If You Had Bought Chant West Holdings (ASX:CWL) Stock Three Years Ago, You'd Be Sitting On A 76% Loss, Today

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

While not a mind-blowing move, it is good to see that the Chant West Holdings Limited (ASX:CWL) share price has gained 15% in the last three months. But only the myopic could ignore the astounding decline over three years. To wit, the share price sky-dived 76% in that time. So it sure is nice to see a big of an improvement. Of course the real question is whether the business can sustain a turnaround.

View our latest analysis for Chant West Holdings

Chant West Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

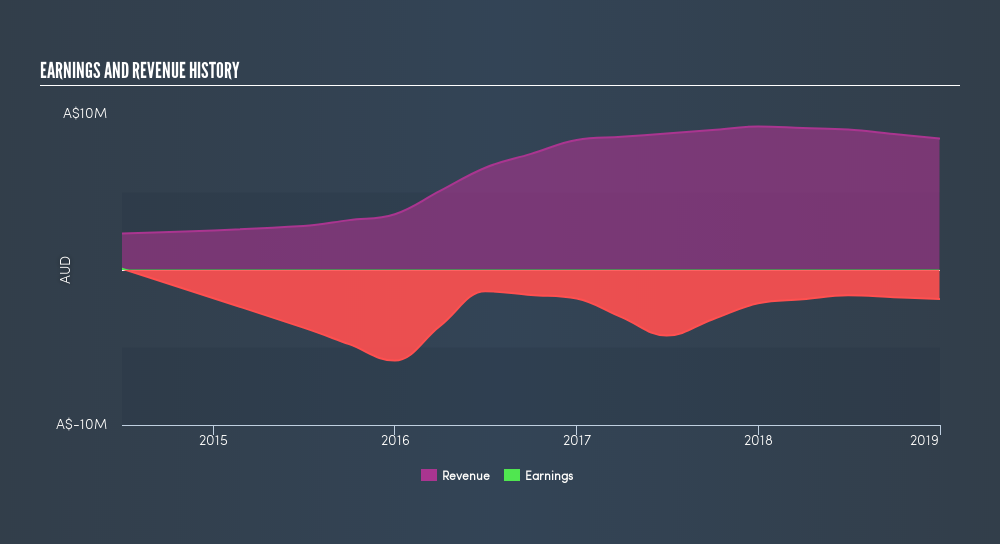

Over three years, Chant West Holdings grew revenue at 18% per year. That's a fairly respectable growth rate. So it seems unlikely the 38% share price drop (each year) is entirely about the revenue. It could be that the losses were much larger than expected. This is exactly why investors need to diversify - even when a loss making company grows revenue, it can fail to deliver for shareholders.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

This free interactive report on Chant West Holdings's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Chant West Holdings rewarded shareholders with a total shareholder return of 62% over the last year. This recent result is much better than the 38% drop suffered by shareholders each year (on average) over the last three. The optimist would say this is evidence that the stock has bottomed, and better days lie ahead. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

For those who like to find winning investments this freelist of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Market Insights

Community Narratives