- Australia

- /

- Capital Markets

- /

- ASX:NGI

Discover 3 ASX Penny Stocks With Over A$200M Market Cap

Reviewed by Simply Wall St

Following a Thursday that marked the best ASX trading day in six weeks, Australian shares have been projected to dip slightly as global investors remain cautious. In this context, penny stocks—once considered a niche investment—still hold potential for growth, especially when backed by strong financial health. Let's explore three such penny stocks that stand out for their financial strength and potential for long-term growth.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.61 | A$125.6M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$2.06 | A$152.04M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.795 | A$1.02B | ✅ 4 ⚠️ 1 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.585 | A$74.77M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.39 | A$370.18M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.62 | A$121.75M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.19 | A$151.37M | ✅ 3 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.83 | A$949.17M | ✅ 5 ⚠️ 3 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.88 | A$1.32B | ✅ 5 ⚠️ 1 View Analysis > |

| LaserBond (ASX:LBL) | A$0.37 | A$43.41M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 978 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Hansen Technologies (ASX:HSN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hansen Technologies Limited develops, integrates, and supports billing systems software for the energy, utilities, communications, and media sectors with a market cap of A$1.01 billion.

Operations: Hansen Technologies' revenue is derived from three geographical segments: Americas (A$78.11 million), Asia Pacific (A$51.79 million), and Europe, the Middle East, and Africa (A$233.43 million).

Market Cap: A$1.01B

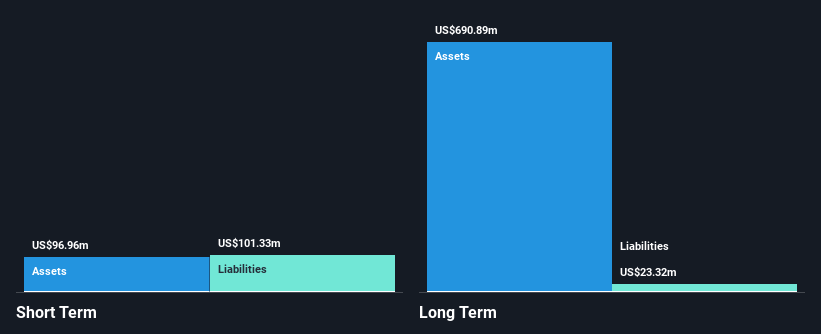

Hansen Technologies, with a market cap of A$1.01 billion, has shown resilience in the software sector despite recent challenges. Its short-term assets exceed both short and long-term liabilities, indicating solid liquidity management. However, the company faced a significant one-off loss impacting its recent financials and reported a net profit margin drop to 1% from 13.4% last year. Despite negative earnings growth over the past year, Hansen's debt levels have improved significantly over five years, suggesting prudent financial management. Recent client announcements and product innovations highlight ongoing efforts to enhance service offerings and operational flexibility.

- Get an in-depth perspective on Hansen Technologies' performance by reading our balance sheet health report here.

- Explore Hansen Technologies' analyst forecasts in our growth report.

Navigator Global Investments (ASX:NGI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Navigator Global Investments, trading as HFA Holdings Limited, is a fund management company based in Australia with a market capitalization of A$911.55 million.

Operations: The company generates revenue primarily through its Lighthouse segment, which accounts for $137.95 million.

Market Cap: A$911.55M

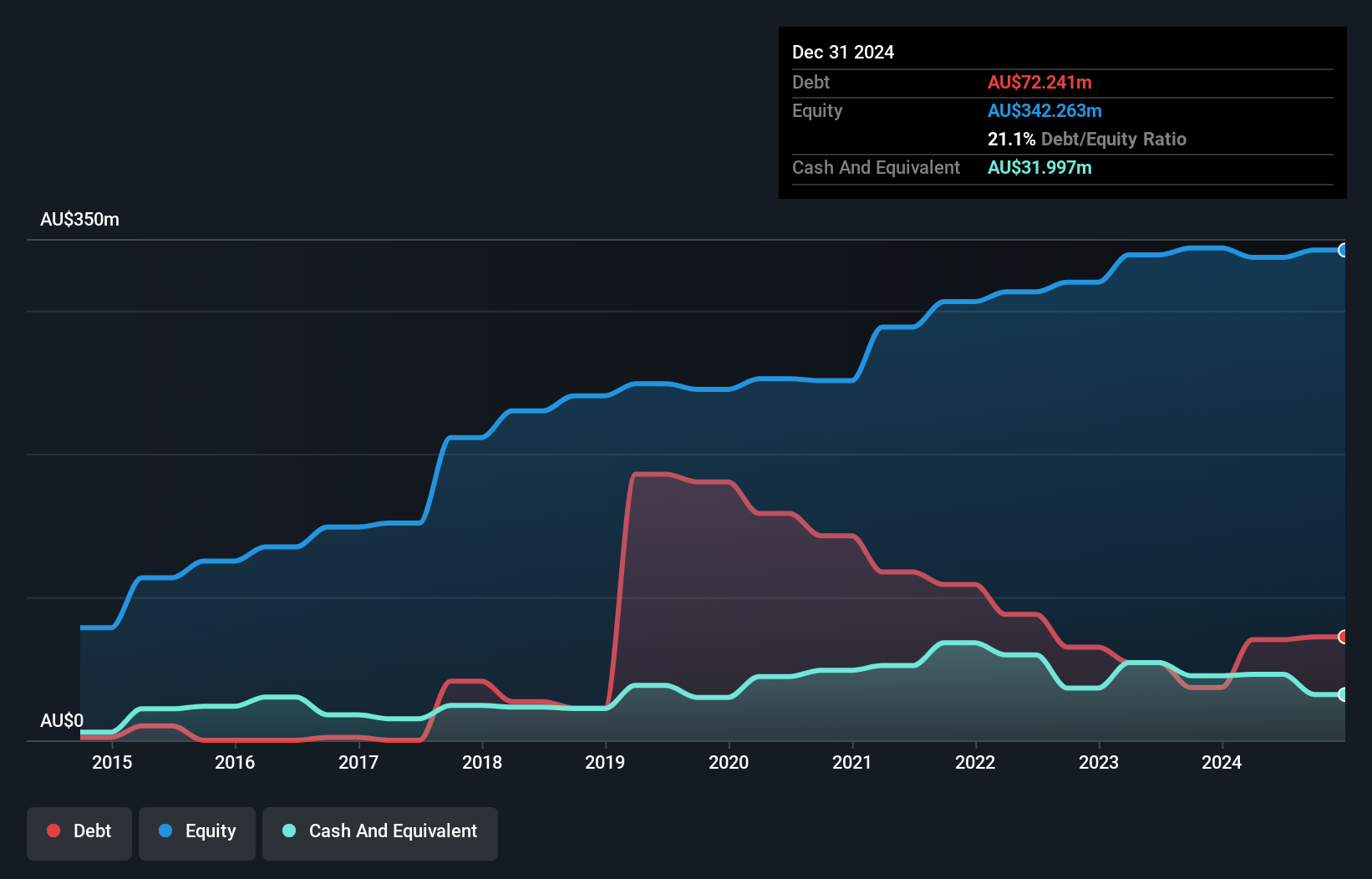

Navigator Global Investments, with a market cap of A$911.55 million, is trading at a significant discount to its estimated fair value and demonstrates solid financial health with short-term assets surpassing liabilities. The company reported substantial earnings growth of 306.8% over the past year, driven by a large one-off gain impacting results. Despite low return on equity at 17.1%, Navigator's revenue increased to US$148.06 million for H1 2025, up from US$105.9 million a year ago, alongside improved net income and earnings per share figures. The board and management are experienced, enhancing corporate stability amidst projected future earnings decline.

- Click here and access our complete financial health analysis report to understand the dynamics of Navigator Global Investments.

- Gain insights into Navigator Global Investments' future direction by reviewing our growth report.

Smart Parking (ASX:SPZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Smart Parking Limited designs, develops, and manages parking management solutions across New Zealand, Australia, Germany, and the United Kingdom with a market cap of A$289.90 million.

Operations: The company's revenue is primarily derived from its Parking Management operations in the United Kingdom (A$47.58 million), New Zealand (A$5.87 million), Germany (A$3.69 million), and Australia (A$0.07 million), as well as its Technology Division, which contributes A$5.30 million.

Market Cap: A$289.9M

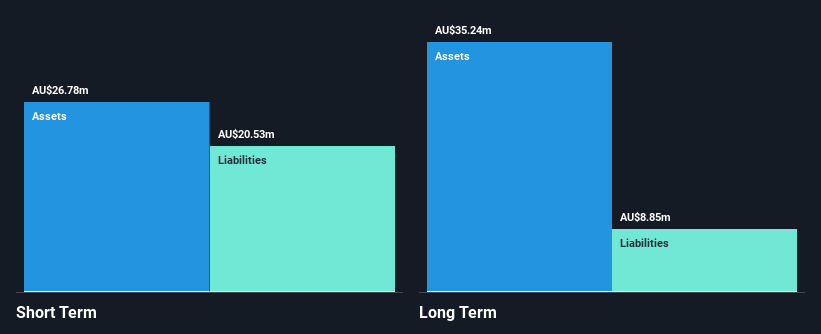

Smart Parking Limited, with a market cap of A$289.90 million, has shown financial stability through its debt-free status and strong short-term asset position exceeding liabilities. Recent earnings reveal a net income increase to A$3.91 million for H1 2025 from A$2.3 million the previous year, despite lower profit margins at 8.8%. The company completed a follow-on equity offering raising A$45.01 million, potentially diluting shares but supporting growth initiatives in its primary UK market and beyond. While trading below estimated fair value, Smart Parking's earnings growth forecast remains optimistic at 34% annually amidst industry challenges.

- Jump into the full analysis health report here for a deeper understanding of Smart Parking.

- Examine Smart Parking's earnings growth report to understand how analysts expect it to perform.

Summing It All Up

- Unlock our comprehensive list of 978 ASX Penny Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Navigator Global Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NGI

Navigator Global Investments

HFA Holdings Limited operates as a fund management company in Australia.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives