3 ASX Stocks That May Be Priced Below Their Estimated Value In May 2025

Reviewed by Simply Wall St

As the ASX200 prepares to open slightly lower despite a strong overnight performance on Wall Street driven by Big Tech earnings, investors are keenly observing market trends and economic indicators. In such an environment, identifying stocks that may be priced below their estimated value can offer potential opportunities for investors looking to capitalize on discrepancies between current prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Domino's Pizza Enterprises (ASX:DMP) | A$25.42 | A$50.83 | 50% |

| Smart Parking (ASX:SPZ) | A$0.90 | A$1.76 | 48.8% |

| Amaero (ASX:3DA) | A$0.26 | A$0.47 | 44.4% |

| Charter Hall Group (ASX:CHC) | A$17.57 | A$34.25 | 48.7% |

| Regis Healthcare (ASX:REG) | A$7.29 | A$14.13 | 48.4% |

| Pantoro Gold (ASX:PNR) | A$2.84 | A$4.91 | 42.1% |

| Integral Diagnostics (ASX:IDX) | A$2.39 | A$4.09 | 41.5% |

| Electro Optic Systems Holdings (ASX:EOS) | A$1.24 | A$2.33 | 46.8% |

| Sandfire Resources (ASX:SFR) | A$10.17 | A$17.80 | 42.9% |

| Superloop (ASX:SLC) | A$2.59 | A$4.58 | 43.4% |

Underneath we present a selection of stocks filtered out by our screen.

Genesis Minerals (ASX:GMD)

Overview: Genesis Minerals Limited focuses on the exploration, production, and development of gold deposits in Western Australia, with a market capitalization of A$4.39 billion.

Operations: The company's revenue is primarily derived from its mineral production, exploration, and development activities, totaling A$561.40 million.

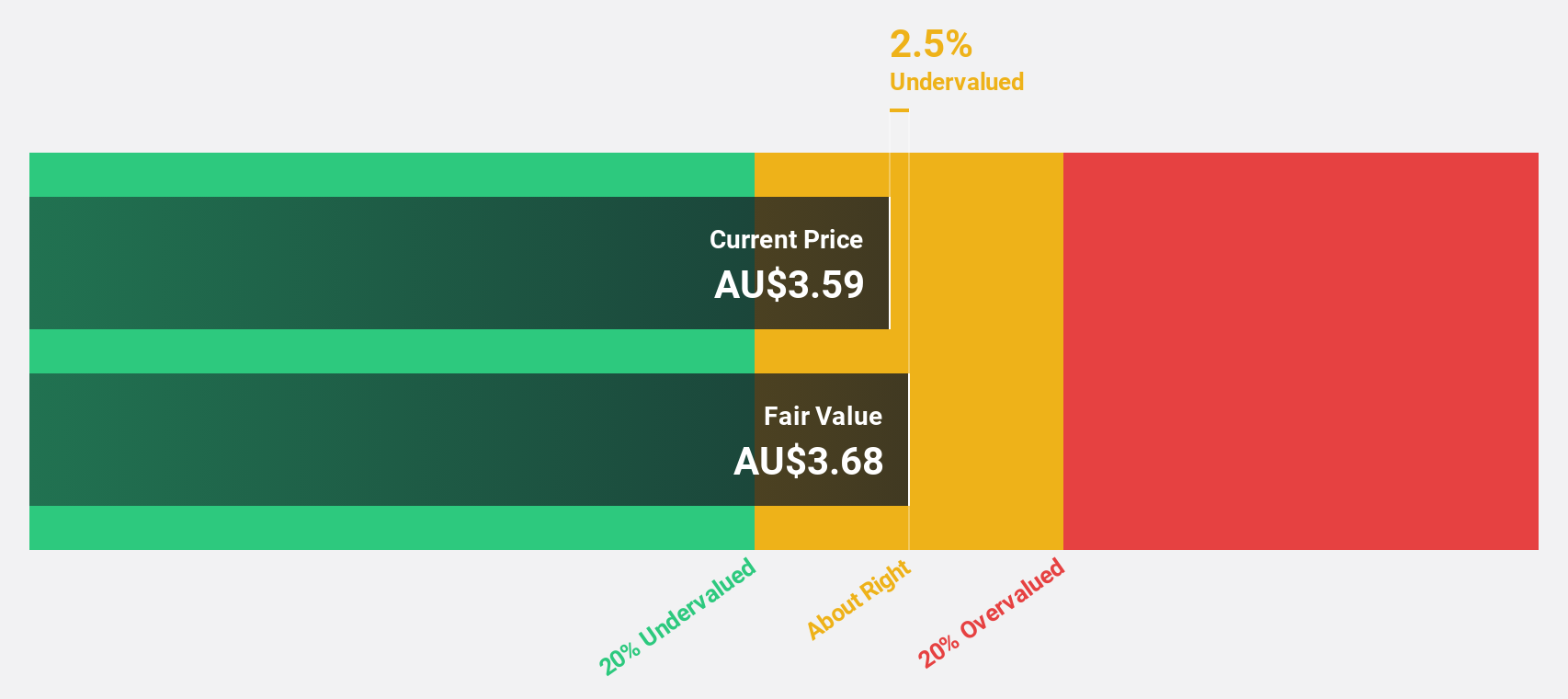

Estimated Discount To Fair Value: 28.8%

Genesis Minerals appears undervalued, trading at A$3.89, below its estimated fair value of A$5.46. Earnings are projected to grow significantly at 23.8% annually, outpacing the Australian market's growth rate of 12.2%. The company recently reported strong half-year results with net income rising to A$59.8 million from A$24.05 million a year ago and increased production guidance for fiscal year 2025 to 190,000-210,000oz of gold, underscoring robust cash flow potential.

- Upon reviewing our latest growth report, Genesis Minerals' projected financial performance appears quite optimistic.

- Take a closer look at Genesis Minerals' balance sheet health here in our report.

GenusPlus Group (ASX:GNP)

Overview: GenusPlus Group Ltd operates in Australia, focusing on the installation, construction, and maintenance of power and communication systems, with a market cap of A$533.35 million.

Operations: The company's revenue segments consist of Industrial (A$187.56 million), Communication (A$86.02 million), and Infrastructure (A$372.42 million).

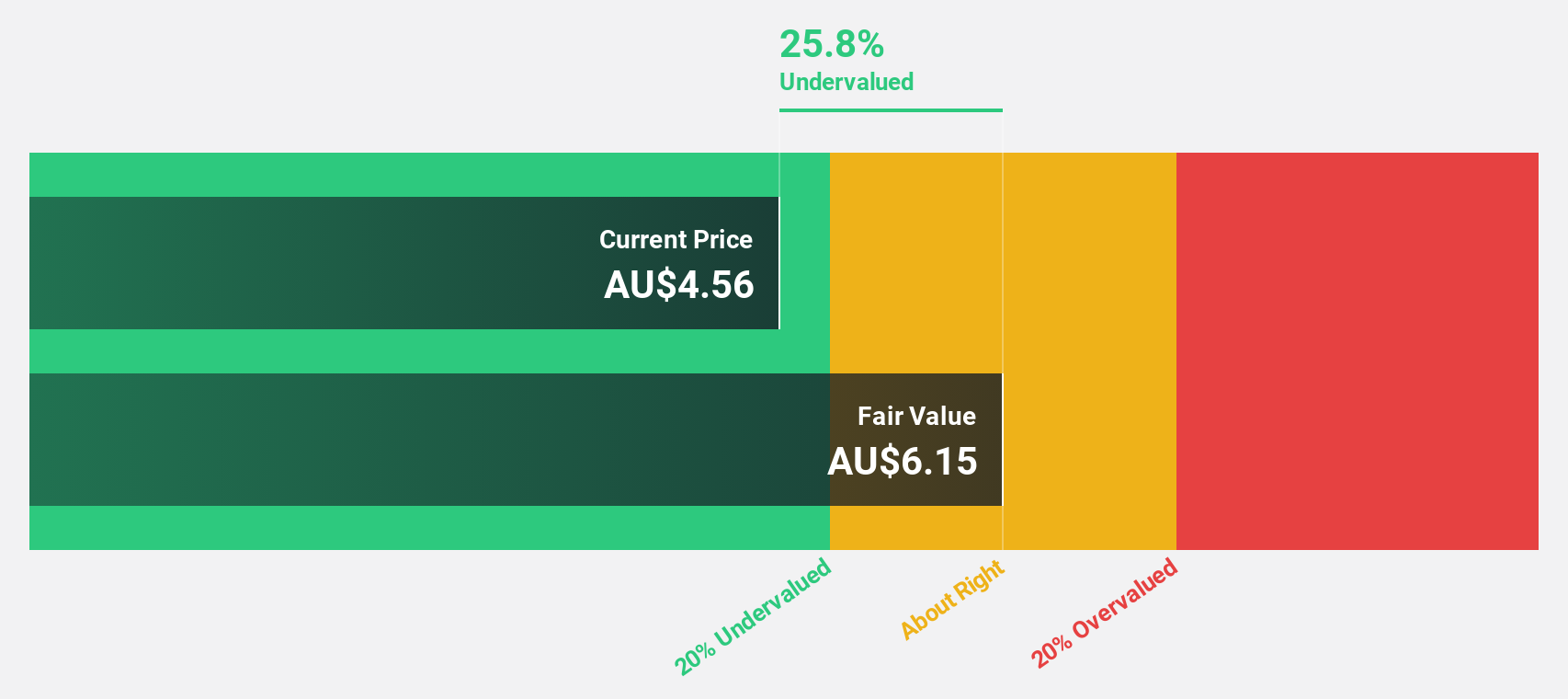

Estimated Discount To Fair Value: 23.3%

GenusPlus Group is trading at A$2.96, below its estimated fair value of A$3.86, suggesting it may be undervalued based on cash flows. The company reported strong half-year results with sales increasing to A$332.87 million from A$249.96 million and net income rising to A$13.7 million from A$9.05 million year-over-year, highlighting robust earnings growth potential of 21.6% annually, which surpasses the Australian market's projected growth rate of 12.2%.

