Anson Resources And 2 Other Promising Penny Stocks On The ASX

Reviewed by Simply Wall St

As the Australian market experiences a relatively flat day, with futures indicating minimal movement and major U.S. indices seeing modest gains, investors are keenly watching for opportunities that may arise amidst these stable conditions. Penny stocks, though an older term, continue to capture interest as they represent smaller or newer companies with potential value. By focusing on those with strong financial foundations and growth prospects, investors can uncover promising opportunities in this often-overlooked segment of the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.785 | A$144.03M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.595 | A$69.81M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.93 | A$91.04M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.48 | A$297.67M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$3.04 | A$252.05M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.54 | A$106.04M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.03 | A$330.52M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.88 | A$103.99M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.16 | A$334.56M | ★★★★☆☆ |

| Centrepoint Alliance (ASX:CAF) | A$0.32 | A$63.64M | ★★★★★☆ |

Click here to see the full list of 1,030 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Anson Resources (ASX:ASN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Anson Resources Limited is a critical minerals company focused on the exploration and development of natural resources in the United States and Australia, with a market cap of A$91.39 million.

Operations: Anson Resources Limited has not reported any revenue segments.

Market Cap: A$91.39M

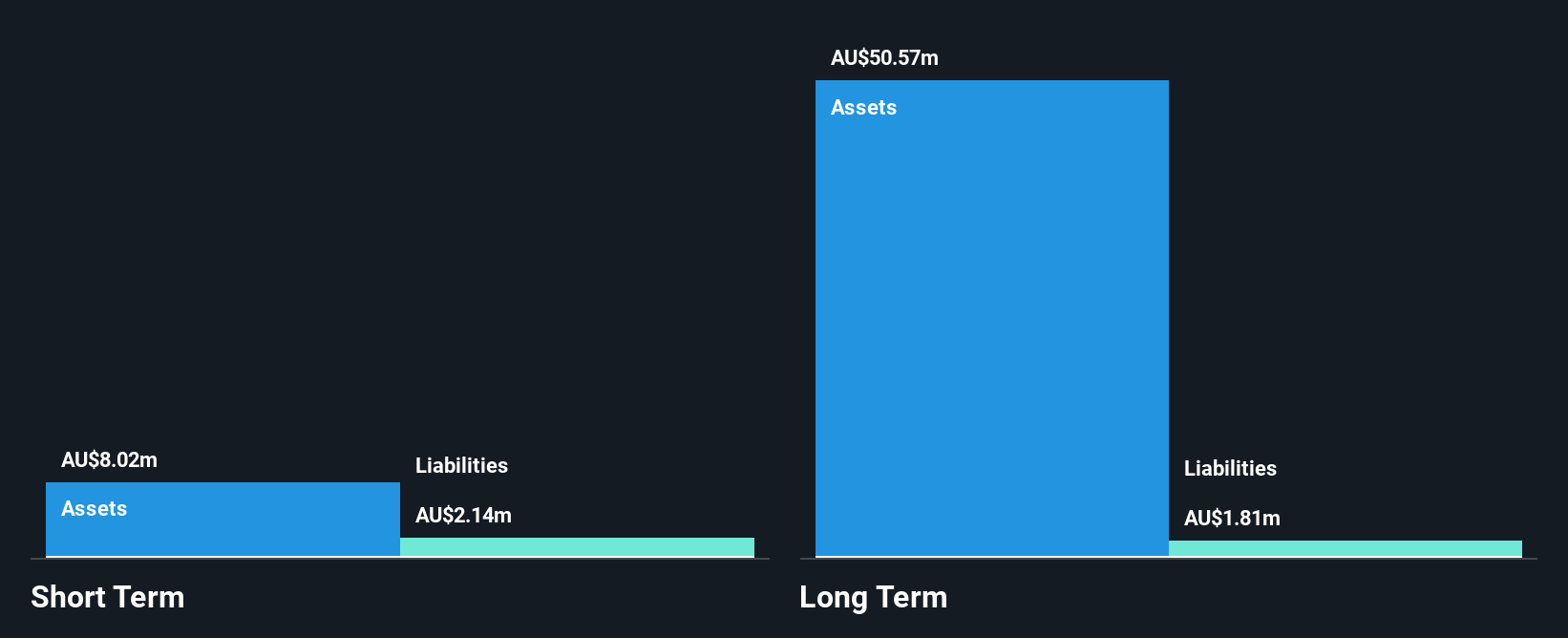

Anson Resources, with a market cap of A$91.39 million, remains pre-revenue and unprofitable, focusing on critical mineral exploration in the U.S. and Australia. Despite having a stable weekly volatility of 7%, the company faces challenges with a limited cash runway of three months as of June 2024, though it has raised additional capital since then. Its debt level is manageable, with more cash than total debt and short-term assets exceeding liabilities. However, profitability isn't expected in the near term, and its negative return on equity reflects ongoing financial hurdles despite an experienced management team and board.

- Unlock comprehensive insights into our analysis of Anson Resources stock in this financial health report.

- Understand Anson Resources' earnings outlook by examining our growth report.

BrainChip Holdings (ASX:BRN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: BrainChip Holdings Ltd develops software and hardware accelerated solutions for artificial intelligence and machine learning applications across various regions, with a market cap of A$591.74 million.

