.25 | A$106.14M | ✅ 3 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.895 | A$55.73M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.79 | A$428.8M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.77 | A$278.25M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.048 | A$56.15M | ✅ 3 ⚠️ 1 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 2 View Analysis > |

| LaserBond (ASX:LBL) | A$0.53 | A$62.59M | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.27 | A$1.39B | ✅ 3 ⚠️ 1 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.95 | A$272.39M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 417 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

BrainChip Holdings (ASX:BRN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: BrainChip Holdings Ltd develops software and hardware solutions for artificial intelligence and machine learning applications across multiple regions, with a market capitalization of A$407.15 million.

Operations: The company's revenue segment is derived from the Technological Development of Designs, amounting to $1.31 million.

Market Cap: A$407.15M

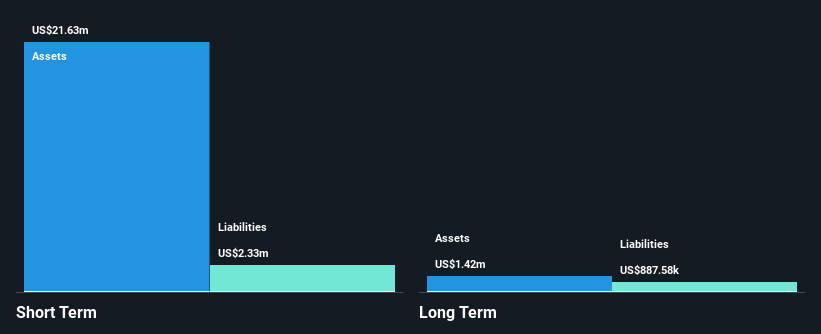

BrainChip Holdings Ltd, with a market cap of A$407.15 million, is pre-revenue and currently unprofitable. The company has no debt and its short-term assets exceed both its short-term and long-term liabilities, indicating a stable financial position despite having less than a year of cash runway. Recent strategic collaborations with Edge Impulse aim to enhance AI/ML model deployment on their Akida platform, potentially driving future revenue growth. However, earnings are forecasted to decline by 5.3% annually over the next three years, highlighting challenges in achieving profitability amid volatile market conditions typical for penny stocks.

- Get an in-depth perspective on BrainChip Holdings' performance by reading our balance sheet health report here.

- Assess BrainChip Holdings' future earnings estimates with our detailed growth reports.

Praemium (ASX:PPS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Praemium Limited, with a market cap of A$437.76 million, provides advisors and wealth management solutions in Australia and internationally.

Operations: The company's revenue is derived from its Software & Programming segment, which generated A$103.04 million.

Market Cap: A$437.76M

Praemium Limited, with a market cap of A$437.76 million, has shown solid financial performance, reporting A$103.04 million in revenue for the year ending June 30, 2025. The company is debt-free and its short-term assets significantly exceed liabilities, underscoring financial stability. Earnings grew by an impressive 55% over the past year, outpacing both its historical average and industry growth rates. However, despite these strengths and being added to the S&P Global BMI Index recently, challenges remain such as low return on equity and dividends not well-covered by free cash flows. The management team is experienced but recent executive changes could impact strategic direction.

- Navigate through the intricacies of Praemium with our comprehensive balance sheet health report here.

- Learn about Praemium's future growth trajectory here.

Perenti (ASX:PRN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Perenti Limited is a global mining services company with a market cap of A$2.55 billion.

Operations: Perenti's revenue is primarily derived from Contract Mining Services at A$2.52 billion, followed by Drilling Services at A$778.13 million, and Mining and Technology Services contributing A$225.71 million.

