Optima Technology Group Limited (ASX:OPA) Might Not Be As Mispriced As It Looks After Plunging 33%

To the annoyance of some shareholders, Optima Technology Group Limited (ASX:OPA) shares are down a considerable 33% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 83% share price decline.

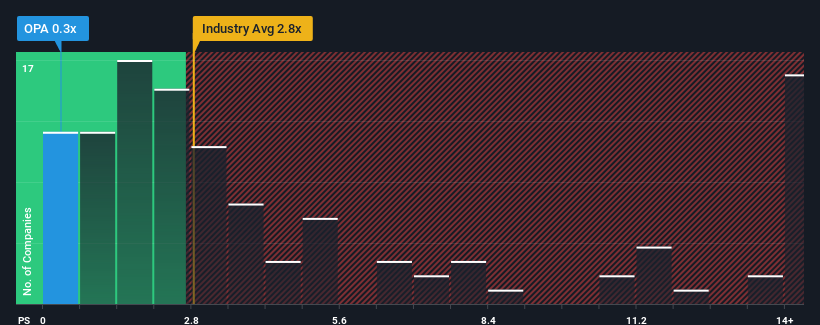

Since its price has dipped substantially, Optima Technology Group's price-to-sales (or "P/S") ratio of 0.3x might make it look like a strong buy right now compared to the wider Software industry in Australia, where around half of the companies have P/S ratios above 2.8x and even P/S above 7x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Optima Technology Group

How Optima Technology Group Has Been Performing

For example, consider that Optima Technology Group's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on Optima Technology Group will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Optima Technology Group will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Optima Technology Group's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 5.0%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 121% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the industry, which is expected to grow by 24% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that Optima Technology Group's P/S sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Optima Technology Group's P/S?

Having almost fallen off a cliff, Optima Technology Group's share price has pulled its P/S way down as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Optima Technology Group revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Plus, you should also learn about these 5 warning signs we've spotted with Optima Technology Group (including 3 which can't be ignored).

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:OPA

Optima Technology Group

Optima Technology Group Limited, a software technology company, provides automated and secure energy data management solutions focused on Net Zero reporting and bill management and procurement planning in Australia, New Zealand, the United States, the United Kingdom, and Europe.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives