Here's What We Think About Elmo Software's (ASX:ELO) CEO Pay

Danny Lessem is the CEO of Elmo Software Limited (ASX:ELO), and in this article, we analyze the executive's compensation package with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for Elmo Software

Comparing Elmo Software Limited's CEO Compensation With the industry

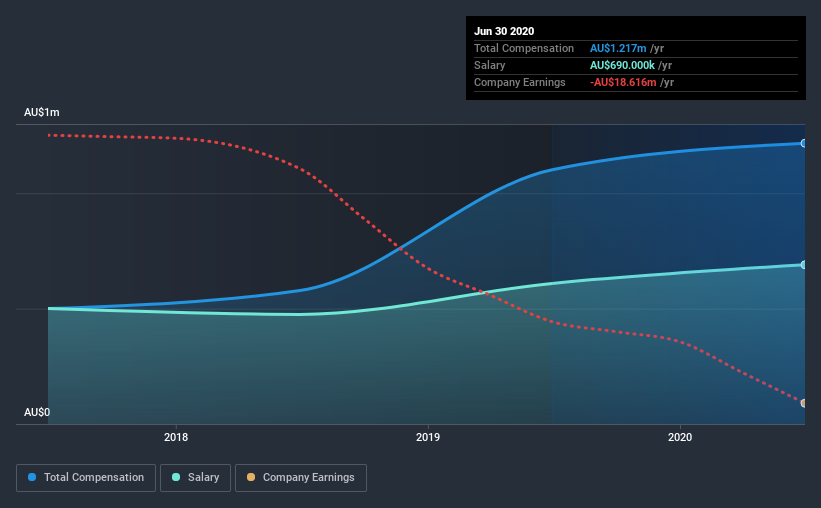

At the time of writing, our data shows that Elmo Software Limited has a market capitalization of AU$493m, and reported total annual CEO compensation of AU$1.2m for the year to June 2020. We note that's an increase of 10% above last year. We note that the salary portion, which stands at AU$690.0k constitutes the majority of total compensation received by the CEO.

On examining similar-sized companies in the industry with market capitalizations between AU$272m and AU$1.1b, we discovered that the median CEO total compensation of that group was AU$1.3m. From this we gather that Danny Lessem is paid around the median for CEOs in the industry. What's more, Danny Lessem holds AU$62m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$690k | AU$609k | 57% |

| Other | AU$527k | AU$492k | 43% |

| Total Compensation | AU$1.2m | AU$1.1m | 100% |

Talking in terms of the industry, salary represented approximately 60% of total compensation out of all the companies we analyzed, while other remuneration made up 40% of the pie. There isn't a significant difference between Elmo Software and the broader market, in terms of salary allocation in the overall compensation package. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Elmo Software Limited's Growth

Over the last three years, Elmo Software Limited has shrunk its earnings per share by 65% per year. Its revenue is up 25% over the last year.

The reduction in EPS, over three years, is arguably concerning. But on the other hand, revenue growth is strong, suggesting a brighter future. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Elmo Software Limited Been A Good Investment?

Most shareholders would probably be pleased with Elmo Software Limited for providing a total return of 140% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

As previously discussed, Danny is compensated close to the median for companies of its size, and which belong to the same industry. The company has logged solid shareholder returns for the past three years. At the same time, revenues are also moving northwards at a healthy pace. However, on a concerning note, EPS is not growing. Considering overall performance, it's fair to say Danny is paid reasonably.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 3 warning signs for Elmo Software that you should be aware of before investing.

Switching gears from Elmo Software, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade Elmo Software, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if ELMO Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:ELO

ELMO Software

ELMO Software Limited provides software-as-a-service, cloud-based human resource (HR), payroll, and expense management solutions in Australia, New Zealand, the United Kingdom, and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion