- Australia

- /

- Auto Components

- /

- ASX:PWH

3 ASX Growth Stocks With High Insider Ownership Growing Earnings Up To 47%

Reviewed by Simply Wall St

As the Australian market navigates a mixed landscape, with materials gaining ground and financials lagging, investors are keenly observing growth opportunities amidst fluctuating conditions. In such an environment, stocks with high insider ownership can be particularly appealing as they often indicate confidence in the company's future prospects.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 10.4% | 96.4% |

| Titomic (ASX:TTT) | 11.2% | 74.9% |

| Pure Hydrogen (ASX:PH2) | 10.4% | 114.6% |

| Pointerra (ASX:3DP) | 19.8% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Lunnon Metals (ASX:LM8) | 11% | 31.4% |

| IRIS Metals (ASX:IR1) | 23.5% | 144.4% |

| Emerald Resources (ASX:EMR) | 18.4% | 57.2% |

| Echo IQ (ASX:EIQ) | 19.1% | 51.4% |

| Adveritas (ASX:AV1) | 18.4% | 96.8% |

Let's take a closer look at a couple of our picks from the screened companies.

Energy One (ASX:EOL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Energy One Limited provides software products, outsourced operations, and advisory services to wholesale energy, environmental, and carbon trading markets in Australasia and Europe, with a market cap of A$525.92 million.

Operations: The company's revenue primarily comes from the Energy Software Industry, amounting to A$61.12 million.

Insider Ownership: 24.7%

Earnings Growth Forecast: 31.5% p.a.

Energy One is experiencing robust growth, with earnings forecasted to rise significantly at 31.5% annually, outpacing the Australian market's 12%. Despite revenue growth projections of 13.9% being below the ideal for high-growth companies, it remains above the broader market average. Analysts expect a stock price increase of 27%, supported by substantial insider buying over recent months. Recently added to the S&P/ASX Emerging Companies Index, Energy One continues to attract investor attention.

- Unlock comprehensive insights into our analysis of Energy One stock in this growth report.

- Our comprehensive valuation report raises the possibility that Energy One is priced higher than what may be justified by its financials.

PWR Holdings (ASX:PWH)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PWR Holdings Limited specializes in the design, prototyping, production, testing, validation, and sale of cooling products and solutions globally with a market capitalization of approximately A$814.65 million.

Operations: The company's revenue is derived from two main segments: PWR C&R, contributing A$42.33 million, and PWR Performance Products, generating A$101.83 million.

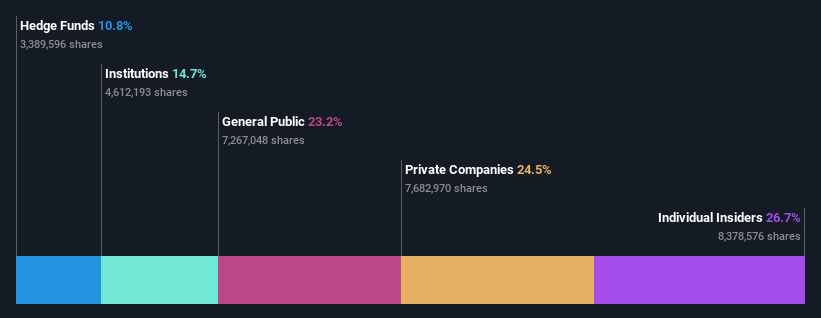

Insider Ownership: 13.4%

Earnings Growth Forecast: 26.9% p.a.

PWR Holdings is experiencing significant earnings growth, forecasted at 26.9% annually, surpassing the Australian market's 12%. While revenue growth of 13.8% per year is below the ideal for high-growth companies, it exceeds the market average of 5.9%. Recent board changes include Kees Weel transitioning to Chairman and Alexandra Coleman as Company Secretary. PWR trades slightly below its estimated fair value, with no substantial insider trading activity reported in recent months.

- Click here and access our complete growth analysis report to understand the dynamics of PWR Holdings.

- Upon reviewing our latest valuation report, PWR Holdings' share price might be too optimistic.

Telix Pharmaceuticals (ASX:TLX)

Simply Wall St Growth Rating: ★★★★★☆

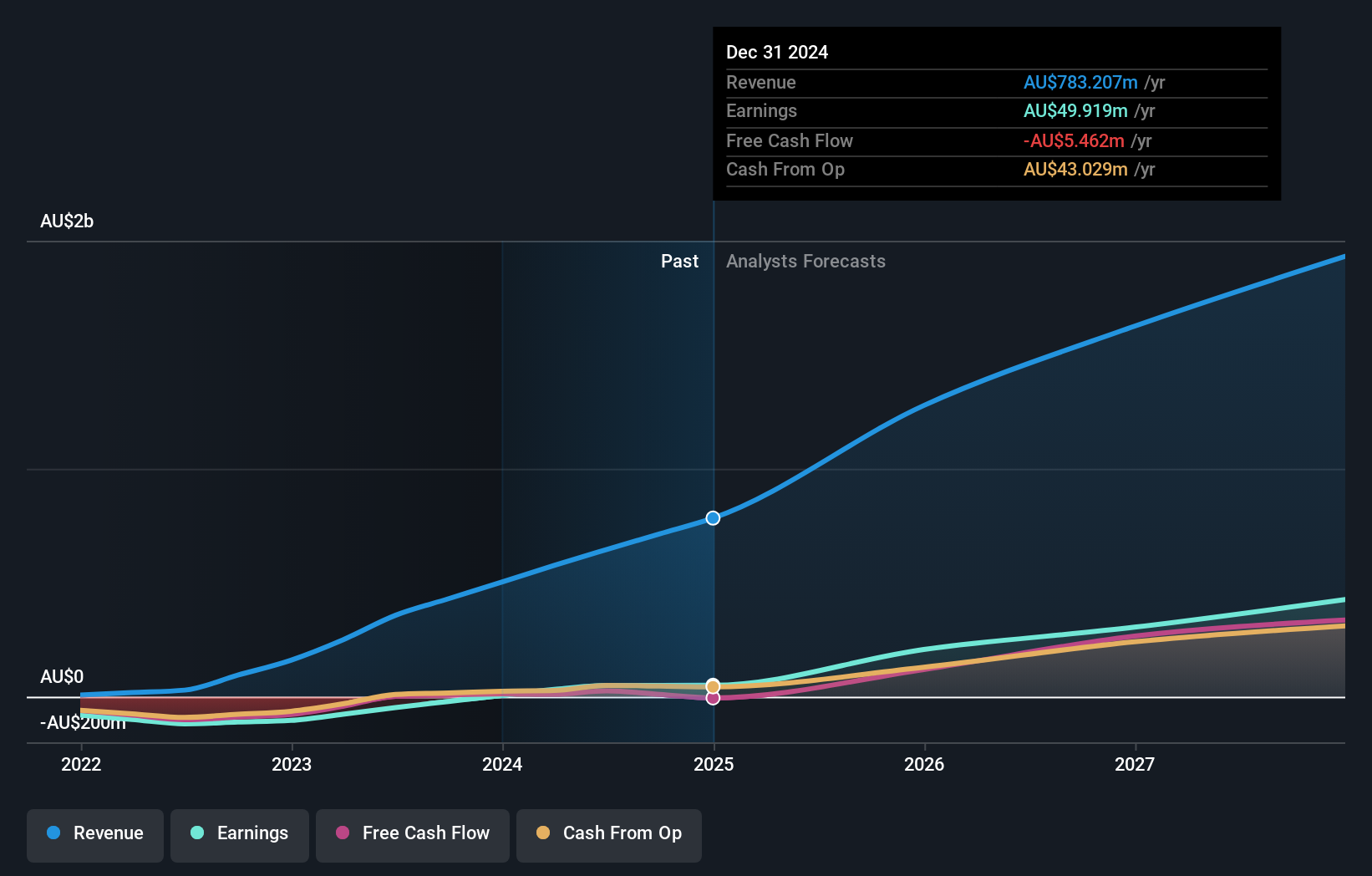

Overview: Telix Pharmaceuticals Limited is a commercial-stage biopharmaceutical company that develops and commercializes therapeutic and diagnostic radiopharmaceuticals, with a market cap of A$5.03 billion.

Operations: The company's revenue is primarily derived from its Precision Medicine segment at $575.13 million, followed by Manufacturing Solutions at $115.57 million and Therapeutics at $7.29 million.

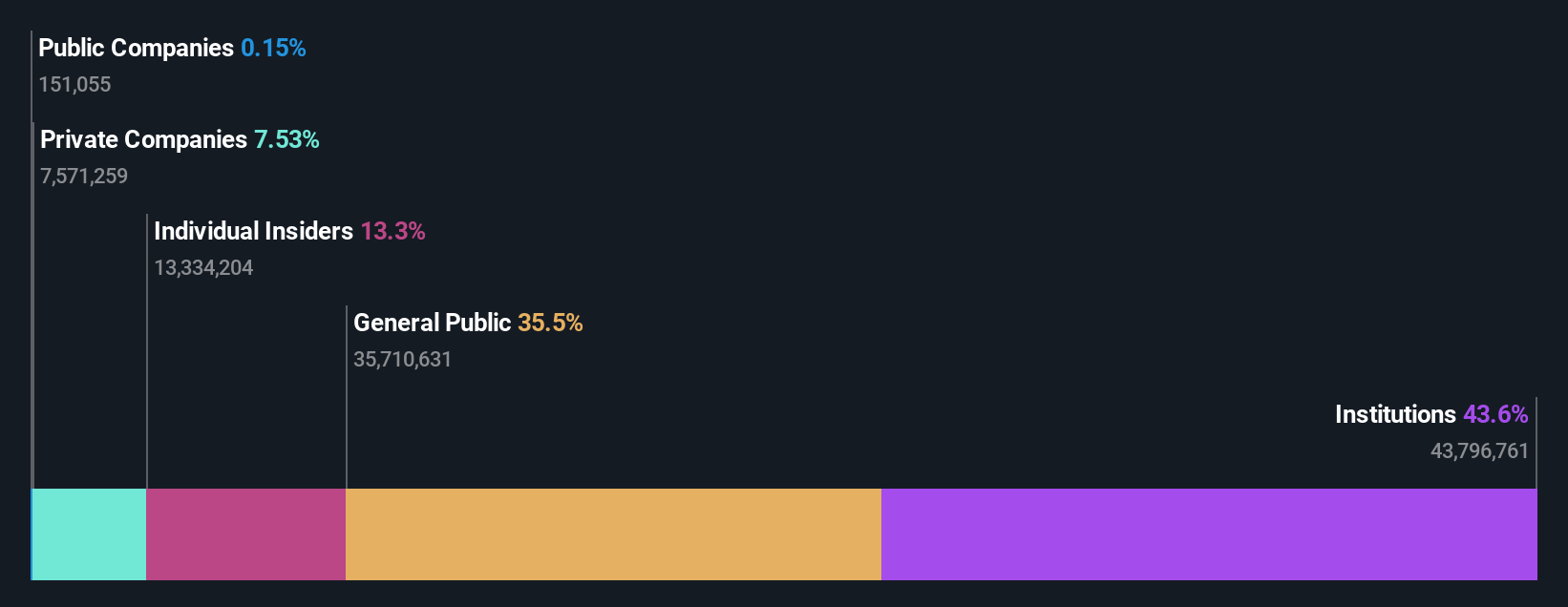

Insider Ownership: 14.9%

Earnings Growth Forecast: 47.5% p.a.

Telix Pharmaceuticals is poised for substantial earnings growth, forecasted at 47.5% annually, significantly outpacing the Australian market. Despite revenue growth expectations of 17.2% per year being below the ideal for high-growth companies, they exceed the market average. Recent product developments include positive ZIRCON-X study results and FDA feedback on TLX250-CDx resubmission plans. Legal challenges persist with a class action lawsuit alleging misleading statements about prostate cancer therapeutics and supply chain quality.

- Delve into the full analysis future growth report here for a deeper understanding of Telix Pharmaceuticals.

- In light of our recent valuation report, it seems possible that Telix Pharmaceuticals is trading behind its estimated value.

Next Steps

- Delve into our full catalog of 106 Fast Growing ASX Companies With High Insider Ownership here.

- Searching for a Fresh Perspective? We've found 14 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PWH

PWR Holdings

Engages in the design, prototyping, production, testing, validation, and sale of cooling products and solutions in Australia, the United States, the United Kingdom, Italy, Germany, France, Japan, Finland, Croatia, and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success