Market Cap: A$2.55B

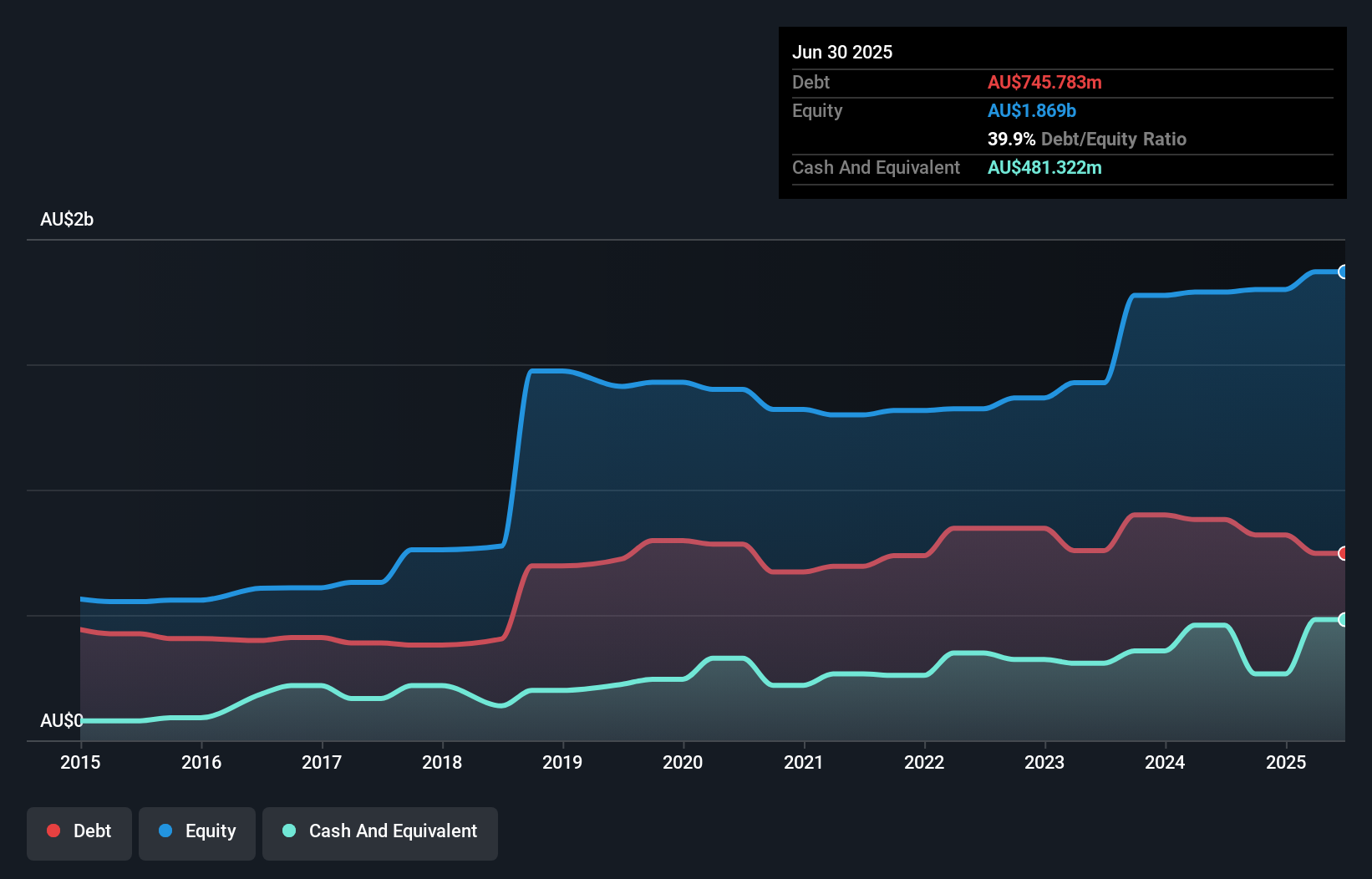

Perenti Limited, with a market cap of A$2.55 billion, has demonstrated robust financial performance in the mining services sector. The company's revenue streams are substantial, led by Contract Mining Services at A$2.52 billion. Despite a low return on equity of 7.4%, Perenti's debt management is commendable with a net debt to equity ratio of 14.1%, and its operating cash flow covers 68.4% of its debt obligations effectively. Recent developments include being added to the S&P/ASX 200 Index and initiating a share repurchase program for up to 9.09% of issued capital, indicating confidence in future prospects despite an unstable dividend track record and significant insider selling recently observed.

- Unlock comprehensive insights into our analysis of Perenti stock in this financial health report.

- Gain insights into Perenti's outlook and expected performance with our report on the company's earnings estimates.

Summing It All Up

- Access the full spectrum of 417 ASX Penny Stocks by clicking on this link.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PRN

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives