COSOL (ASX:COS) Ticks All The Boxes When It Comes To Earnings Growth

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like COSOL (ASX:COS). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide COSOL with the means to add long-term value to shareholders.

View our latest analysis for COSOL

How Quickly Is COSOL Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, COSOL has grown EPS by 21% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

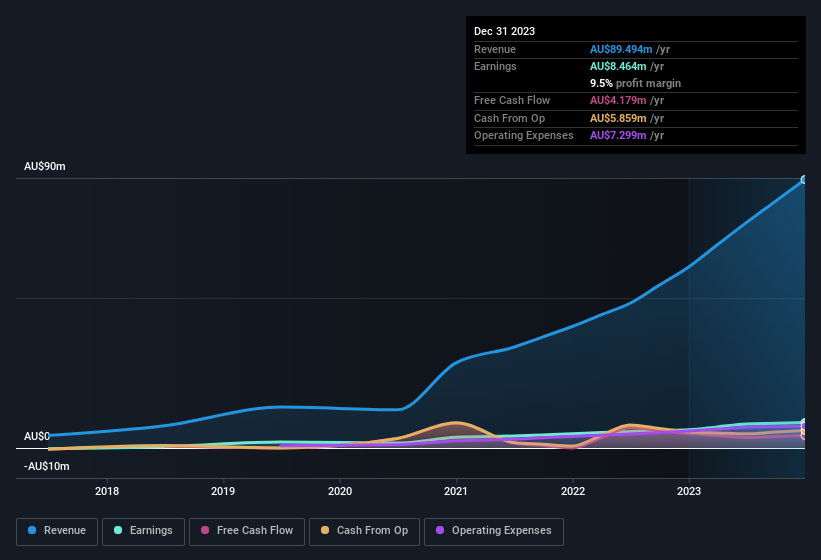

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for COSOL remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 48% to AU$89m. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for COSOL?

Are COSOL Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Shareholders in COSOL will be more than happy to see insiders committing themselves to the company, spending AU$1m on shares in just twelve months. And when you consider that there was no insider selling, you can understand why shareholders might believe that there are brighter days ahead. It is also worth noting that it was Non-Executive Chairman Geoffrey Lewis who made the biggest single purchase, worth AU$500k, paying AU$0.76 per share.

On top of the insider buying, we can also see that COSOL insiders own a large chunk of the company. Owning 49% of the company, insiders have plenty riding on the performance of the the share price. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. In terms of absolute value, insiders have AU$99m invested in the business, at the current share price. So there's plenty there to keep them focused!

Is COSOL Worth Keeping An Eye On?

For growth investors, COSOL's raw rate of earnings growth is a beacon in the night. On top of that, insiders own a significant stake in the company and have been buying more shares. These things considered, this is one stock worth watching. We don't want to rain on the parade too much, but we did also find 1 warning sign for COSOL that you need to be mindful of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of COSOL, you'll probably love this curated collection of companies in AU that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:COS

COSOL

Provides asset management as a service in the Asia Pacific, North America, Europe, the Middle East, Africa, and internationally.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives