Cirrus Networks Holdings (ASX:CNW) Is Looking To Continue Growing Its Returns On Capital

What are the early trends we should look for to identify a stock that could multiply in value over the long term? One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. So on that note, Cirrus Networks Holdings (ASX:CNW) looks quite promising in regards to its trends of return on capital.

What Is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for Cirrus Networks Holdings, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.14 = AU$2.7m ÷ (AU$38m - AU$19m) (Based on the trailing twelve months to December 2022).

So, Cirrus Networks Holdings has an ROCE of 14%. That's a relatively normal return on capital, and it's around the 17% generated by the IT industry.

Check out our latest analysis for Cirrus Networks Holdings

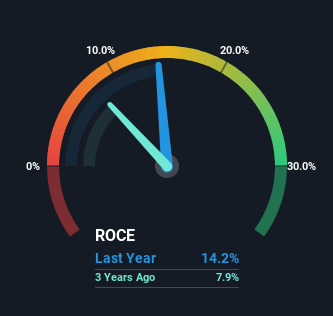

Historical performance is a great place to start when researching a stock so above you can see the gauge for Cirrus Networks Holdings' ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of Cirrus Networks Holdings, check out these free graphs here.

What Can We Tell From Cirrus Networks Holdings' ROCE Trend?

Investors would be pleased with what's happening at Cirrus Networks Holdings. The numbers show that in the last five years, the returns generated on capital employed have grown considerably to 14%. The amount of capital employed has increased too, by 147%. The increasing returns on a growing amount of capital is common amongst multi-baggers and that's why we're impressed.

One more thing to note, Cirrus Networks Holdings has decreased current liabilities to 50% of total assets over this period, which effectively reduces the amount of funding from suppliers or short-term creditors. So this improvement in ROCE has come from the business' underlying economics, which is great to see. However, current liabilities are still at a pretty high level, so just be aware that this can bring with it some risks.

In Conclusion...

To sum it up, Cirrus Networks Holdings has proven it can reinvest in the business and generate higher returns on that capital employed, which is terrific. And a remarkable 105% total return over the last five years tells us that investors are expecting more good things to come in the future. In light of that, we think it's worth looking further into this stock because if Cirrus Networks Holdings can keep these trends up, it could have a bright future ahead.

Cirrus Networks Holdings does have some risks though, and we've spotted 2 warning signs for Cirrus Networks Holdings that you might be interested in.

While Cirrus Networks Holdings isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:CNW

Cirrus Networks Holdings

Cirrus Networks Holdings Limited, together with its subsidiaries, provides information technology solutions in Australia.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion