This article will reflect on the compensation paid to Stephen Canning who has served as CEO of JCurve Solutions Limited (ASX:JCS) since 2015. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for JCurve Solutions

How Does Total Compensation For Stephen Canning Compare With Other Companies In The Industry?

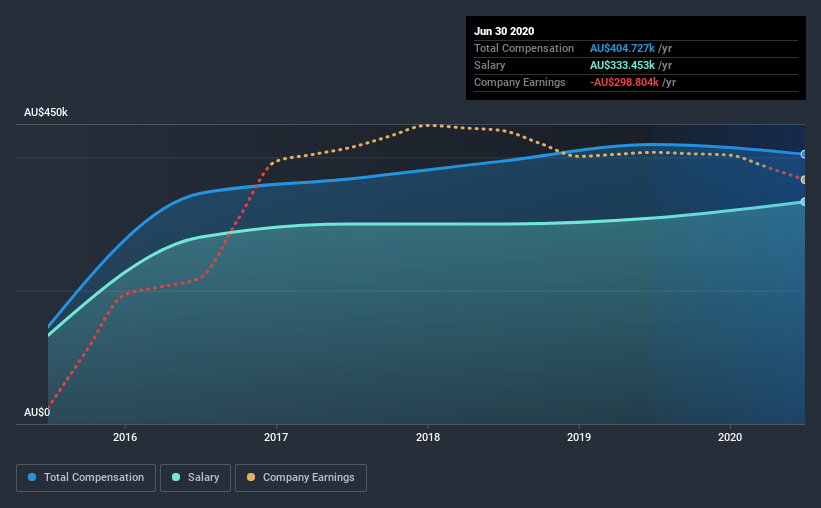

At the time of writing, our data shows that JCurve Solutions Limited has a market capitalization of AU$12m, and reported total annual CEO compensation of AU$405k for the year to June 2020. That's a slight decrease of 3.5% on the prior year. We note that the salary portion, which stands at AU$333.5k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the industry with market capitalizations below AU$259m, reported a median total CEO compensation of AU$324k. From this we gather that Stephen Canning is paid around the median for CEOs in the industry. Furthermore, Stephen Canning directly owns AU$116k worth of shares in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$333k | AU$309k | 82% |

| Other | AU$71k | AU$110k | 18% |

| Total Compensation | AU$405k | AU$419k | 100% |

Speaking on an industry level, nearly 60% of total compensation represents salary, while the remainder of 40% is other remuneration. According to our research, JCurve Solutions has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

JCurve Solutions Limited's Growth

Over the last three years, JCurve Solutions Limited has shrunk its earnings per share by 64% per year. Its revenue is down 11% over the previous year.

The decline in EPS is a bit concerning. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has JCurve Solutions Limited Been A Good Investment?

Given the total shareholder loss of 12% over three years, many shareholders in JCurve Solutions Limited are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

As we noted earlier, JCurve Solutions pays its CEO in line with similar-sized companies belonging to the same industry. Meanwhile, EPS growth and shareholder returns have been in the red for the last three years. We'd stop short of saying compensation is inappropriate, but we would understand if shareholders had questions regarding a future raise.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We did our research and identified 2 warning signs (and 1 which is a bit unpleasant) in JCurve Solutions we think you should know about.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading JCurve Solutions or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:JCS

JCurve Solutions

Provides enterprise resource planning (ERP) and telecommunications expense management solutions in Australia, New Zealand, Singapore, Thailand, and the Philippines.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)