Last Update21 Aug 25Fair value Increased 80%

Driven by a notable improvement in net profit margin and a higher future P/E ratio indicating increased earnings expectations and investor optimism, the consensus analyst price target for Energy One has been significantly raised from A$10.91 to A$19.22.

Valuation Changes

Summary of Valuation Changes for Energy One

- The Consensus Analyst Price Target has significantly risen from A$10.91 to A$19.22.

- The Future P/E for Energy One has significantly risen from 26.54x to 37.70x.

- The Net Profit Margin for Energy One has significantly risen from 18.83% to 21.18%.

Key Takeaways

- Energy One is well-placed to benefit from rising complexity in renewable energy markets through advanced software, geographic expansion, and early moves into emerging technology trends.

- Investments in technology, SaaS offerings, and compliance are strengthening recurring revenues, supporting margin expansion, and attracting larger customers for long-term growth.

- Heavy concentration in limited regions, rising competition, investment burdens, and client insourcing trends threaten growth, market share, and future earnings stability.

Catalysts

About Energy One- Provides software products, outsourced operations, and advisory services to wholesale energy, environmental, and carbon trading markets in the Australasia, and Europe.

- The accelerated transition to renewables globally and the resulting increase in grid complexity are driving sustained and growing demand for advanced energy trading and management software. Energy One's strong positioning in providing mission-critical, end-to-end solutions uniquely positions it to capture market share and grow revenues as utilities and energy providers expand their use of renewables and battery assets.

- Rising requirements for market transparency, reporting, and grid compliance-particularly as energy markets diversify-are intensifying the need for sophisticated software platforms. Energy One's investment in technology and achievement (expected) of ISO 27001 cybersecurity certification enhances its credibility and appeal, supporting new customer acquisition and expansion into larger Tier 1 accounts, which should bolster revenue growth and improve earnings quality.

- The ongoing digitalization of energy markets, with growing adoption of cloud-based and SaaS models, is increasing recurring revenue and enabling operational efficiencies. Energy One's expanding SaaS offerings and cross-selling initiatives are driving ARR (Annual Recurring Revenue) growth and are likely to support margin expansion over time, directly impacting both revenue stability and net margins.

- Geographic expansion remains a tangible revenue growth catalyst-Europe's significantly larger addressable market is still at an earlier stage of penetration, with strong recent performance, ongoing operational improvements, and a clear pathway to higher margins closer to those seen in the mature Australian business. As Energy One increases its European presence and potentially enters North America, top-line growth and international revenue diversification are likely to accelerate.

- The emergence and proliferation of distributed energy resources (DERs), virtual power plants, and peer-to-peer/behind-the-meter trading represent major long-term growth drivers. These trends will drive complexity and increase the need for advanced, integrated software solutions. Energy One's early investments and acquisition strategy position it to capitalize on these industry shifts, providing structural support to future revenue growth.

Energy One Future Earnings and Revenue Growth

Assumptions

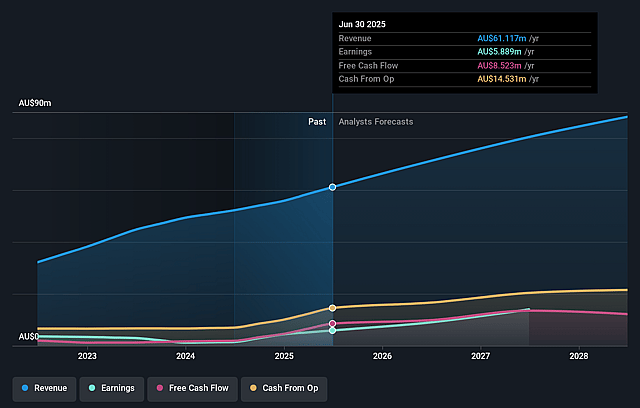

How have these above catalysts been quantified?- Analysts are assuming Energy One's revenue will grow by 13.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.6% today to 22.6% in 3 years time.

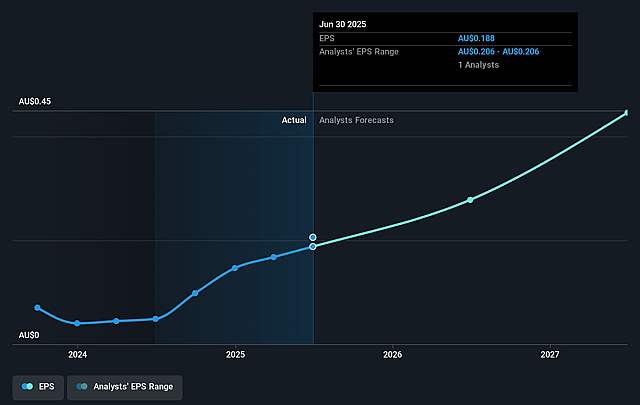

- Analysts expect earnings to reach A$19.9 million (and earnings per share of A$0.64) by about September 2028, up from A$5.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 38.5x on those 2028 earnings, down from 79.5x today. This future PE is greater than the current PE for the AU Software industry at 33.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.03%, as per the Simply Wall St company report.

Energy One Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on the Australian and UK/European markets, with limited current exposure outside these regions, could constrain long-term revenue growth and leave the company vulnerable to region-specific economic downturns or unfavourable regulatory changes, which would impact future topline growth and diversification.

- Expansion into the U.S. market is mentioned as a strategic priority but comes with significant execution risk; failed or poorly integrated acquisitions or unsuccessful market entry could lead to increased operating expenses and potential dilution from equity raises, negatively affecting net margins and EPS.

- Intensifying competition, both from larger global energy software vendors (especially as the sector consolidates) and from specialized or open-source entrants, could erode Energy One's market share and pricing power, placing pressure on revenue and long-term profitability.

- The company acknowledges relatively high ongoing investment requirements in technology, cybersecurity ("at least $1 million spend" and pursuit of ISO certifications), and service quality; if market growth or margin expansion lags expectations, these fixed cost commitments could squeeze future net margins and delay earnings growth.

- Customer attrition risk-highlighted by the recent spike to 4% churn in Europe due to clients bringing capabilities in-house-demonstrates the vulnerability to client-side technology shifts or insourcing trends, potentially impacting recurring revenue and stability of future earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$19.61 for Energy One based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$88.2 million, earnings will come to A$19.9 million, and it would be trading on a PE ratio of 38.5x, assuming you use a discount rate of 8.0%.

- Given the current share price of A$14.9, the analyst price target of A$19.61 is 24.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.