Laurence Baynham has been the CEO of Data#3 Limited (ASX:DTL) since 2014, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

See our latest analysis for Data#3

How Does Total Compensation For Laurence Baynham Compare With Other Companies In The Industry?

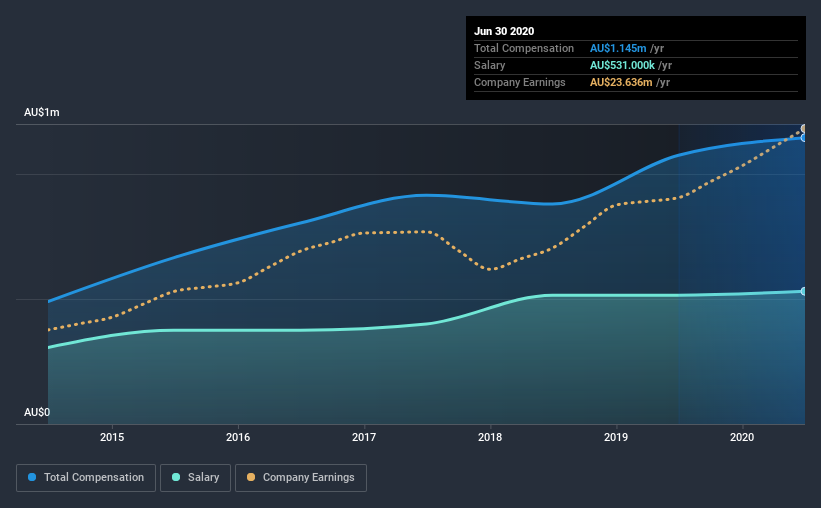

At the time of writing, our data shows that Data#3 Limited has a market capitalization of AU$821m, and reported total annual CEO compensation of AU$1.1m for the year to June 2020. That's a fairly small increase of 6.6% over the previous year. While we always look at total compensation first, our analysis shows that the salary component is less, at AU$531k.

For comparison, other companies in the same industry with market capitalizations ranging between AU$520m and AU$2.1b had a median total CEO compensation of AU$1.4m. This suggests that Data#3 remunerates its CEO largely in line with the industry average. Furthermore, Laurence Baynham directly owns AU$724k worth of shares in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$531k | AU$515k | 46% |

| Other | AU$614k | AU$560k | 54% |

| Total Compensation | AU$1.1m | AU$1.1m | 100% |

On an industry level, around 66% of total compensation represents salary and 34% is other remuneration. Data#3 pays a modest slice of remuneration through salary, as compared to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Data#3 Limited's Growth

Data#3 Limited's earnings per share (EPS) grew 15% per year over the last three years. It achieved revenue growth of 15% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Data#3 Limited Been A Good Investment?

We think that the total shareholder return of 250%, over three years, would leave most Data#3 Limited shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

As previously discussed, Laurence is compensated close to the median for companies of its size, and which belong to the same industry. The company is growing EPS and total shareholder returns have been pleasing. So one could argue that CEO compensation is quite modest, if you consider company performance! Stockholders might even be okay with a bump in pay, seeing as how investor returns have been so strong.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 2 warning signs for Data#3 that investors should think about before committing capital to this stock.

Important note: Data#3 is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade Data#3, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:DTL

Data#3

Provides information technology solutions and services in Australia.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion