If You Had Bought Dropsuite (ASX:DSE) Stock A Year Ago, You Could Pocket A 283% Gain Today

When you buy shares in a company, there is always a risk that the price drops to zero. But if you pick the right stock, you can make a lot more than 100%. For example, the Dropsuite Limited (ASX:DSE) share price has soared 283% in the last year. Most would be very happy with that, especially in just one year! Also pleasing for shareholders was the 64% gain in the last three months. Looking back further, the stock price is 205% higher than it was three years ago.

View our latest analysis for Dropsuite

Dropsuite wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year Dropsuite saw its revenue shrink by 1.6%. So we would not have expected the share price to rise 283%. It just goes to show the market doesn't always pay attention to the reported numbers. It's quite likely the revenue fall was already priced in, anyway.

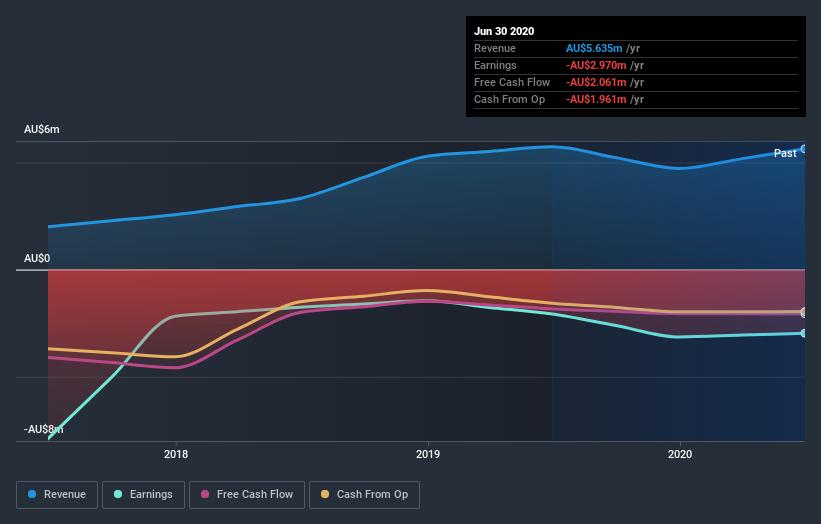

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We're pleased to report that Dropsuite rewarded shareholders with a total shareholder return of 283% over the last year. That's better than the annualized TSR of 45% over the last three years. The improving returns to shareholders suggests the stock is becoming more popular with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 4 warning signs we've spotted with Dropsuite .

But note: Dropsuite may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you decide to trade Dropsuite, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:DSE

Dropsuite

Provides cloud-based suite of data backup and archiving solutions in Australia, Singapore, Europe, the United States, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion