- Australia

- /

- Metals and Mining

- /

- ASX:MLX

Discover 3 ASX Penny Stocks With Market Caps Over A$100M

Reviewed by Simply Wall St

As the Australian stock market navigates the close of a turbulent financial year, it reflects a global trend of cautious optimism bolstered by strong performances in U.S. markets. Penny stocks, though often considered a relic from past market eras, continue to offer intriguing investment opportunities by highlighting smaller or newer companies that may be overlooked. By focusing on those with robust financials and potential for growth, investors can uncover promising prospects among these lesser-known equities.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.37 | A$106.04M | ✅ 3 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.30 | A$108.5M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.65 | A$123.97M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.85 | A$439.42M | ✅ 4 ⚠️ 2 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.79 | A$473.29M | ✅ 4 ⚠️ 1 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$352.8M | ✅ 2 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.70 | A$833.14M | ✅ 5 ⚠️ 3 View Analysis > |

| Lindsay Australia (ASX:LAU) | A$0.72 | A$228.41M | ✅ 4 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.77 | A$178.89M | ✅ 3 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.775 | A$142.97M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 473 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Aroa Biosurgery (ASX:ARX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aroa Biosurgery Limited is a company that develops, manufactures, and sells medical devices for wound and soft tissue repair using ECM technology, with a market cap of A$193.22 million.

Operations: The company generates revenue of NZ$84.70 million from its operations in developing, manufacturing, and selling soft tissue repair products.

Market Cap: A$193.22M

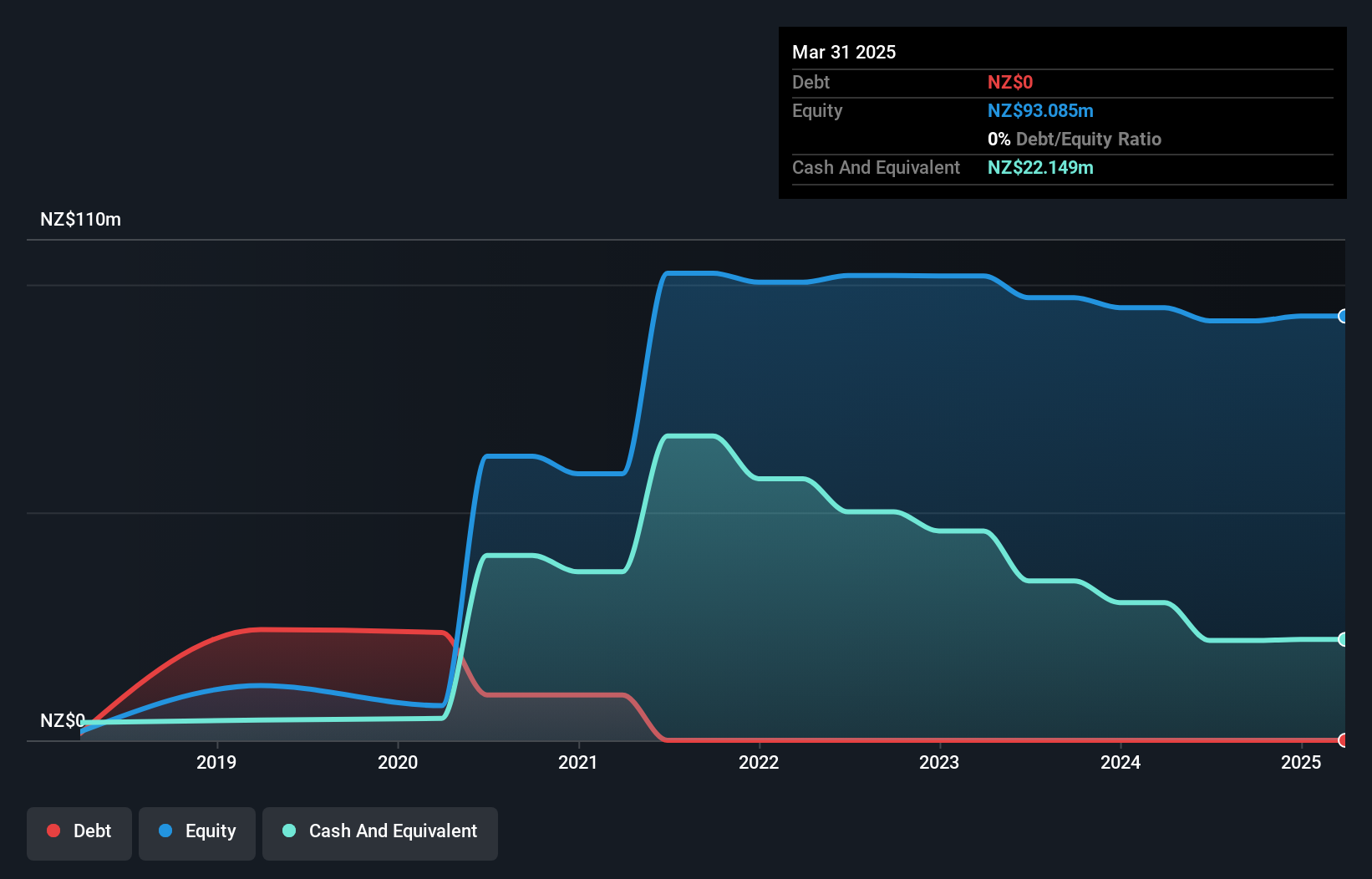

Aroa Biosurgery Limited, with a market cap of A$193.22 million, has shown promising growth in revenue, reporting NZ$84.70 million for the fiscal year ending March 31, 2025. Despite being currently unprofitable, it has reduced losses by 21.2% annually over five years and expects sales between US$90 million to US$100 million in Fiscal Year 2026. The company is debt-free and maintains a strong cash runway exceeding three years based on current free cash flow. Recent clinical studies highlight the effectiveness of its Endoform Natural product, potentially enhancing patient outcomes and reducing healthcare costs significantly.

- Navigate through the intricacies of Aroa Biosurgery with our comprehensive balance sheet health report here.

- Explore Aroa Biosurgery's analyst forecasts in our growth report.

COSOL (ASX:COS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: COSOL Limited, with a market cap of A$115.56 million, provides information technology services across the Asia Pacific, North America, Europe, the Middle East, Africa, and other international markets.

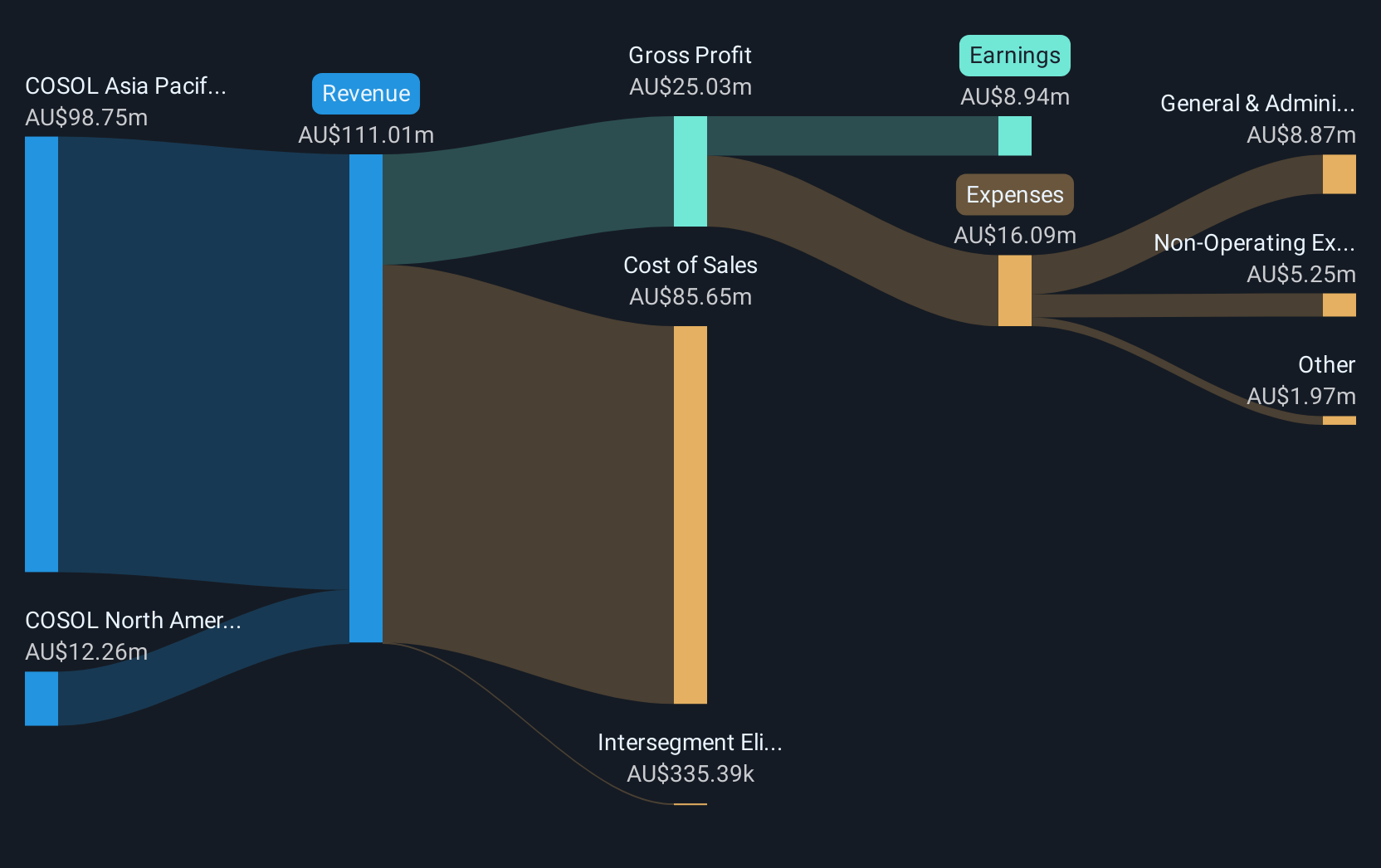

Operations: The company's revenue is derived from its Asia Pacific segment, contributing A$98.75 million, and its North America segment, which adds A$12.26 million.

Market Cap: A$115.56M

COSOL Limited, with a market cap of A$115.56 million, operates across various international markets, deriving significant revenue from its Asia Pacific and North America segments. The company has demonstrated high-quality earnings and trades at a lower price-to-earnings ratio compared to the Australian market average. While its interest payments are well covered by EBIT, short-term assets do not cover long-term liabilities. Despite an increase in debt-to-equity ratio over five years, it remains satisfactory. COSOL's earnings have grown significantly over the past five years but recently slowed below industry growth rates; however, future forecasts predict a 19.34% annual growth rate in earnings.

- Dive into the specifics of COSOL here with our thorough balance sheet health report.

- Gain insights into COSOL's future direction by reviewing our growth report.

Metals X (ASX:MLX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Metals X Limited is an Australian company focused on the production of tin, with a market capitalization of A$505.24 million.

Operations: The company generates revenue from its 50% ownership in the Renison Tin Operation, amounting to A$218.82 million.

Market Cap: A$505.24M

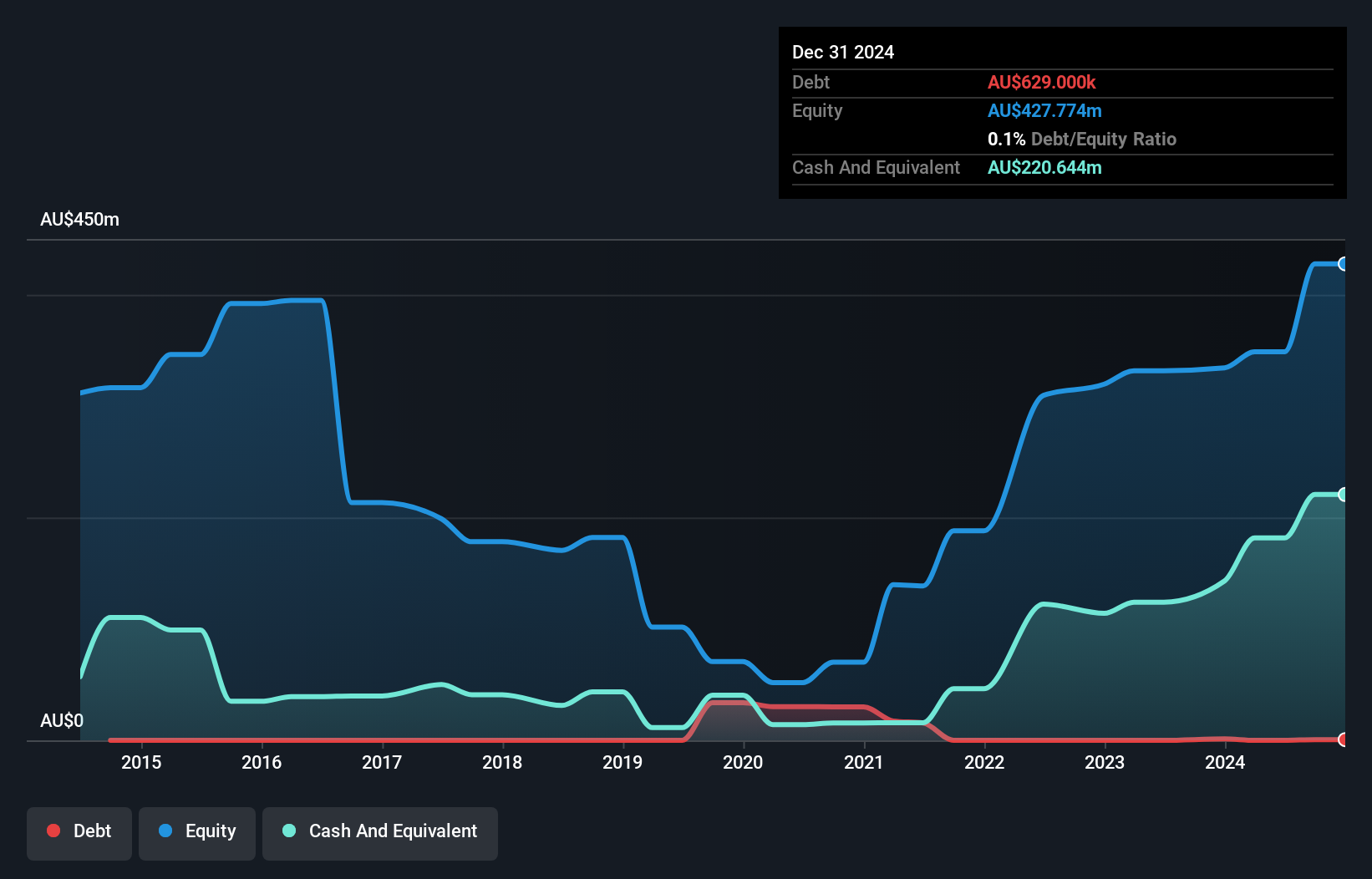

Metals X Limited, with a market cap of A$505.24 million, has shown impressive financial performance with its earnings growing by a very large 601.7% over the past year, significantly outpacing the industry. The company benefits from experienced management and board members and maintains strong liquidity, as short-term assets exceed both short- and long-term liabilities. Its debt is well covered by operating cash flow, indicating robust financial health. Despite a large one-off gain impacting recent results, Metals X's profitability has accelerated over five years while maintaining high return on equity at 23.9%, suggesting efficient use of capital resources.

- Click here and access our complete financial health analysis report to understand the dynamics of Metals X.

- Understand Metals X's track record by examining our performance history report.

Turning Ideas Into Actions

- Jump into our full catalog of 473 ASX Penny Stocks here.

- Ready For A Different Approach? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MLX

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives