Optimistic Investors Push Catapult Group International Ltd (ASX:CAT) Shares Up 26% But Growth Is Lacking

Catapult Group International Ltd (ASX:CAT) shares have had a really impressive month, gaining 26% after a shaky period beforehand. The annual gain comes to 102% following the latest surge, making investors sit up and take notice.

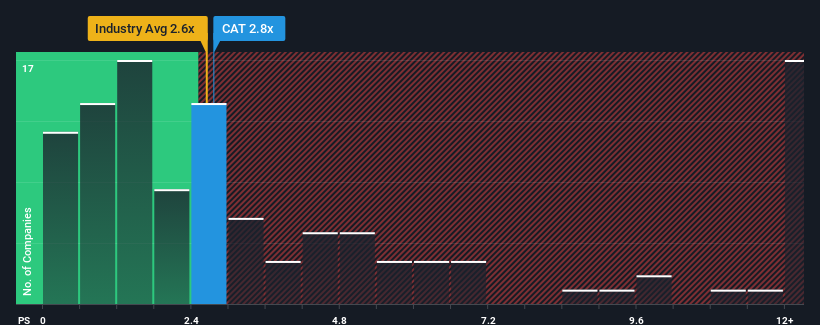

Although its price has surged higher, it's still not a stretch to say that Catapult Group International's price-to-sales (or "P/S") ratio of 2.8x right now seems quite "middle-of-the-road" compared to the Software industry in Australia, where the median P/S ratio is around 2.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Catapult Group International

How Catapult Group International Has Been Performing

Recent times haven't been great for Catapult Group International as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Catapult Group International will help you uncover what's on the horizon.How Is Catapult Group International's Revenue Growth Trending?

In order to justify its P/S ratio, Catapult Group International would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 14% last year. This was backed up an excellent period prior to see revenue up by 38% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 19% over the next year. Meanwhile, the rest of the industry is forecast to expand by 22%, which is noticeably more attractive.

With this information, we find it interesting that Catapult Group International is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Catapult Group International's P/S?

Its shares have lifted substantially and now Catapult Group International's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look at the analysts forecasts of Catapult Group International's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Plus, you should also learn about these 2 warning signs we've spotted with Catapult Group International.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:CAT

Catapult Sports

A sports science and analytics company, development and supply of technologies that improve the performance of athletes and sports teams in Australia, Europe, the Middle East, Africa, the Asia Pacific, and the Americas.

Excellent balance sheet and overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026