Operations: The company's revenue is derived from the Technological Development of Designs, amounting to $0.22 million.

Market Cap: A$591.74M

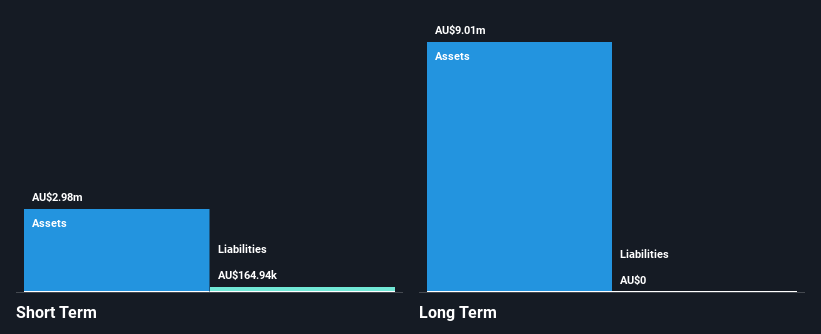

BrainChip Holdings, with a market cap of A$591.74 million, is pre-revenue, generating only US$0.22 million from technological development designs. Despite being debt-free and having short-term assets exceeding liabilities, the company faces financial challenges with an 8-month cash runway based on free cash flow estimates. Recent capital raises may extend this runway. BrainChip's Akida processor integration into cybersecurity and AI applications highlights its innovative edge AI capabilities in energy-efficient processing for various sectors like aerospace and cybersecurity. However, high volatility remains a concern alongside its negative return on equity due to ongoing unprofitability despite an experienced management team and board.

- Get an in-depth perspective on BrainChip Holdings' performance by reading our balance sheet health report here.

- Assess BrainChip Holdings' previous results with our detailed historical performance reports.

Odyssey Gold (ASX:ODY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Odyssey Gold Limited is involved in the exploration and development of mineral resource properties in Western Australia, with a market cap of A$20.67 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: A$20.67M

Odyssey Gold, with a market cap of A$20.67 million, is pre-revenue and focuses on mineral exploration in Western Australia. The company is debt-free but faces financial constraints with less than a year of cash runway based on current free cash flow trends. Despite having no long-term liabilities and short-term assets exceeding liabilities, Odyssey's high share price volatility poses a risk for investors. The board's experience averages 4.5 years, providing some stability amid challenges like increasing losses over the past five years at an annual rate of 25.7%.

- Click here and access our complete financial health analysis report to understand the dynamics of Odyssey Gold.

- Understand Odyssey Gold's track record by examining our performance history report.

Taking Advantage

- Investigate our full lineup of 1,030 ASX Penny Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BrainChip Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BRN

BrainChip Holdings

Develops software and hardware accelerated solutions for artificial intelligence and machine learning applications in North America, Oceania, Europe, the Middle East, and Asia.

Flawless balance sheet low.

Market Insights

Community Narratives