- Australia

- /

- Metals and Mining

- /

- ASX:MGA

Swelling losses haven't held back gains for MetalsGrove Mining (ASX:MGA) shareholders since they're up 3.9% over 1 year

It is a pleasure to report that the MetalsGrove Mining Limited (ASX:MGA) is up 42% in the last quarter. But in truth the last year hasn't been good for the share price. After all, the share price is down 22% in the last year, significantly under-performing the market.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

View our latest analysis for MetalsGrove Mining

MetalsGrove Mining recorded just AU$50,386 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. You have to wonder why venture capitalists aren't funding it. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. For example, investors may be hoping that MetalsGrove Mining finds some valuable resources, before it runs out of money.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing.

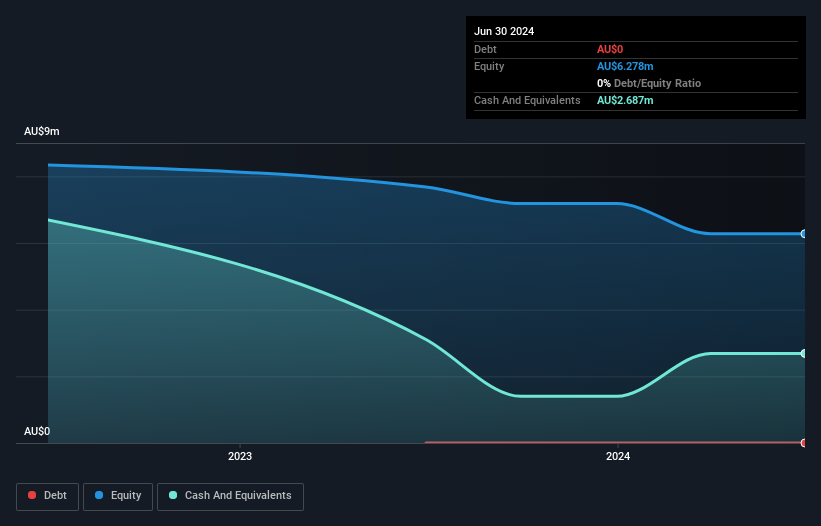

When it last reported its balance sheet in June 2024, MetalsGrove Mining had cash in excess of all liabilities of AU$2.6m. While that's nothing to panic about, there is some possibility the company will raise more capital, especially if profits are not imminent. We'd venture that shareholders are concerned about the need for more capital, because the share price has dropped 22% in the last year. You can click on the image below to see (in greater detail) how MetalsGrove Mining's cash levels have changed over time.

Of course, the truth is that it is hard to value companies without much revenue or profit. Given that situation, would you be concerned if it turned out insiders were relentlessly selling stock? I'd like that just about as much as I like to drink milk and fruit juice mixed together. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between MetalsGrove Mining's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. MetalsGrove Mining hasn't been paying dividends, but its TSR of 3.9% exceeds its share price return of -22%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

MetalsGrove Mining shareholders have gained 3.9% for the year. The bad news is that's no better than the average market return, which was roughly 25%. Shareholders are doubtless excited that the stock price has been doing even better lately, with a gain of 42% in just ninety days. The very recent increase in the share price could be evidence that the narrative is changing for the better due to fundamental improvements. It's always interesting to track share price performance over the longer term. But to understand MetalsGrove Mining better, we need to consider many other factors. Even so, be aware that MetalsGrove Mining is showing 6 warning signs in our investment analysis , and 5 of those are significant...

MetalsGrove Mining is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:MGA

MetalsGrove Mining

Operates as an exploration and development company in Australia.

Excellent balance sheet slight.

Market Insights

Community Narratives