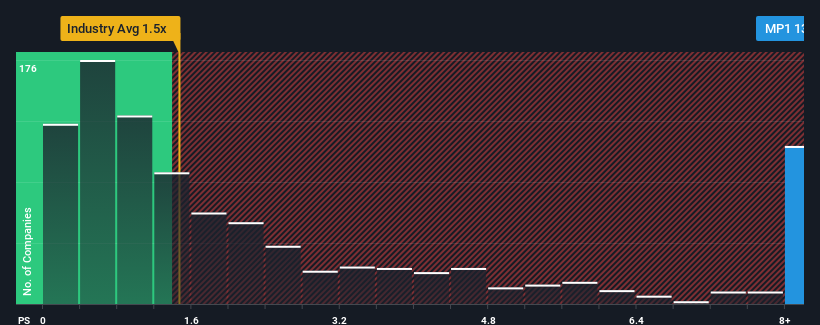

When you see that almost half of the companies in the IT industry in Australia have price-to-sales ratios (or "P/S") below 1.4x, Megaport Limited (ASX:MP1) looks to be giving off strong sell signals with its 13.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Megaport

What Does Megaport's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Megaport has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Megaport.How Is Megaport's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Megaport's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 42% gain to the company's top line. Pleasingly, revenue has also lifted 160% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 22% per annum during the coming three years according to the analysts following the company. That's shaping up to be materially higher than the 15% each year growth forecast for the broader industry.

With this information, we can see why Megaport is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Megaport's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Megaport shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Megaport with six simple checks on some of these key factors.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:MP1

Megaport

Provides on-demand interconnection services in Australia, New Zealand, Hong Kong, Singapore, Japan, the United States of America, Canada, Mexico, and Brazil, and Europe.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026