Analyst Estimates: Here's What Brokers Think Of Hansen Technologies Limited (ASX:HSN) After Its Half-Yearly Report

The half-yearly results for Hansen Technologies Limited (ASX:HSN) were released last week, making it a good time to revisit its performance. Revenues came in 3.1% below expectations, at AU$143m. Statutory earnings per share were relatively better off, with a per-share profit of AU$0.13 being roughly in line with analyst estimates. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on Hansen Technologies after the latest results.

See our latest analysis for Hansen Technologies

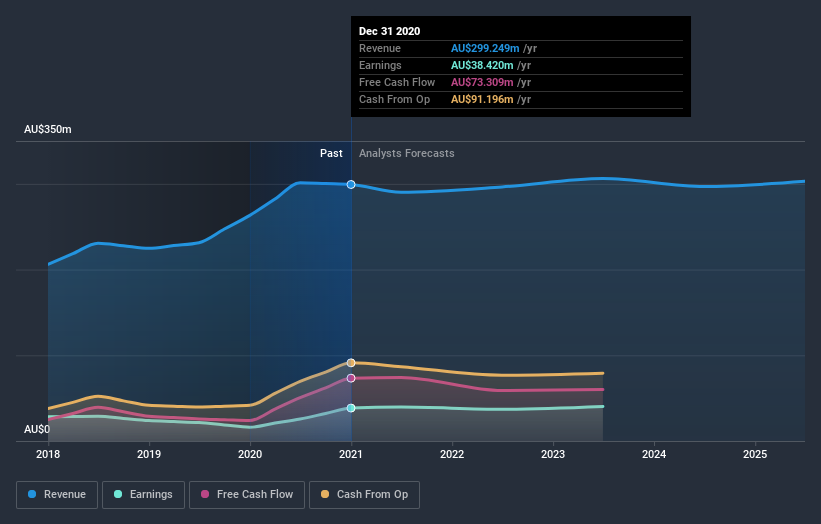

Following the recent earnings report, the consensus from three analysts covering Hansen Technologies is for revenues of AU$290.3m in 2021, implying a noticeable 3.0% decline in sales compared to the last 12 months. Statutory per-share earnings are expected to be AU$0.20, roughly flat on the last 12 months. Before this earnings report, the analysts had been forecasting revenues of AU$291.9m and earnings per share (EPS) of AU$0.19 in 2021. The analysts seems to have become more bullish on the business, judging by their new earnings per share estimates.

There's been no major changes to the consensus price target of AU$4.99, suggesting that the improved earnings per share outlook is not enough to have a long-term positive impact on the stock's valuation. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. Currently, the most bullish analyst values Hansen Technologies at AU$5.40 per share, while the most bearish prices it at AU$4.50. The narrow spread of estimates could suggest that the business' future is relatively easy to value, or thatthe analysts have a strong view on its prospects.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. These estimates imply that sales are expected to slow, with a forecast revenue decline of 3.0%, a significant reduction from annual growth of 16% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 17% next year. It's pretty clear that Hansen Technologies' revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most important thing here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards Hansen Technologies following these results. Fortunately, the analysts also reconfirmed their revenue estimates, suggesting sales are tracking in line with expectations - although our data does suggest that Hansen Technologies' revenues are expected to perform worse than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for Hansen Technologies going out to 2025, and you can see them free on our platform here..

However, before you get too enthused, we've discovered 2 warning signs for Hansen Technologies that you should be aware of.

When trading Hansen Technologies or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Hansen Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:HSN

Hansen Technologies

Engages in the development, integration, and support of billing and customer information systems.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion