- Australia

- /

- Personal Products

- /

- ASX:MCP

January 2025 ASX Penny Stocks Spotlight

Reviewed by Simply Wall St

The Australian market has shown modest growth, with the ASX200 rising by 0.2% to 8,273 points in afternoon trade, while sectors like IT and Telecommunications lead the way. Amid these movements, investors continue to explore various opportunities across different market segments. Penny stocks, though often considered a nostalgic term, remain relevant as they offer potential for growth at lower price points when backed by strong fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.56 | A$65.64M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.54 | A$334.88M | ★★★★★☆ |

| Vita Life Sciences (ASX:VLS) | A$1.96 | A$109.9M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.09 | A$340.29M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.88 | A$238.78M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$226.38M | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.285 | A$109.71M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.68 | A$823.33M | ★★★★★☆ |

| Servcorp (ASX:SRV) | A$4.98 | A$491.35M | ★★★★☆☆ |

Click here to see the full list of 1,050 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

McPherson's (ASX:MCP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: McPherson's Limited is a company that offers health, wellness, and beauty products across Australia, New Zealand, Asia, and other international markets with a market cap of A$47.50 million.

Operations: The company's revenue is primarily generated from Australia and New Zealand, amounting to A$192.09 million, with an additional contribution of A$5.58 million from international markets.

Market Cap: A$47.5M

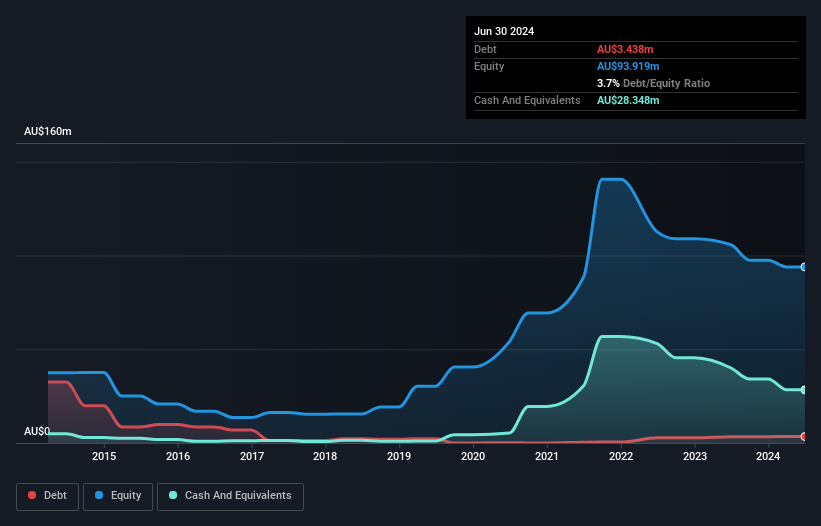

McPherson's Limited, with a market cap of A$47.50 million, generates significant revenue from Australia and New Zealand but remains unprofitable. Its short-term assets (A$75.8M) comfortably cover both short-term (A$46.7M) and long-term liabilities (A$10.5M), while the company holds more cash than its total debt, indicating a strong liquidity position despite ongoing losses that have increased by 65.3% annually over five years. The company's shares trade at 60.4% below estimated fair value, providing potential value for investors seeking opportunities in penny stocks; however, its negative return on equity (-12.7%) highlights profitability challenges amidst stable weekly volatility and an experienced board overseeing operations.

- Jump into the full analysis health report here for a deeper understanding of McPherson's.

- Explore historical data to track McPherson's performance over time in our past results report.

PharmX Technologies (ASX:PHX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PharmX Technologies Limited operates as a technology and software development company in Australia, with a market cap of A$45.49 million.

Operations: The company generates revenue from its Health Services segment, amounting to A$6.42 million.

Market Cap: A$45.49M

PharmX Technologies, with a market cap of A$45.49 million, has transitioned to profitability over the past year, achieving earnings growth of 36% annually over five years. The company is debt-free and boasts high-quality earnings, with short-term assets (A$16.4M) exceeding both short-term (A$12.0M) and long-term liabilities (A$1.9M). Despite low return on equity at 0.6%, PharmX's experienced board and management team support its operations amidst reduced volatility from 16% to 10%. Recent executive changes include Christopher Fernandes' appointment as Company Secretary, enhancing corporate governance capabilities for future growth initiatives.

- Dive into the specifics of PharmX Technologies here with our thorough balance sheet health report.

- Understand PharmX Technologies' track record by examining our performance history report.

PPK Group (ASX:PPK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: PPK Group Limited, with a market cap of A$33.96 million, operates in Australia providing nanomaterials, artificial intelligence, and energy solutions through its subsidiaries.

Operations: The company's revenue is primarily derived from its Energy Storage segment, which generated A$27.47 million, and its Technology - Subsidiary Companies segment, contributing A$0.01 million.

Market Cap: A$33.96M

PPK Group Limited, with a market cap of A$33.96 million, focuses on nanomaterials and energy solutions but remains pre-revenue, indicating early-stage operations. The company has improved its debt position significantly over the past five years and holds more cash than total debt, suggesting a cautious approach to financial management. However, PPK is unprofitable with increasing losses and negative return on equity at -16.92%. While short-term assets comfortably cover both short- and long-term liabilities, the company's high share price volatility poses risks for investors seeking stability in penny stocks. Recent board changes may impact strategic direction moving forward.

- Click to explore a detailed breakdown of our findings in PPK Group's financial health report.

- Evaluate PPK Group's historical performance by accessing our past performance report.

Key Takeaways

- Discover the full array of 1,050 ASX Penny Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MCP

McPherson's

Provides health, wellness, and beauty products in Australia, New Zealand, Asia, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives