The Australian market has shown a mixed performance, with the ASX 200 closing slightly up and sectors like IT and Materials leading gains, while Utilities lagged significantly. Despite varying sector performances, the allure of penny stocks remains intriguing for investors seeking affordable entry points with potential growth. Although often seen as a vestige from earlier market days, penny stocks continue to offer opportunities in smaller or newer companies that demonstrate strong financial health.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lindsay Australia (ASX:LAU) | A$0.665 | A$210.92M | ✅ 4 ⚠️ 2 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.835 | A$147.8M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.875 | A$1.13B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.54 | A$72.65M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.62 | A$403.96M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.60 | A$114.64M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.63 | A$172.24M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.12 | A$712.67M | ✅ 4 ⚠️ 4 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.705 | A$835.59M | ✅ 5 ⚠️ 3 View Analysis > |

| Tasmea (ASX:TEA) | A$2.95 | A$690.41M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 998 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Big River Industries (ASX:BRI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Big River Industries Limited operates in the manufacture, distribution, and retail of timber and building products across Australia and New Zealand, with a market cap of A$109.30 million.

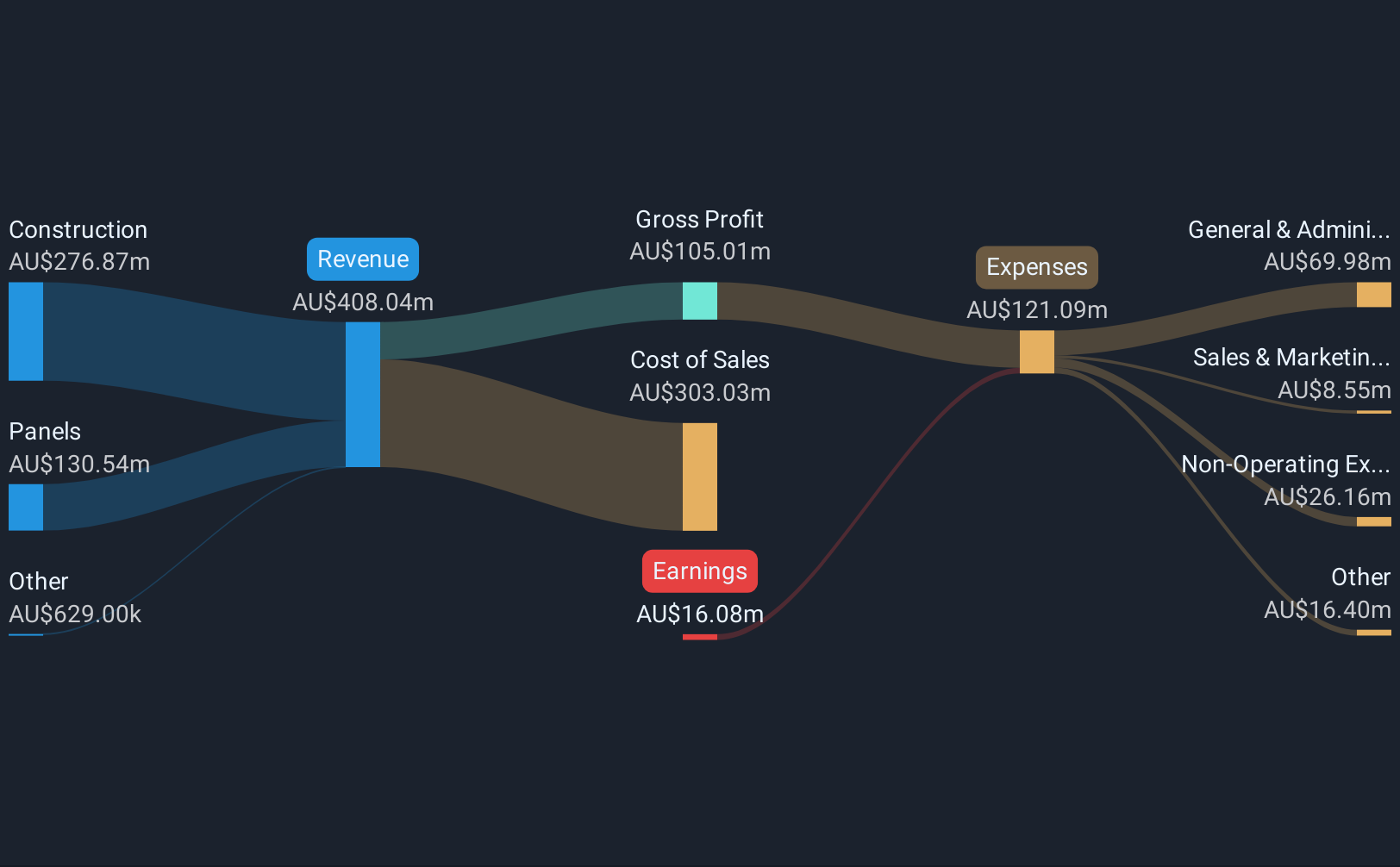

Operations: The company generates revenue from two main segments: Panels, contributing A$130.54 million, and Construction, with A$276.87 million.

Market Cap: A$109.3M

Big River Industries Limited, with a market cap of A$109.30 million, operates in the timber and building products sector. Despite being unprofitable, the company trades at 57.3% below its estimated fair value and has reduced losses over the past five years by 8.6% annually. Its net debt to equity ratio is satisfactory at 26.8%, and its short-term assets exceed both short- and long-term liabilities, indicating solid liquidity management. However, interest payments are not well covered by EBIT, highlighting financial pressure points. Recent board changes include Brendan York's resignation as a Non-Executive Director effective June 2025.

- Get an in-depth perspective on Big River Industries' performance by reading our balance sheet health report here.

- Learn about Big River Industries' future growth trajectory here.

Cash Converters International (ASX:CCV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cash Converters International Limited operates as a franchisor and retailer of second-hand goods and financial services stores under the Cash Converters brand in Australia, New Zealand, the United Kingdom, and internationally, with a market cap of A$161.94 million.

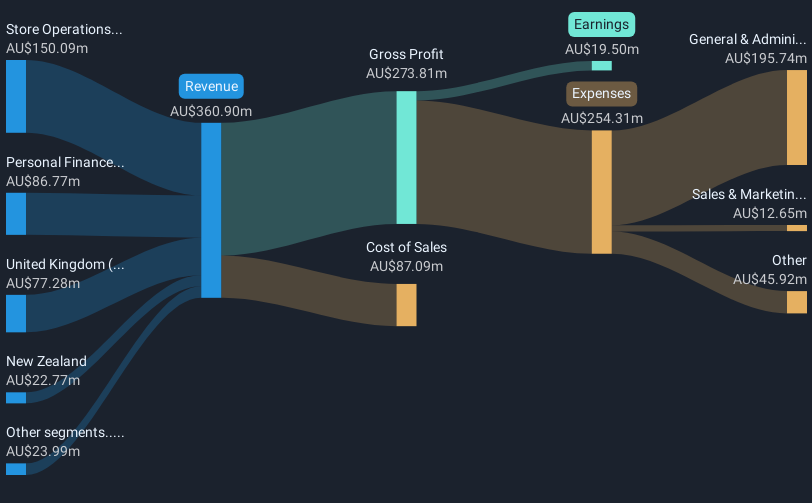

Operations: Cash Converters International generates revenue through various segments, including Store Operations (A$150.09 million), Personal Finance (A$86.77 million), the United Kingdom (A$77.28 million), New Zealand (A$22.77 million), and Vehicle Finance (A$14.20 million).

Market Cap: A$161.94M

Cash Converters International, with a market cap of A$161.94 million, demonstrates some strengths and weaknesses typical of penny stocks. The company's earnings grew by 5.5% last year, outpacing the Consumer Finance industry decline and showing high-quality past earnings. It trades at a favorable price-to-earnings ratio of 8.3x compared to the broader Australian market's 18x, suggesting good relative value. However, its net profit margins have slightly declined from last year to 5.4%, and its dividend track record remains unstable. While debt levels have increased over five years, they are well covered by operating cash flow (41.9%).

- Unlock comprehensive insights into our analysis of Cash Converters International stock in this financial health report.

- Evaluate Cash Converters International's prospects by accessing our earnings growth report.

Praemium (ASX:PPS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Praemium Limited, with a market cap of A$351.48 million, offers advisors and wealth management solutions through a seamless digital platform experience in Australia and internationally.

Operations: The company's revenue segment is primarily from Australia, generating A$95.58 million.

Market Cap: A$351.48M

Praemium Limited, with a market cap of A$351.48 million, presents a mixed picture for potential investors. The company is debt-free and has strong short-term asset coverage over liabilities, indicating financial stability. However, its earnings growth of 4.9% last year lagged behind its five-year average of 19.8%. Despite trading at a significant discount to estimated fair value and analysts predicting further price appreciation, the company's return on equity remains low at 9.8%. Additionally, recent executive changes with an interim CFO may introduce some uncertainty in strategic direction and financial management continuity.

- Jump into the full analysis health report here for a deeper understanding of Praemium.

- Gain insights into Praemium's future direction by reviewing our growth report.

Next Steps

- Click through to start exploring the rest of the 995 ASX Penny Stocks now.

- Interested In Other Possibilities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PPS

Praemium

Provides advisors and wealth management solutions by seamless digital platform experience in Australia and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives