Has 99 Technology (ASX:NNT) Got What It Takes To Become A Multi-Bagger?

If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an eye out for. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. Having said that, from a first glance at 99 Technology (ASX:NNT) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

What is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. To calculate this metric for 99 Technology, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.047 = CN¥15m ÷ (CN¥816m - CN¥484m) (Based on the trailing twelve months to June 2020).

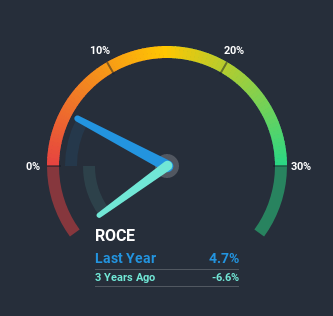

Thus, 99 Technology has an ROCE of 4.7%. In absolute terms, that's a low return and it also under-performs the Software industry average of 13%.

View our latest analysis for 99 Technology

Historical performance is a great place to start when researching a stock so above you can see the gauge for 99 Technology's ROCE against it's prior returns. If you'd like to look at how 99 Technology has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

What Can We Tell From 99 Technology's ROCE Trend?

There hasn't been much to report for 99 Technology's returns and its level of capital employed because both metrics have been steady for the past five years. This tells us the company isn't reinvesting in itself, so it's plausible that it's past the growth phase. So don't be surprised if 99 Technology doesn't end up being a multi-bagger in a few years time.

Another point to note, we noticed the company has increased current liabilities over the last five years. This is intriguing because if current liabilities hadn't increased to 59% of total assets, this reported ROCE would probably be less than4.7% because total capital employed would be higher.The 4.7% ROCE could be even lower if current liabilities weren't 59% of total assets, because the the formula would show a larger base of total capital employed. Additionally, this high level of current liabilities isn't ideal because it means the company's suppliers (or short-term creditors) are effectively funding a large portion of the business.The Key Takeaway

We can conclude that in regards to 99 Technology's returns on capital employed and the trends, there isn't much change to report on. And investors may be recognizing these trends since the stock has only returned a total of 4.8% to shareholders over the last five years. Therefore, if you're looking for a multi-bagger, we'd propose looking at other options.

If you'd like to know about the risks facing 99 Technology, we've discovered 3 warning signs that you should be aware of.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

If you’re looking to trade 99 Technology, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if 99 Loyalty might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:99L

99 Loyalty

99 Loyalty Limited, an investment holding company, provides loyalty technology services to enterprise clients in the financial services market in the People’s Republic of China.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026