Have Insiders Been Selling LiveTiles Limited (ASX:LVT) Shares?

We wouldn't blame LiveTiles Limited ( ASX:LVT ) shareholders if they were a little worried about the fact that Peter Nguyen-Brown, the Chief Experience Officer & Executive Director recently sold about AU$1.7m selling shares at an average price of AU$0.21. However, it's crucial to note this sale was actually a transfer required as part of a settlement for a recent legal proceeding the company was involved in. Additionally, it appears Peter remains very much invested in the stock as that transfer only reduced their holding by 8.3%.

See our latest analysis for LiveTiles

LiveTiles Insider Transactions Over The Last Year

In fact, the recent transfer by Peter Nguyen-Brown was the biggest "sale" of LiveTiles shares made by an insider individual in the last twelve months, according to our records. We generally consider it a negative if insiders have been selling, especially if they did so below the current price, because it implies that they considered a lower price to be reasonable. However, while insider selling is sometimes discouraging, it's only a weak signal, and again, this was a transfer in a settlement rather than a sale.

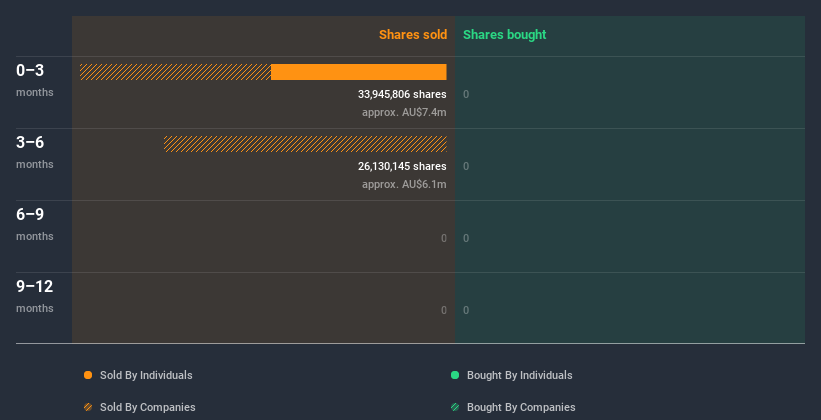

Insiders in LiveTiles didn't buy any shares in the last year. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Insider Ownership of LiveTiles

For a common shareholder, it is worth checking how many shares are held by company insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. LiveTiles insiders own about AU$73m worth of shares. That equates to 32% of the company. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

So What Do The LiveTiles Insider Transactions Indicate?

Insiders haven't bought LiveTiles stock in the last three months, and there weren't any purchases over the last year either. While insiders do own shares, they don't own a heap. We'd practice some caution before buying! So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. To that end, you should learn about the 4 warning signs we've spotted with LiveTiles (including 1 which is a bit concerning) .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading LiveTiles or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers . You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

* Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com .

About ASX:LVT

LiveTiles

LiveTiles Limited, a workplace technology company, engages in the provision of software as a service solution in Australia, North America, Europe, and the Asia Pacific.

Low and slightly overvalued.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026