CPT Global Limited (ASX:CGO) Looks Interesting, And It's About To Pay A Dividend

CPT Global Limited (ASX:CGO) stock is about to trade ex-dividend in 4 days. This means that investors who purchase shares on or after the 4th of March will not receive the dividend, which will be paid on the 29th of March.

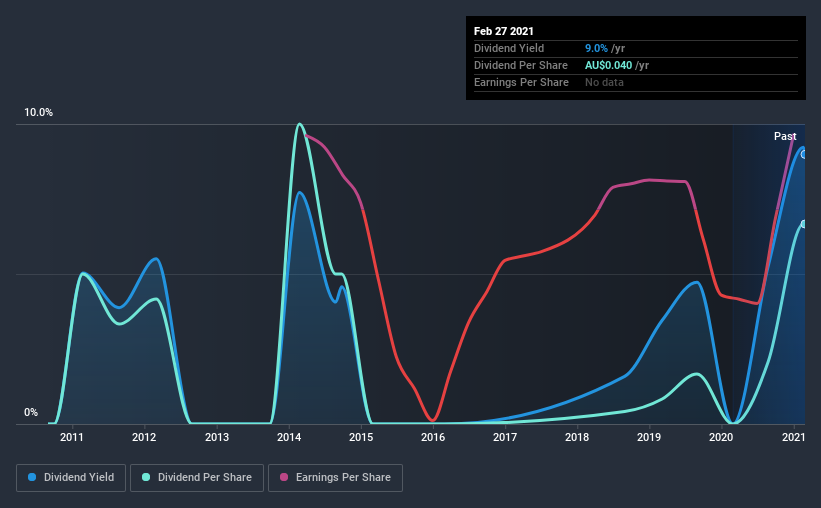

CPT Global's upcoming dividend is AU$0.02 a share, following on from the last 12 months, when the company distributed a total of AU$0.04 per share to shareholders. Based on the last year's worth of payments, CPT Global has a trailing yield of 9.0% on the current stock price of A$0.445. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. We need to see whether the dividend is covered by earnings and if it's growing.

See our latest analysis for CPT Global

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. CPT Global paid out a comfortable 46% of its profit last year. A useful secondary check can be to evaluate whether CPT Global generated enough free cash flow to afford its dividend. The good news is it paid out just 19% of its free cash flow in the last year.

It's positive to see that CPT Global's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see how much of its profit CPT Global paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. That's why it's comforting to see CPT Global's earnings have been skyrocketing, up 40% per annum for the past five years. CPT Global is paying out less than half its earnings and cash flow, while simultaneously growing earnings per share at a rapid clip. This is a very favourable combination that can often lead to the dividend multiplying over the long term, if earnings grow and the company pays out a higher percentage of its earnings.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. In the last 10 years, CPT Global has lifted its dividend by approximately 2.9% a year on average. Earnings per share have been growing much quicker than dividends, potentially because CPT Global is keeping back more of its profits to grow the business.

The Bottom Line

Is CPT Global an attractive dividend stock, or better left on the shelf? It's great that CPT Global is growing earnings per share while simultaneously paying out a low percentage of both its earnings and cash flow. It's disappointing to see the dividend has been cut at least once in the past, but as things stand now, the low payout ratio suggests a conservative approach to dividends, which we like. Overall we think this is an attractive combination and worthy of further research.

On that note, you'll want to research what risks CPT Global is facing. Every company has risks, and we've spotted 4 warning signs for CPT Global you should know about.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade CPT Global, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:CGO

CPT Global

Provides specialist information technology (IT) consultancy services for federal and state government, banking and finance, insurance, telecommunications, and retail and manufacturing sectors in Australia, Europe, North America, and internationally.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion