David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Adveritas Limited (ASX:AV1) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Adveritas

What Is Adveritas's Debt?

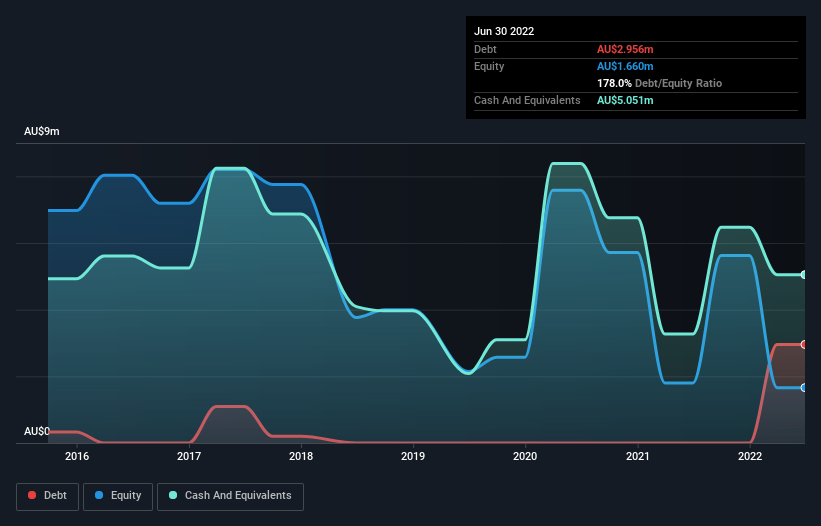

You can click the graphic below for the historical numbers, but it shows that as of June 2022 Adveritas had AU$2.96m of debt, an increase on none, over one year. But on the other hand it also has AU$5.05m in cash, leading to a AU$2.09m net cash position.

How Healthy Is Adveritas' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Adveritas had liabilities of AU$2.07m due within 12 months and liabilities of AU$3.39m due beyond that. Offsetting this, it had AU$5.05m in cash and AU$512.0k in receivables that were due within 12 months. So these liquid assets roughly match the total liabilities.

This state of affairs indicates that Adveritas' balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So while it's hard to imagine that the AU$35.6m company is struggling for cash, we still think it's worth monitoring its balance sheet. Simply put, the fact that Adveritas has more cash than debt is arguably a good indication that it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But it is Adveritas's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Adveritas reported revenue of AU$3.9m, which is a gain of 300%, although it did not report any earnings before interest and tax. When it comes to revenue growth, that's like nailing the game winning 3-pointer!

So How Risky Is Adveritas?

Statistically speaking companies that lose money are riskier than those that make money. And in the last year Adveritas had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of AU$9.5m and booked a AU$9.1m accounting loss. Given it only has net cash of AU$2.09m, the company may need to raise more capital if it doesn't reach break-even soon. The good news for shareholders is that Adveritas has dazzling revenue growth, so there's a very good chance it can boost its free cash flow in the years to come. High growth pre-profit companies may well be risky, but they can also offer great rewards. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 5 warning signs for Adveritas you should be aware of, and 2 of them are significant.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:AV1

Adveritas

Provides funnel measurement, verification, and fraud prevention solutions for digital advertising in North America, Latin America, Asia Pacific, Australia, Europe, and internationally.

Exceptional growth potential with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026