- Insights from our recent growth report point to a promising forecast for GenusPlus Group's business outlook.

- Unlock comprehensive insights into our analysis of GenusPlus Group stock in this financial health report.

Infomedia (ASX:IFM)

Overview: Infomedia Ltd is a technology company that provides electronic parts catalogues, service quoting software, and e-commerce solutions to the global automotive industry, with a market cap of A$467.96 million.

Operations: The company's revenue is primarily derived from its Publishing - Periodicals segment, amounting to A$142.41 million.

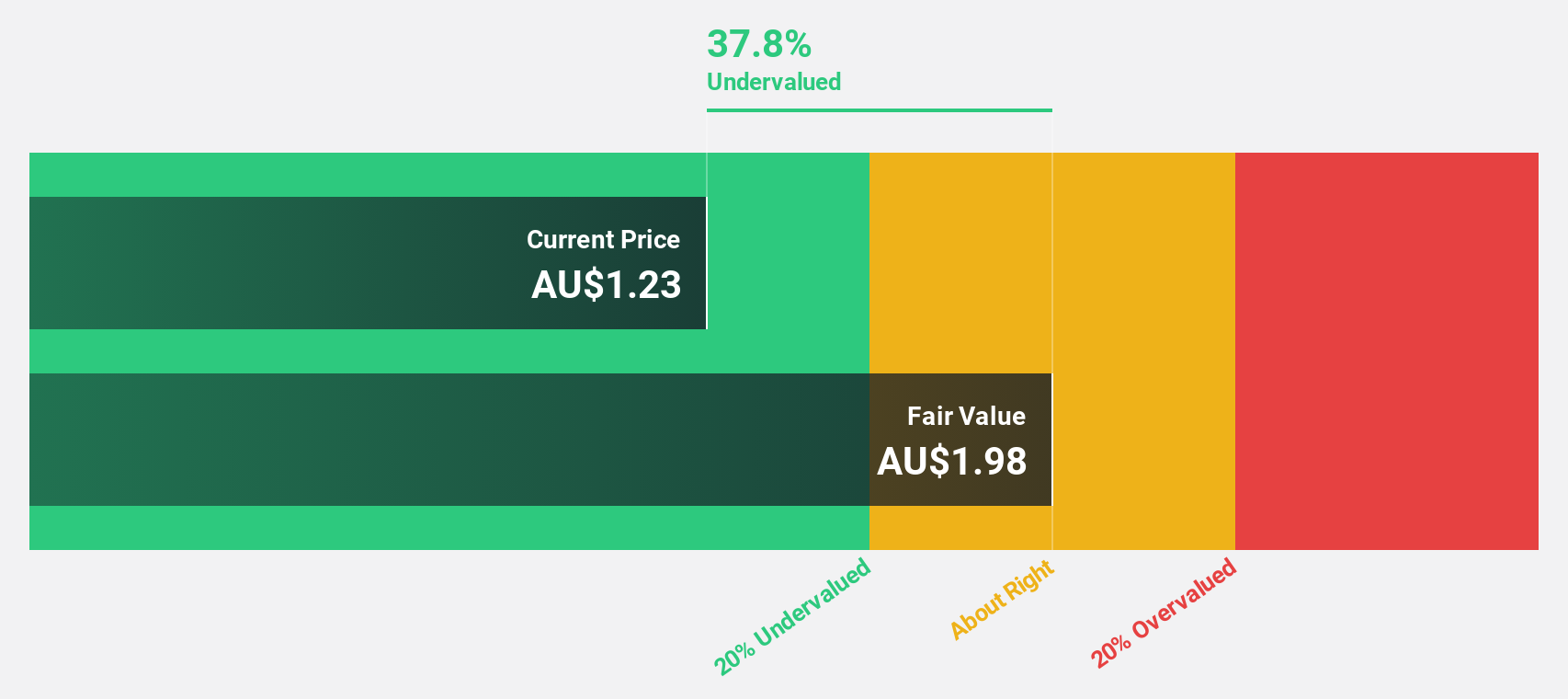

Estimated Discount To Fair Value: 32.7%

Infomedia, trading at A$1.24, is undervalued based on cash flows with a fair value estimate of A$1.84. Recent earnings showed net income rising to A$8.33 million from A$5.12 million year-over-year, and analysts forecast earnings growth of 19.9% annually, outpacing the Australian market's 12.2%. Despite a dividend not fully covered by earnings and recent board changes, the company announced a share buyback program to enhance shareholder value by reducing outstanding shares.

- The analysis detailed in our Infomedia growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Infomedia.

Seize The Opportunity

- Discover the full array of 36 Undervalued ASX Stocks Based On Cash Flows right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IFM

Infomedia

A technology company, develops and supplies electronic parts catalogues, service quoting software, and e-commerce solutions for the automotive industry worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives