The 8common (ASX:8CO) Share Price Has Gained 129%, So Why Not Pay It Some Attention?

8common Limited (ASX:8CO) shareholders might be rather concerned because the share price has dropped 35% in the last month. On the other hand, over the last twelve months the stock has delivered rather impressive returns. Indeed, the share price is up an impressive 129% in that time. So it may be that the share price is simply cooling off after a strong rise. Investors should be wondering whether the business itself has the fundamental value required to continue to drive gains.

View our latest analysis for 8common

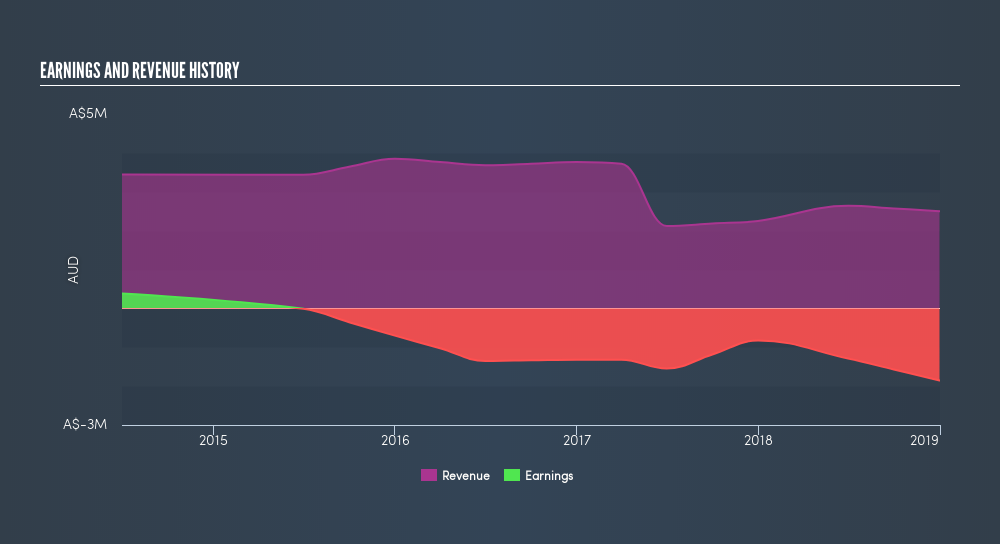

8common isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last twelve months, 8common's revenue grew by 11%. That's not great considering the company is losing money. So we wouldn't have expected the share price to rise by 129%. We're happy that investors have made money, though we wonder if the increase will be sustained. We're not so sure that revenue growth is driving the market optimism about the stock.

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. It might be well worthwhile taking a look at our free report on 8common's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between 8common's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. 8common hasn't been paying dividends, but its TSR of 129% exceeds its share price return of 129%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's nice to see that 8common shareholders have gained 129% (in total) over the last year. That certainly beats the loss of about 11% per year over three years. We're generally cautious about putting too much weigh on shorter term data, but the recent improvement is definitely a positive. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

8common is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:8CO

8common

Engages in the expense management software business in Australia, Asia, North America, and internationally.

Medium-low and slightly overvalued.

Market Insights

Community Narratives