- Canada

- /

- Office REITs

- /

- TSX:AP.UN

3 Undervalued Small Caps In Global With Insider Action To Consider

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks have faced mixed performance, with the Russell 2000 Index declining by 0.86% amid broader economic uncertainties and fluctuating investor sentiment. Despite these challenges, some small-cap companies exhibit potential value through strategic insider actions that may align with improving economic indicators such as cooling inflation and evolving interest rate policies. In this environment, identifying promising small-cap stocks involves looking for those that demonstrate resilience in uncertain conditions and are supported by positive insider activity, which can signal confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Paragon Care | 16.5x | 0.1x | 26.02% | ★★★★★☆ |

| Centurion | 3.7x | 3.1x | -53.38% | ★★★★☆☆ |

| Vita Life Sciences | 15.0x | 1.6x | 37.06% | ★★★★☆☆ |

| Chinasoft International | 21.0x | 0.7x | -1179.42% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 44.00% | ★★★★☆☆ |

| BWP Trust | 10.9x | 14.2x | 12.41% | ★★★★☆☆ |

| Dicker Data | 22.4x | 0.8x | -46.65% | ★★★☆☆☆ |

| Amaero | NA | 63.7x | 32.34% | ★★★☆☆☆ |

| PSC | 9.8x | 0.4x | 19.71% | ★★★☆☆☆ |

| Nufarm | NA | 0.2x | -118.97% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

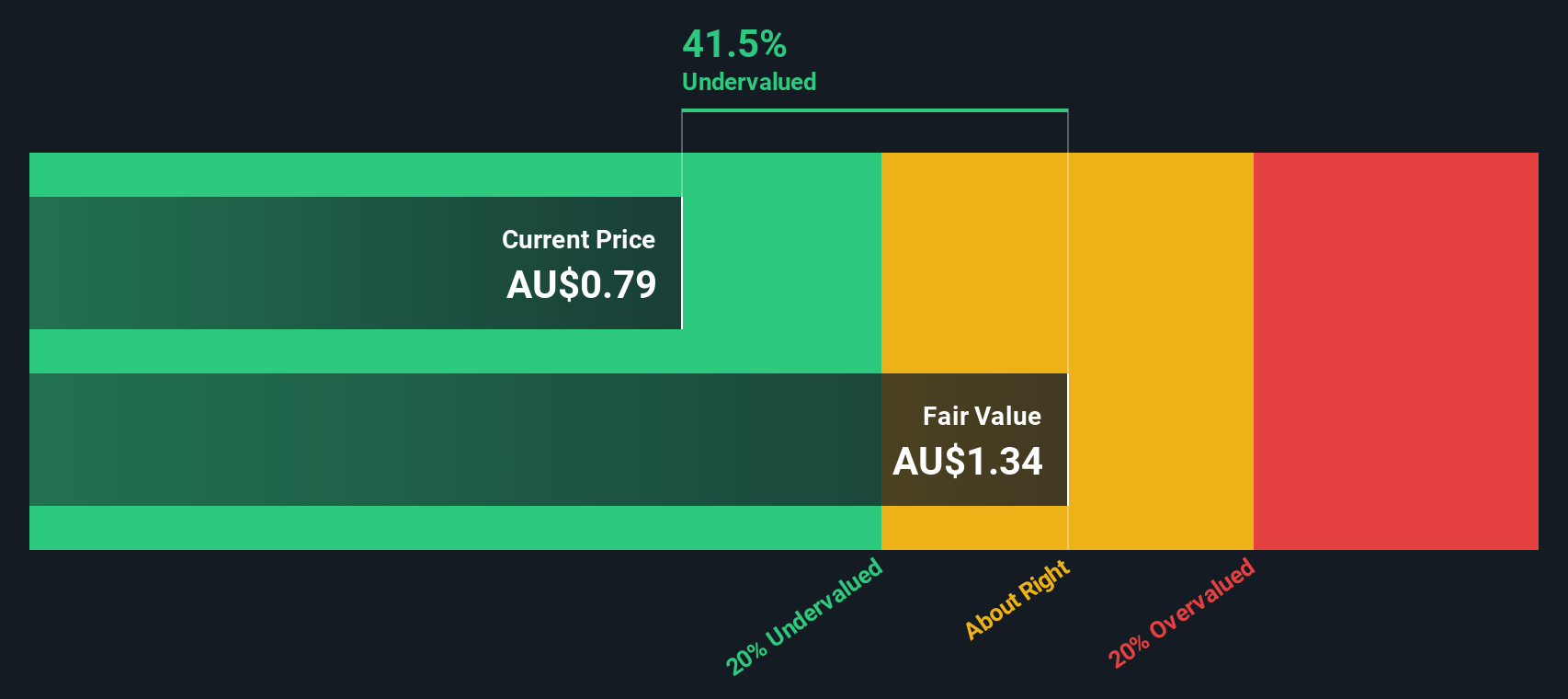

Praemium (ASX:PPS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Praemium is a company that provides software and programming solutions, with a market capitalization of A$0.92 billion.

Operations: Praemium generates its revenue primarily from software and programming, with a recent reported revenue of A$103.04 million. The cost of goods sold (COGS) stands at A$57.42 million, leading to a gross profit margin of 44.27%. Operating expenses are recorded at A$26.50 million, which impacts the net income margin, currently at 13.16%.

PE: 28.2x

Praemium, a company with a focus on external borrowing as its funding source, presents an intriguing opportunity in the small-cap sector. Despite higher risk from this funding structure, insider confidence is evident with recent share purchases. Their earnings call on October 6 highlighted growth prospects, forecasting a 17% annual earnings increase. The company's strategy and financials were further discussed at their Annual General Meeting scheduled for November 26 in Melbourne.

- Get an in-depth perspective on Praemium's performance by reading our valuation report here.

Explore historical data to track Praemium's performance over time in our Past section.

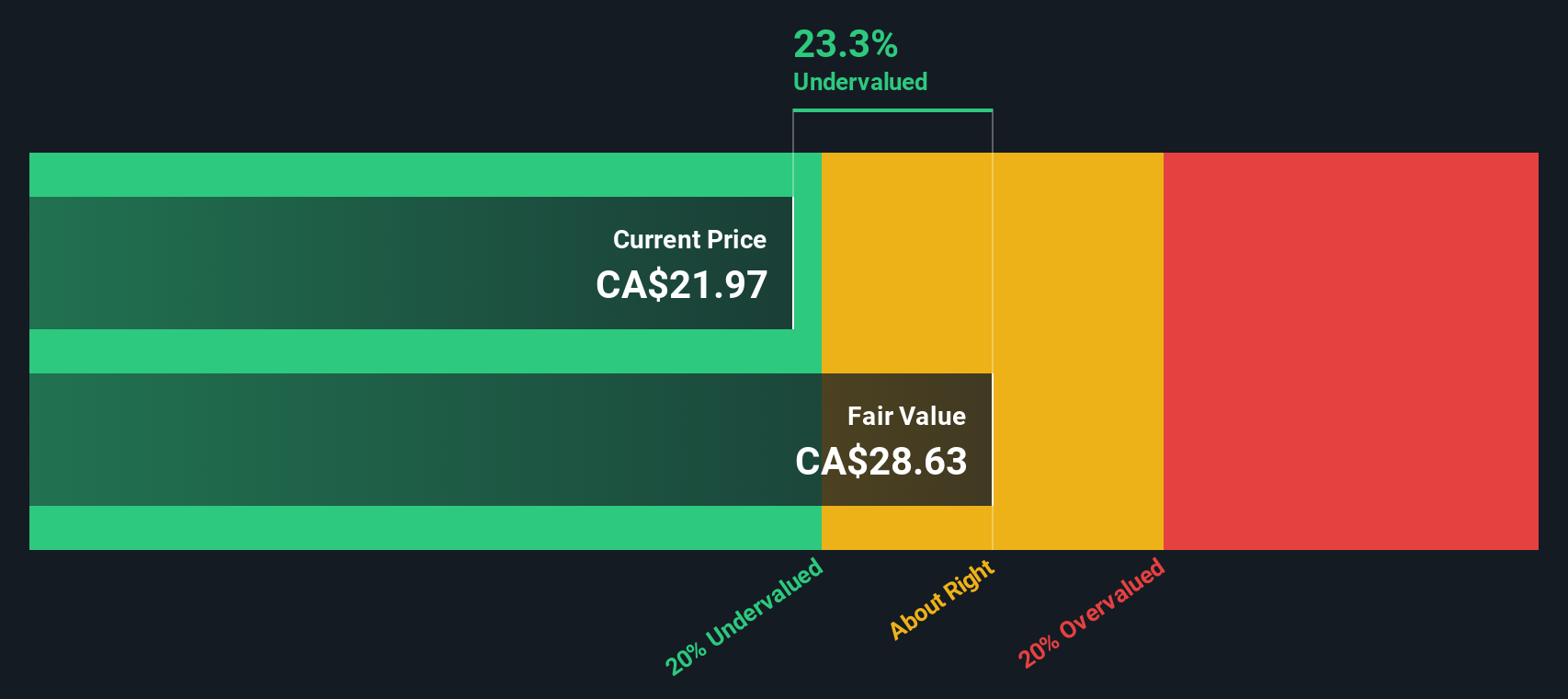

China XLX Fertiliser (SEHK:1866)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: China XLX Fertiliser is engaged in the production and sale of chemical fertilizers and related products, with a market capitalization of CN¥7.2 billion.

Operations: The company's revenue streams are primarily driven by products like urea, methanol, and compound fertiliser. Over the analyzed periods, the gross profit margin showed fluctuations with a notable range from 17.68% to 24.96%. Operating expenses consistently impacted profitability, with significant allocations towards sales and marketing as well as general and administrative expenses.

PE: 8.1x

China XLX Fertiliser, a smaller company in the fertiliser industry, is drawing attention due to its growth potential and insider confidence. Insiders have shown faith by purchasing shares recently. The company plans to repurchase up to 128 million shares under a program aimed at boosting earnings per share. Despite relying on external borrowing for funding, China XLX's earnings are expected to grow 27% annually. Recent leadership changes include appointing an experienced joint company secretary, enhancing governance capabilities.

- Dive into the specifics of China XLX Fertiliser here with our thorough valuation report.

Understand China XLX Fertiliser's track record by examining our Past report.

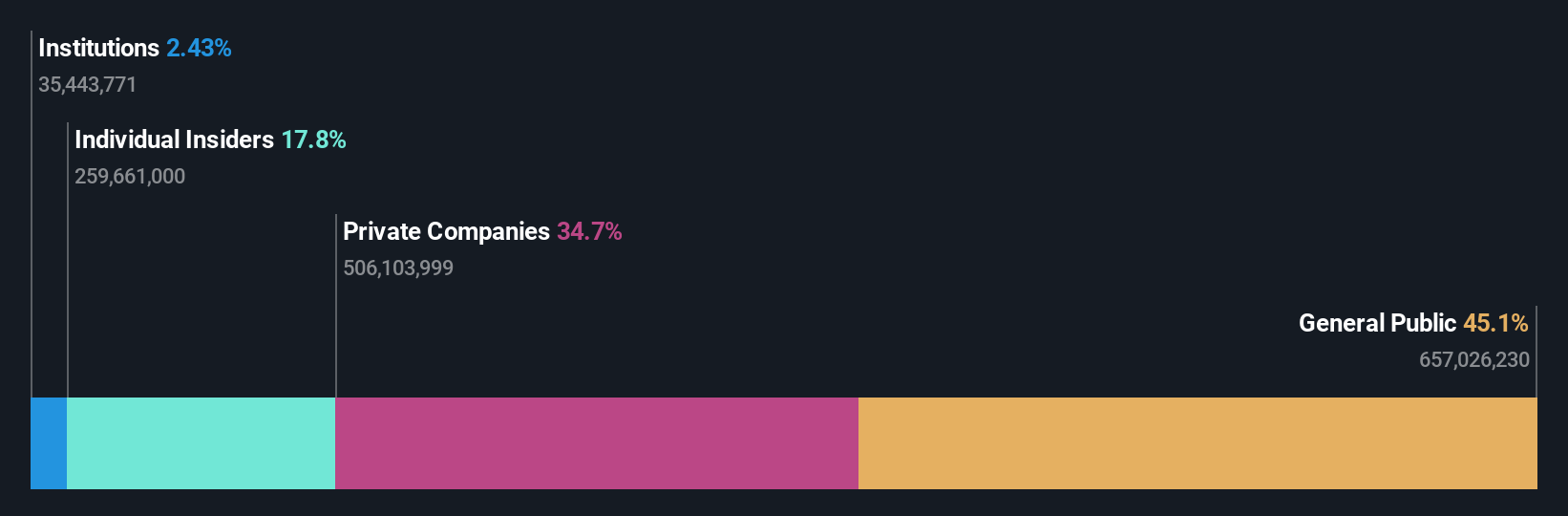

Allied Properties Real Estate Investment Trust (TSX:AP.UN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Allied Properties Real Estate Investment Trust is a Canadian real estate investment trust focused on owning, managing, and developing urban office environments, with operations primarily in Toronto & Kitchener, Montréal & Ottawa, Vancouver, and Calgary & Edmonton.

Operations: The company generates revenue primarily from its properties in Toronto & Kitchener and Montréal & Ottawa, contributing CA$297.39 million and CA$202.22 million respectively. The gross profit margin has shown fluctuations, reaching 54.56% as of the latest period. Operating expenses have varied over time, with general and administrative expenses being a notable component at CA$28.51 million in recent data points. Non-operating expenses have significantly impacted net income margins, which have been negative in recent periods due to substantial non-operating costs.

PE: -3.2x

Allied Properties Real Estate Investment Trust, a smaller player in the real estate sector, is capturing attention due to its financial strategies and recent leasing activity. Despite reporting a net loss of C$113 million in Q3 2025, Allied's earnings are projected to grow significantly at 106.5% annually. The company recently secured a major lease for office space in Toronto and completed a C$450 million debt financing under its Green Financing Framework. Insider confidence is evident with insider purchases over the last quarter, signaling potential trust in future growth despite current challenges with interest coverage from earnings.

Seize The Opportunity

- Reveal the 146 hidden gems among our Undervalued Global Small Caps With Insider Buying screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AP.UN

Allied Properties Real Estate Investment Trust

Allied is a leading owner-operator of distinctive urban workspace in Canada’s major cities.

Established dividend payer and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion