The Australian market is bravely fighting to end five straight days of losses, with the ASX 200 expected to open just slightly lower. Amidst these fluctuations, investors are looking for opportunities that balance affordability with potential growth. Penny stocks, often representing smaller or newer companies, remain a relevant investment area due to their ability to offer value and growth potential when supported by strong financials. In this article, we explore three penny stocks on the ASX that stand out for their financial resilience and promise in today's market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.755 | A$138.53M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.51 | A$316.27M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.84 | A$235.47M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.925 | A$313.42M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.75 | A$96.8M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.61 | A$789.03M | ★★★★★☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$219.66M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.84 | A$103.2M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.97 | A$490.37M | ★★★★☆☆ |

Click here to see the full list of 1,050 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Engenco (ASX:EGN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Engenco Limited, along with its subsidiaries, offers transportation solutions and has a market cap of A$58.46 million.

Operations: The company's revenue is primarily derived from its business segments, with Gemco Rail contributing A$93.60 million, Drivetrain generating A$65.05 million, Convair Engineering bringing in A$31.58 million, Workforce Solutions accounting for A$18.05 million, and Hedemora Turbo & Diesel adding A$8.32 million.

Market Cap: A$58.46M

Engenco Limited's market cap of A$58.46 million places it within the realm of penny stocks, with substantial revenue contributions from its diverse business segments, notably Gemco Rail and Drivetrain. Despite a stable management team and adequate short-term asset coverage for liabilities, Engenco faces challenges such as declining earnings over the past five years and low return on equity at 4.1%. The company's debt is well-covered by operating cash flow; however, profit margins have decreased to 1.8%, signaling potential profitability concerns amidst volatile earnings impacted by large one-off gains.

- Unlock comprehensive insights into our analysis of Engenco stock in this financial health report.

- Assess Engenco's previous results with our detailed historical performance reports.

icetana (ASX:ICE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: icetana Limited is a Software as a Service company offering video analytics solutions across the Asia Pacific, North America, Europe, the Middle East, and Africa with a market cap of A$6.62 million.

Operations: The company's revenue is generated from its Software & Programming segment, amounting to A$3.70 million.

Market Cap: A$6.62M

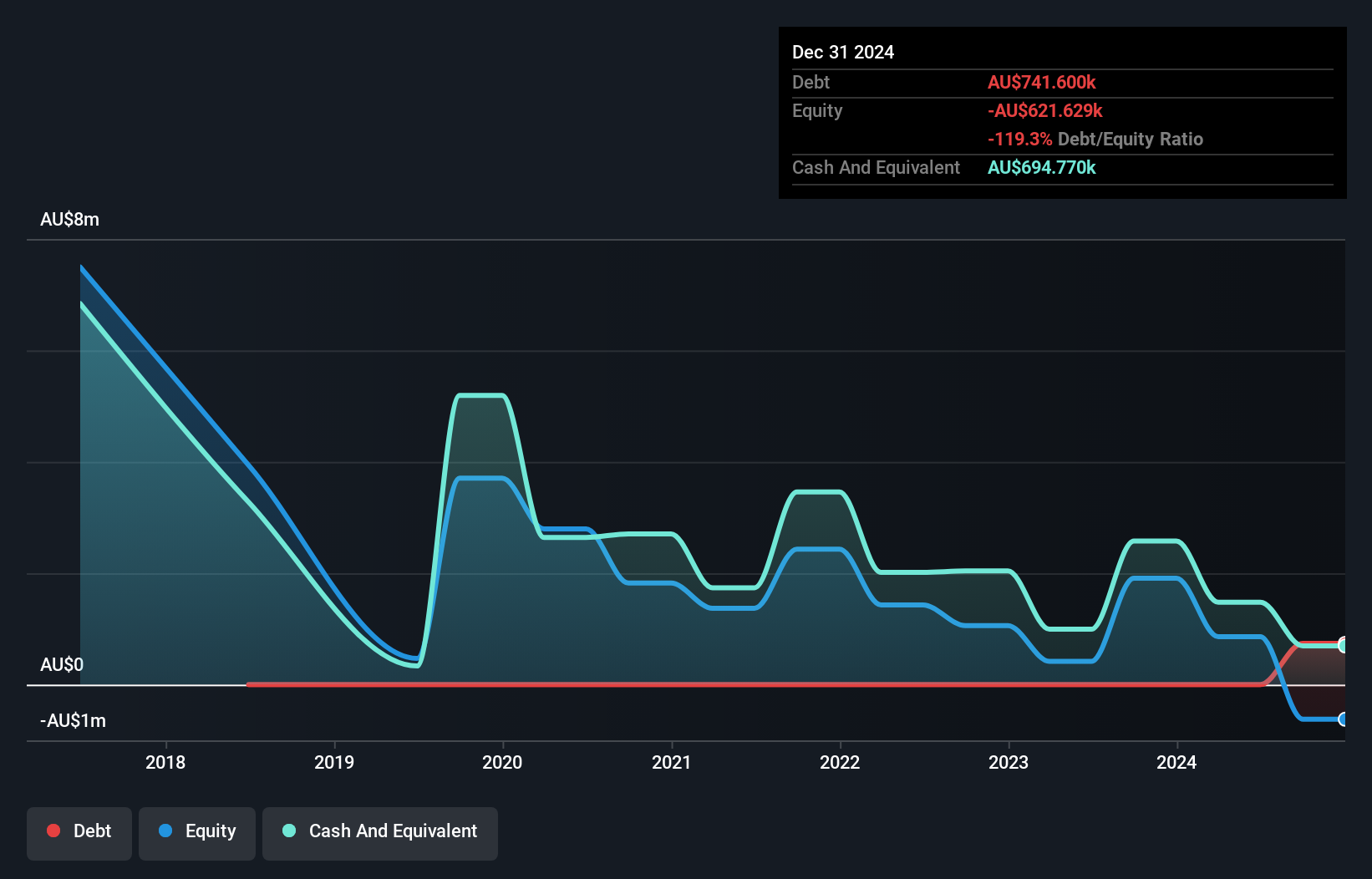

icetana Limited, with a market cap of A$6.62 million, operates in the Software as a Service sector but lacks meaningful revenue, generating only A$3.70 million annually. The company is currently unprofitable and has less than one year of cash runway based on its free cash flow trends. Despite being debt-free for five years and having short-term assets exceeding liabilities, icetana's high share price volatility and negative return on equity highlight financial instability. The board's limited experience may also pose challenges in strategic decision-making amidst ongoing efforts to stabilize earnings growth.

- Click here and access our complete financial health analysis report to understand the dynamics of icetana.

- Gain insights into icetana's historical outcomes by reviewing our past performance report.

Integrated Research (ASX:IRI)

Simply Wall St Financial Health Rating: ★★★★★★

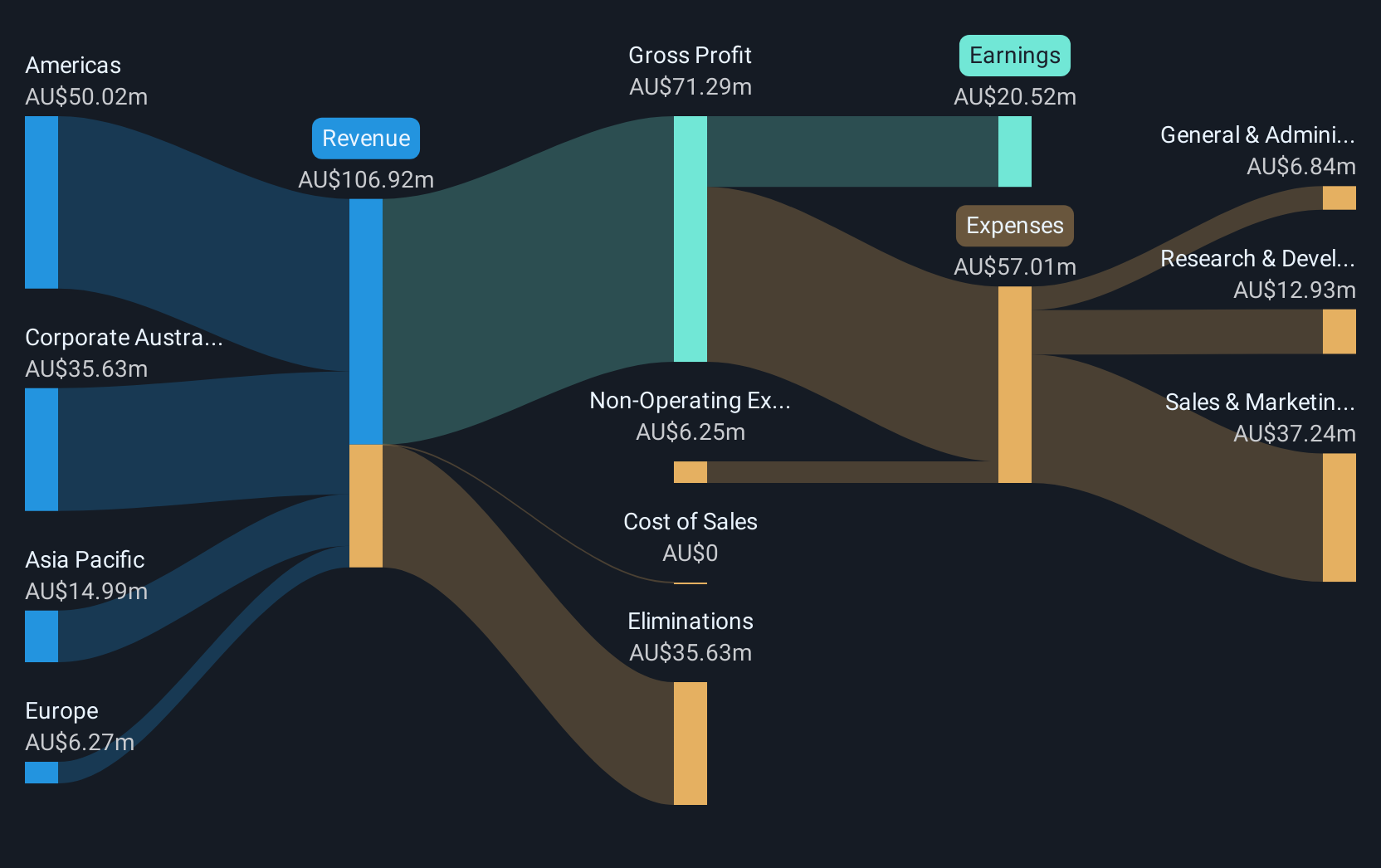

Overview: Integrated Research Limited specializes in designing, developing, implementing, and selling systems and applications management software for business-critical computing and unified communication and payment networks, with a market cap of A$94.88 million.

Operations: The company generates revenue from its Software & Programming segment, totaling A$83.29 million.

Market Cap: A$94.88M

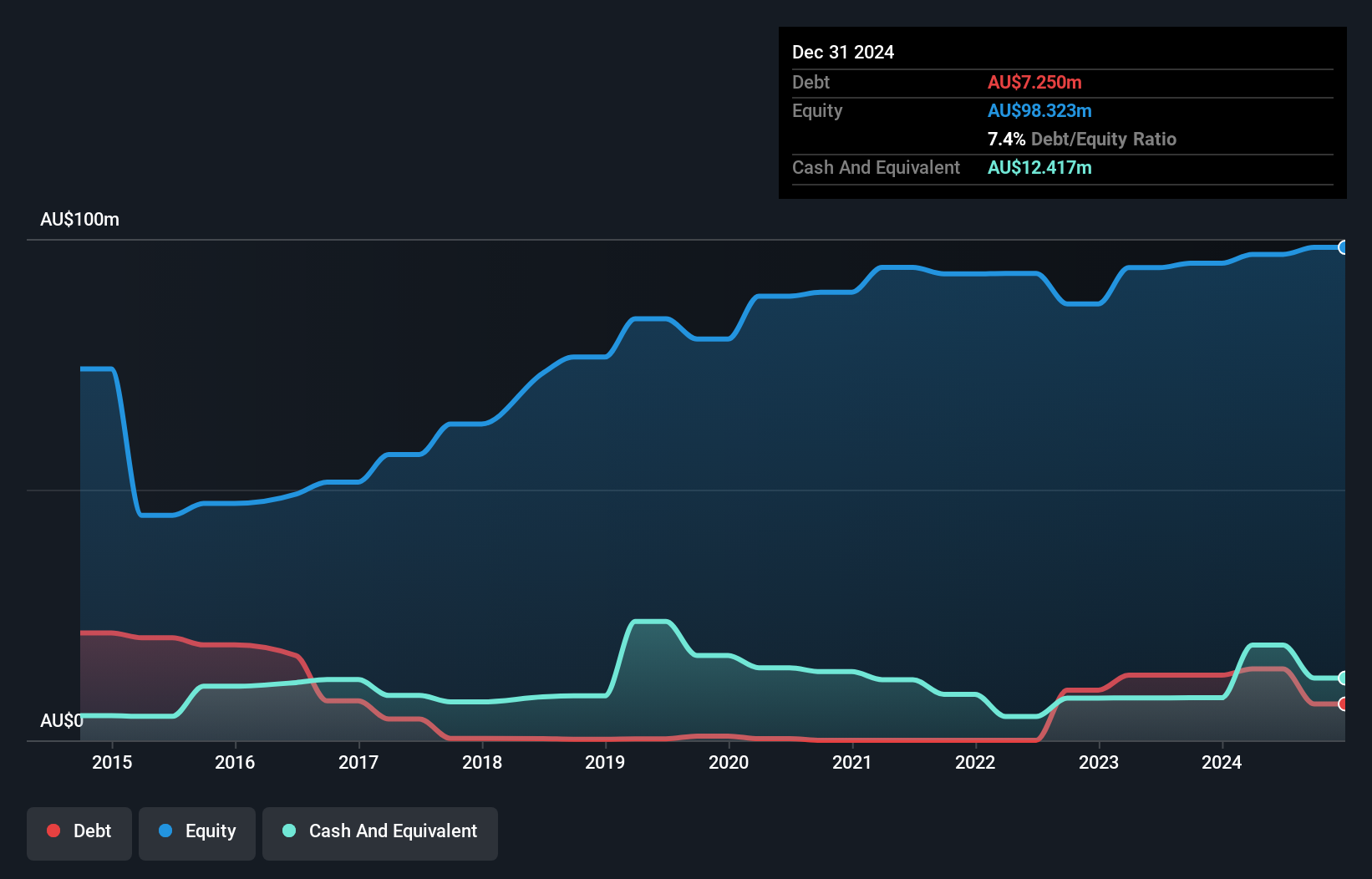

Integrated Research Limited, with a market cap of A$94.88 million, presents a mixed picture for investors in the penny stock realm. The company recently became profitable, yet its earnings have declined significantly over the past five years and are forecast to continue decreasing by an average of 20.4% annually over the next three years. Despite this, Integrated Research is debt-free and maintains strong short-term asset coverage against liabilities. Its Return on Equity stands high at 30.7%, indicating efficient profit generation relative to shareholder equity, while its low Price-To-Earnings ratio suggests it trades at good value compared to peers.

- Take a closer look at Integrated Research's potential here in our financial health report.

- Gain insights into Integrated Research's future direction by reviewing our growth report.

Where To Now?

- Gain an insight into the universe of 1,050 ASX Penny Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if icetana might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ICE

icetana

A Software as a Service software company, provides video analytics solutions in the Asia Pacific, North America, Europe, the Middle East, and Africa.

Moderate risk with imperfect balance sheet.

Market Insights

Community Narratives