Exploring Australia's High Growth Tech Stocks for August 2024

Reviewed by Simply Wall St

The market has climbed 1.4% in the last 7 days, contrasting with a 3.1% drop in the Energy sector, and over the past year, it has risen by 12%, with earnings forecast to grow by 14% annually. In this dynamic environment, identifying high growth tech stocks that align well with these positive trends can be crucial for investors seeking robust returns in Australia's evolving market landscape.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Infomedia | 7.67% | 28.71% | ★★★★★☆ |

| Clinuvel Pharmaceuticals | 22.90% | 28.13% | ★★★★★★ |

| Doctor Care Anywhere Group | 23.44% | 96.41% | ★★★★★★ |

| Megaport | 13.63% | 32.15% | ★★★★★☆ |

| Enlitic | 104.77% | 94.35% | ★★★★★☆ |

| DUG Technology | 13.29% | 46.01% | ★★★★★☆ |

| Xero | 13.50% | 24.14% | ★★★★★☆ |

| Mesoblast | 45.23% | 49.67% | ★★★★★★ |

| Adveritas | 66.47% | 103.87% | ★★★★★★ |

| SiteMinder | 20.26% | 70.41% | ★★★★★☆ |

Click here to see the full list of 53 stocks from our ASX High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Data#3 (ASX:DTL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Data#3 Limited provides IT solutions and services across Australia, Fiji, and the Pacific Islands with a market cap of A$1.23 billion.

Operations: The company generates revenue primarily through its Value-Added IT Reseller and IT Solutions Provider segment, which accounted for A$805.75 million. The business focuses on delivering comprehensive IT solutions and services in its operating regions.

Data#3 Limited has shown robust performance with a net income increase to AUD 43.31 million from AUD 37.03 million, and revenue growth to AUD 815.68 million from AUD 812.5 million year-on-year. The company's R&D expenses have been pivotal in driving innovation, with a notable expenditure leading to an expected revenue growth of 34.1% annually, significantly outpacing the Australian market's average of 5.4%. Moreover, Data#3's earnings are forecasted to grow at a steady rate of 10.8% per year, reflecting its strong position in the tech sector despite recent sales figures showing minor fluctuations. In addition to financial metrics, Data#3 has declared a cash dividend of AUD 0.129 per share for the period ending June 30, highlighting its commitment to shareholder returns while continuing substantial investments in R&D for future growth prospects. The company's focus on cloud solutions and IT services positions it well within an industry rapidly shifting towards SaaS models and recurring revenue streams from subscriptions, ensuring sustained profitability and market relevance amidst evolving technological landscapes.

- Click here to discover the nuances of Data#3 with our detailed analytical health report.

Understand Data#3's track record by examining our Past report.

FINEOS Corporation Holdings (ASX:FCL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: FINEOS Corporation Holdings plc develops and sells enterprise claims and policy management software for the employee benefits and life, accident, and health insurance industries worldwide, with a market cap of A$456.73 million.

Operations: FINEOS Corporation Holdings generates revenue primarily from its software and programming segment, amounting to €122.24 million. The company focuses on providing enterprise claims and policy management solutions tailored for the employee benefits, life, accident, and health insurance sectors globally.

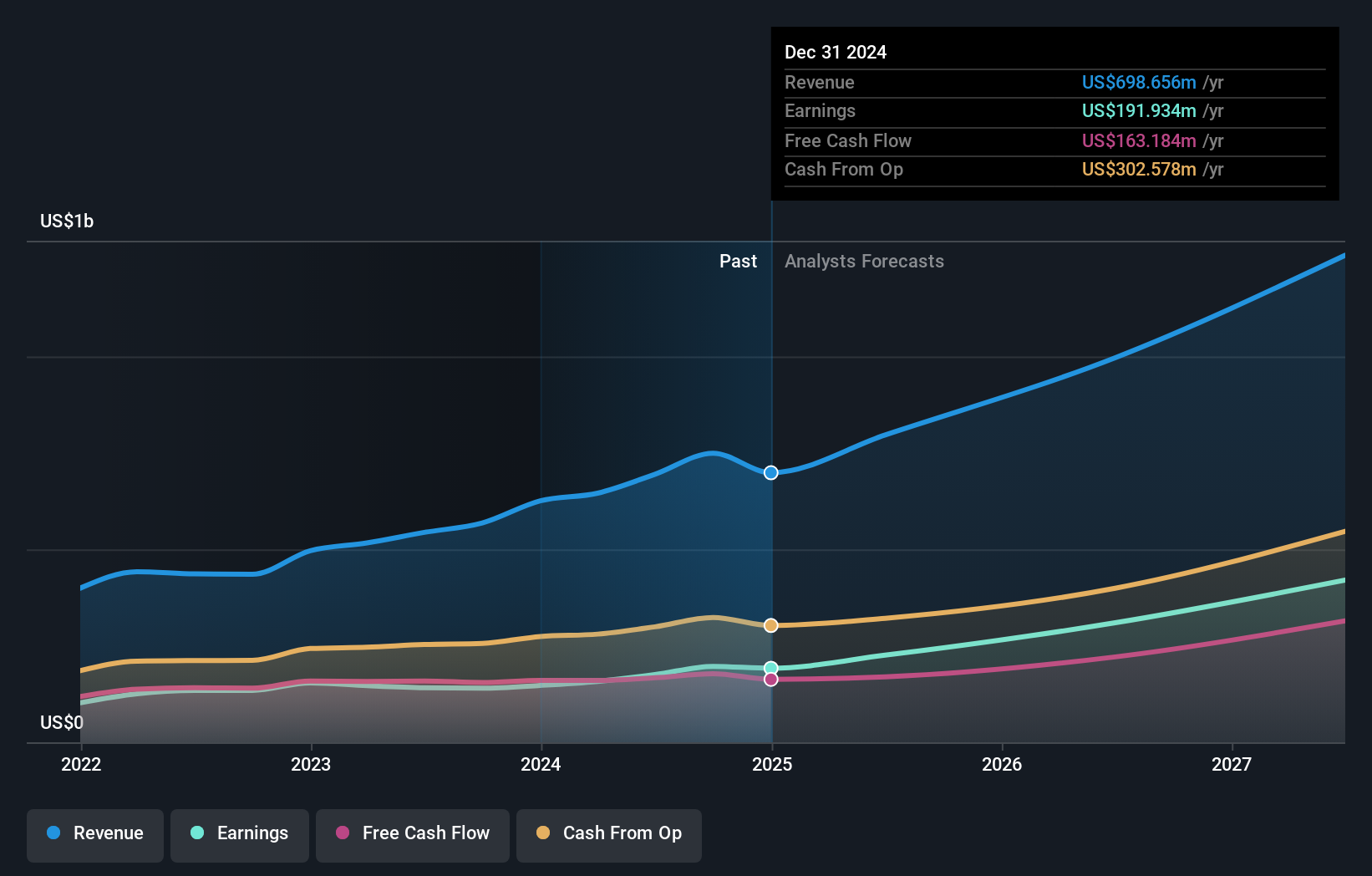

FINEOS Corporation Holdings, a leader in life, accident, and health insurance software systems, is forecasted to grow its revenue by 9.9% per year, surpassing the Australian market's average of 5.4%. The company's R&D expenses have been significant in driving innovation and supporting its IDAM claims platform used by major clients like Voya Financial; for instance, FINEOS reported EUR 64.48 million in sales for H1 2024 despite a net loss of EUR 5.32 million. With over forty customers in North America and serving seven of the ten largest employee benefits insurers in the U.S., FINEOS's strategic focus on integrated disability management positions it well within an evolving industry landscape emphasizing comprehensive employee benefits solutions.

WiseTech Global (ASX:WTC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: WiseTech Global Limited develops and provides software solutions for the logistics execution industry across various regions including the Americas, Asia Pacific, Europe, the Middle East, and Africa, with a market cap of A$39.43 billion.

Operations: WiseTech Global Limited generates revenue primarily from its Internet Software & Services segment, which accounts for A$1.04 billion. The company's software solutions cater to the logistics execution industry across multiple regions including the Americas, Asia Pacific, Europe, the Middle East, and Africa.

WiseTech Global's revenue is projected to grow at 18.9% per year, significantly outpacing the Australian market's average of 5.4%. The company's earnings growth over the past year was an impressive 23.8%, surpassing the software industry's average of 6.7%. In FY2024, WiseTech reported AUD 1.04 billion in revenue and a net income of AUD 262.8 million, reflecting robust financial health and operational efficiency. With substantial R&D investments driving innovation, WiseTech continues to enhance its logistics software solutions for global clients like DHL and FedEx.

- Delve into the full analysis health report here for a deeper understanding of WiseTech Global.

Gain insights into WiseTech Global's past trends and performance with our Past report.

Turning Ideas Into Actions

- Access the full spectrum of 53 ASX High Growth Tech and AI Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FCL

FINEOS Corporation Holdings

Engages in the development and sale of enterprise claims and policy management software for employee benefits and life, accident, and health insurance industries worldwide.

Undervalued with reasonable growth potential.