Some CV Check (ASX:CV1) Shareholders Have Taken A Painful 79% Share Price Drop

It is a pleasure to report that the CV Check Ltd (ASX:CV1) is up 52% in the last quarter. But that doesn't change the fact that the returns over the last three years have been stomach churning. To wit, the share price sky-dived 79% in that time. So it sure is nice to see a big of an improvement. Of course the real question is whether the business can sustain a turnaround.

See our latest analysis for CV Check

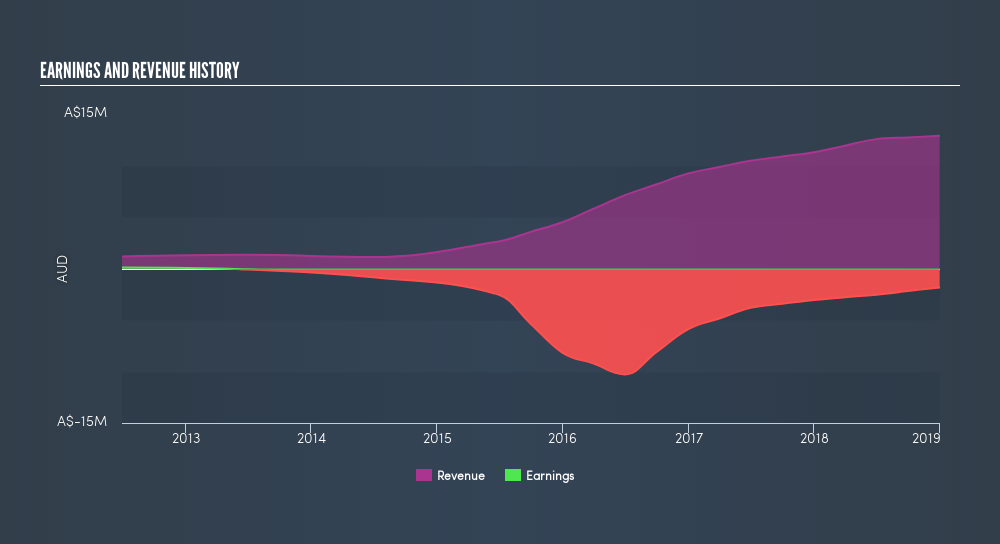

CV Check isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, CV Check saw its revenue grow by 28% per year, compound. That's well above most other pre-profit companies. So on the face of it we're really surprised to see the share price down 41% a year in the same time period. You'd want to take a close look at the balance sheet, as well as the losses. Ultimately, revenue growth doesn't amount to much if the business can't scale well. If the company is low on cash, it may have to raise capital soon.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

Take a more thorough look at CV Check's financial health with this freereport on its balance sheet.

A Different Perspective

The last twelve months weren't great for CV Check shares, which cost holders 5.2%, while the market was up about 8.3%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. However, the loss over the last year isn't as bad as the 41% per annum loss investors have suffered over the last three years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. If you would like to research CV Check in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

But note: CV Check may not be the best stock to buy. So take a peek at this freelist of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:KYP

Kinatico

Provides screening, verification, and SaaS-based workforce management and compliance technology systems in Australia and New Zealand.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives