Pureprofile Ltd (ASX:PPL) Stock Rockets 26% As Investors Are Less Pessimistic Than Expected

Pureprofile Ltd (ASX:PPL) shares have continued their recent momentum with a 26% gain in the last month alone. The last month tops off a massive increase of 158% in the last year.

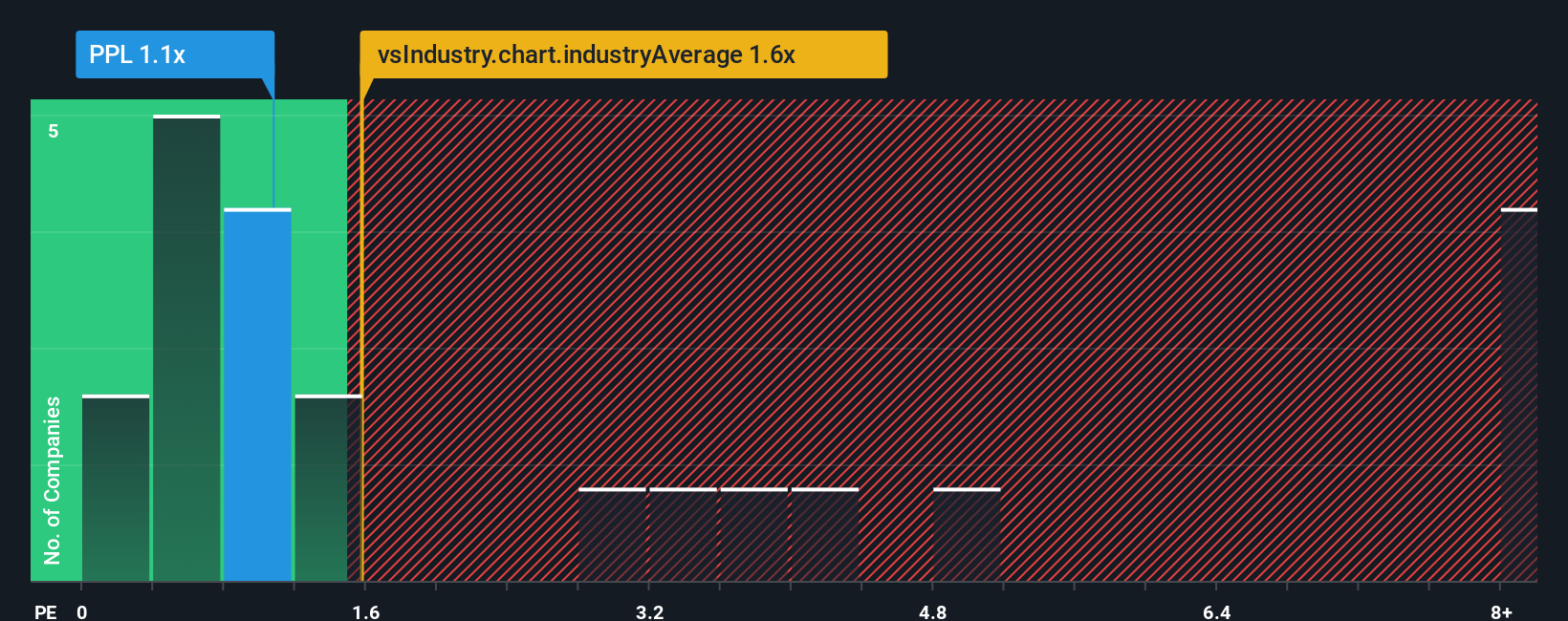

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Pureprofile's P/S ratio of 1.1x, since the median price-to-sales (or "P/S") ratio for the IT industry in Australia is also close to 1.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Pureprofile

What Does Pureprofile's P/S Mean For Shareholders?

Recent times have been advantageous for Pureprofile as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Pureprofile.Is There Some Revenue Growth Forecasted For Pureprofile?

Pureprofile's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 17%. Pleasingly, revenue has also lifted 50% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 16% as estimated by the one analyst watching the company. That's shaping up to be materially lower than the 37% growth forecast for the broader industry.

With this in mind, we find it intriguing that Pureprofile's P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Pureprofile's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Given that Pureprofile's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It is also worth noting that we have found 1 warning sign for Pureprofile that you need to take into consideration.

If these risks are making you reconsider your opinion on Pureprofile, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:PPL

Pureprofile

A data and insights organization, engages in the provision of online research solutions for agencies, marketers, researchers, brands and businesses in Australasia, Europe, and the United States.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives