Will Energy One’s (ASX:EOL) Equity Incentives Deepen Alignment or Signal Evolving Management Priorities?

Reviewed by Simply Wall St

- In recent days, Energy One Limited issued a total of 106,590 ordinary fully paid securities under its employee incentive scheme, including 87,210 shares acquired by Director Shaun Ankers as part of share rights vesting, and an additional 19,380 shares to be quoted on the ASX.

- This coordinated move highlights the company's focus on aligning employee and management interests with company growth objectives and corporate governance standards.

- Next, we'll explore how the expanded employee incentive scheme and director share acquisition could influence Energy One's investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Energy One Investment Narrative Recap

To be a shareholder in Energy One, you need conviction in the long-term growth of renewables-driven energy markets and the company's ongoing success in providing mission-critical software solutions across Australia and Europe. The recent employee incentive scheme expansion and director share acquisition reinforce alignment between staff, management and shareholders, but these actions are unlikely to materially affect the near-term focus on international expansion or the primary risk of geographic concentration.

Of the recent announcements, the company’s newly released corporate governance statement stands out, further reinforcing management’s commitment to transparency and accountability, both essential as Energy One balances rapid market growth with competitive threats and expansion ambitions. Investors following the catalysts for earnings growth and the risks involved may find this governance focus offers context for assessing management decisions and oversight practices.

But while these steps may boost confidence, investors should also consider the company’s heavy reliance on the Australian and European markets, raising important questions about regional revenue exposure that...

Read the full narrative on Energy One (it's free!)

Energy One's outlook anticipates A$88.2 million in revenue and A$19.9 million in earnings by 2028. Achieving this would require annual revenue growth of 13.0% and an increase in earnings of A$14 million from the current A$5.9 million.

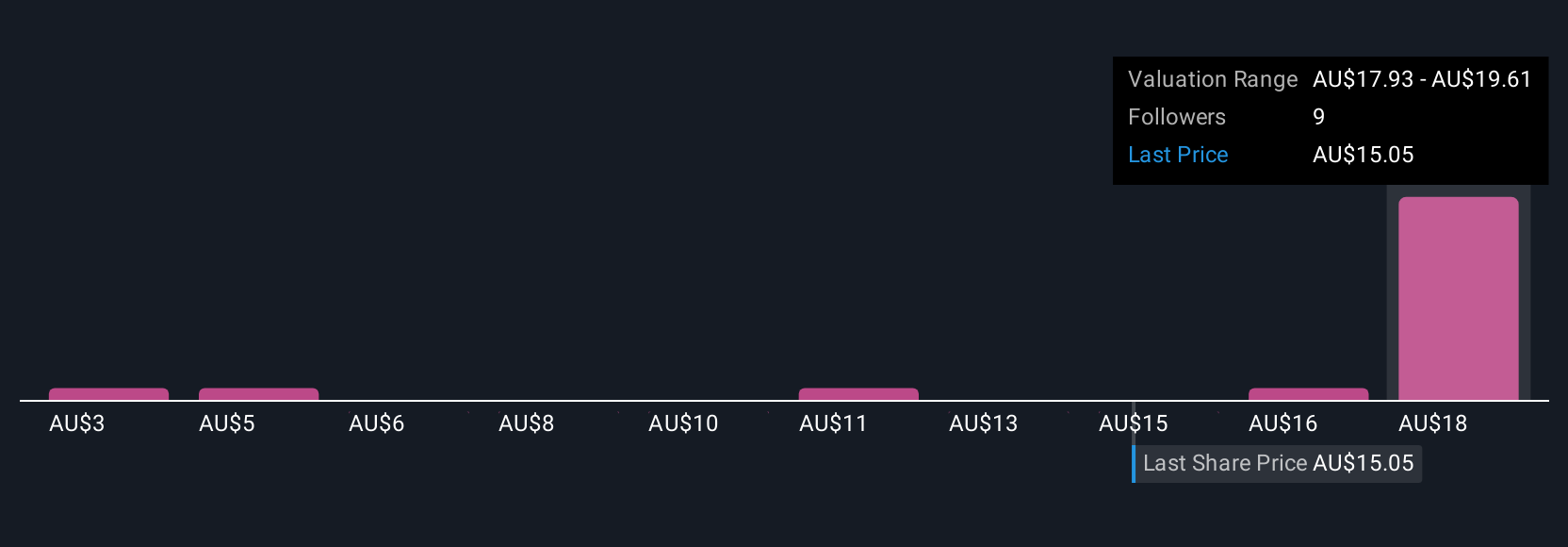

Uncover how Energy One's forecasts yield a A$19.61 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Six different Simply Wall St Community members estimate Energy One’s fair value across a wide spectrum, from A$2.85 up to A$19.61 per share. With competition rising and the company’s expansion plans in focus, perspectives can vary widely, consider contrasting outlooks before making decisions.

Explore 6 other fair value estimates on Energy One - why the stock might be worth as much as 27% more than the current price!

Build Your Own Energy One Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Energy One research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Energy One research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Energy One's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energy One might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EOL

Energy One

Engages in the provision of software products, outsourced operations, and advisory services to wholesale energy, environmental, and carbon trading markets in the Australasia, and Europe.

High growth potential with solid track record.

Market Insights

Community Narratives