Update: Damstra Holdings (ASX:DTC) Stock Gained 19% In The Last Year

While Damstra Holdings Limited (ASX:DTC) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 28% in the last quarter. But looking back over the last year, the returns have actually been rather pleasing! Looking at the full year, the company has easily bested an index fund by gaining 19%.

View our latest analysis for Damstra Holdings

Damstra Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

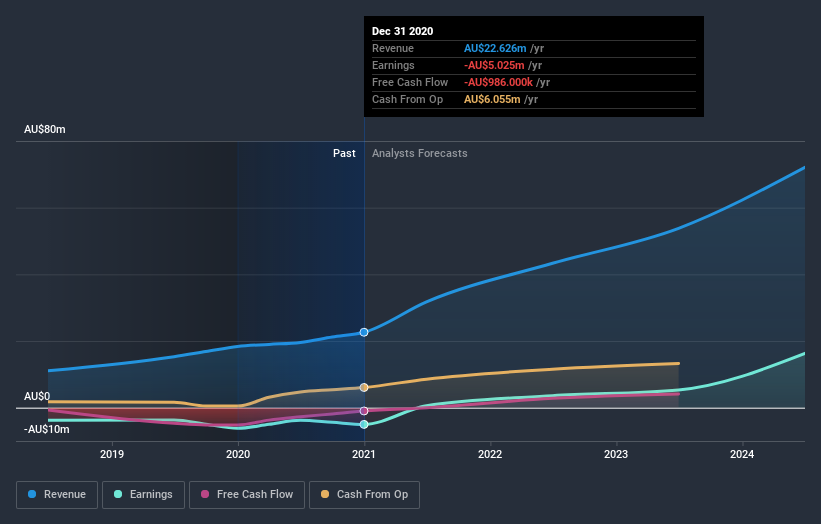

Damstra Holdings grew its revenue by 23% last year. That's a fairly respectable growth rate. While the share price performed well, gaining 19% over twelve months, you could argue the revenue growth warranted it. If revenue stays on trend, there may be plenty more share price gains to come. But before deciding this growth stock is underappreciated, you might want to check out profitability trends (and cash flow)

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling Damstra Holdings stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Damstra Holdings boasts a total shareholder return of 19% for the last year. We regret to report that the share price is down 28% over ninety days. Shorter term share price moves often don't signify much about the business itself. It's always interesting to track share price performance over the longer term. But to understand Damstra Holdings better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Damstra Holdings you should know about.

Damstra Holdings is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you decide to trade Damstra Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:DTC

Damstra Holdings

Damstra Holdings Limited operates as an enterprise protection software provider in Australia, the United States, New Zealand, and internationally.

Adequate balance sheet and fair value.

Market Insights

Community Narratives