- Australia

- /

- Construction

- /

- ASX:SXE

ASX Penny Stocks: 3 Promising Picks With Over A$40M Market Cap

Reviewed by Simply Wall St

The Australian market is experiencing a cautious start, with the ASX200 expected to open lower amid global concerns over inflation and economic growth. In such a climate, investors may find opportunities in penny stocks, which despite their vintage label, can still offer significant value when backed by strong financials. This article explores several promising penny stocks that combine solid fundamentals with potential for growth, making them intriguing options for those seeking under-the-radar investments.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$1.92 | A$312.61M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.55 | A$341.08M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$103.44M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.62 | A$72.68M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.77 | A$229.66M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.665 | A$815.98M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.185 | A$1.09B | ★★★★★★ |

| West African Resources (ASX:WAF) | A$1.535 | A$1.75B | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$3.05 | A$135.49M | ★★★★★★ |

Click here to see the full list of 1,035 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

5G Networks (ASX:5GN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: 5G Networks Limited is a digital services company offering cloud enabling solutions in Australia and New Zealand, with a market cap of A$45.79 million.

Operations: The company's revenue is derived from two segments: Wholesale, contributing A$8.86 million, and Enterprise, generating A$40.48 million.

Market Cap: A$45.79M

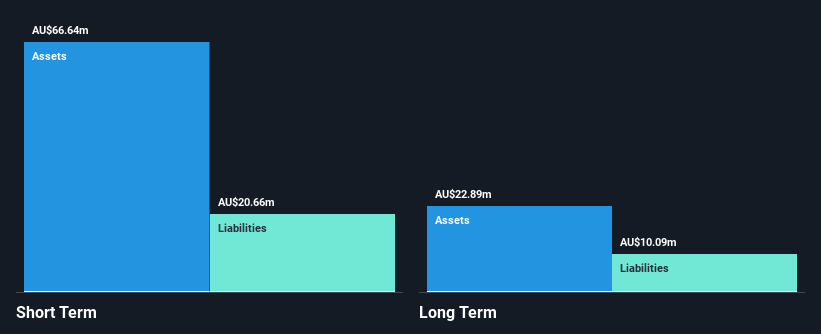

5G Networks Limited, with a market cap of A$45.79 million, has shown significant financial activity recently. Despite being unprofitable and experiencing increased losses over the past five years, the company reported improved revenue of A$52.87 million for the year ending June 2024 and a net income turnaround to A$66.62 million from a prior loss. The company completed a share buyback program worth A$4.99 million, reflecting strategic capital management efforts amid plans to sell its operating businesses and delist. With no debt and sufficient short-term asset coverage, 5G Networks maintains financial stability despite uncertainties in leadership changes and future direction.

- Get an in-depth perspective on 5G Networks' performance by reading our balance sheet health report here.

- Gain insights into 5G Networks' past trends and performance with our report on the company's historical track record.

Southern Cross Electrical Engineering (ASX:SXE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Southern Cross Electrical Engineering Limited offers electrical, instrumentation, communications, security, and maintenance services to the resources, commercial, and infrastructure sectors in Australia with a market cap of A$413.58 million.

Operations: The company generates revenue of A$551.87 million from its electrical services segment.

Market Cap: A$413.58M

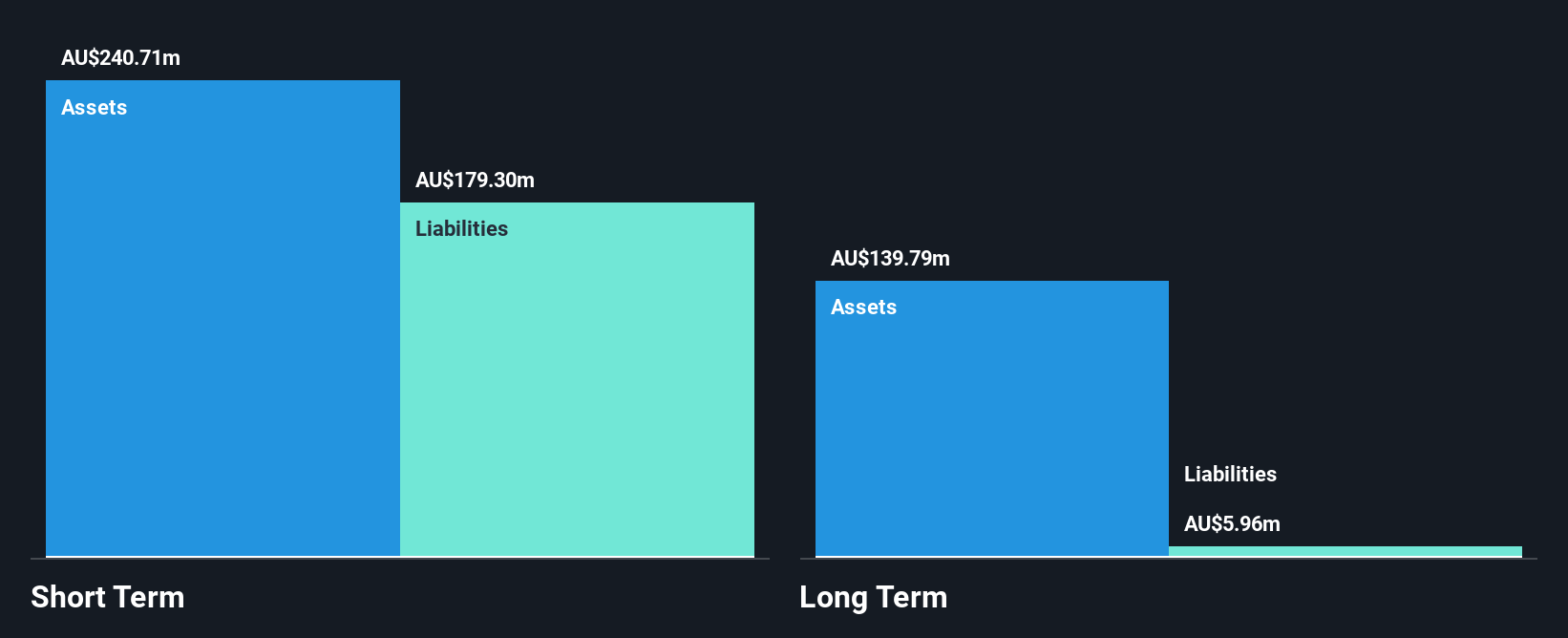

Southern Cross Electrical Engineering Limited, with a market cap of A$413.58 million, has demonstrated stable financial performance despite some challenges. The company reported revenue of A$551.87 million and net income of A$21.92 million for the year ending June 2024, although its earnings growth rate of 9.1% lags behind the industry average. With no debt and strong asset coverage over liabilities, it maintains a robust balance sheet position. Recent inclusion in the S&P Global BMI Index reflects growing recognition but its dividend history remains unstable and profit margins have slightly decreased from last year’s figures, indicating areas for potential improvement.

- Navigate through the intricacies of Southern Cross Electrical Engineering with our comprehensive balance sheet health report here.

- Gain insights into Southern Cross Electrical Engineering's future direction by reviewing our growth report.

Touch Ventures (ASX:TVL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Touch Ventures Limited is a private equity and venture capital firm that focuses on providing growth capital to high-growth, post-revenue, and later-stage companies, with a market cap of A$52.42 million.

Operations: The company's revenue segment involves operating and managing investments in high-growth securities, generating -A$38.07 million.

Market Cap: A$52.42M

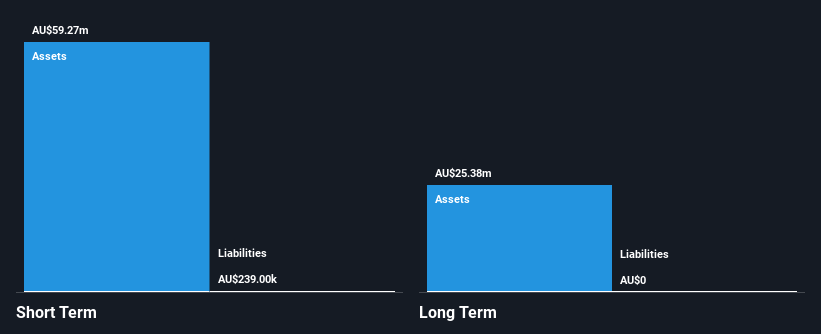

Touch Ventures Limited, with a market cap of A$52.42 million, is currently pre-revenue and unprofitable, reporting a net loss of A$24.55 million for the half year ending June 2024. Despite its financial challenges, the company maintains a strong balance sheet with no debt and sufficient cash runway exceeding three years based on current free cash flow trends. The board is experienced with an average tenure of 4.5 years, indicating stability in governance. However, earnings have declined significantly over the past five years at an annual rate of 54.6%, reflecting ongoing operational hurdles as it navigates its investment strategy in high-growth securities.

- Dive into the specifics of Touch Ventures here with our thorough balance sheet health report.

- Evaluate Touch Ventures' historical performance by accessing our past performance report.

Key Takeaways

- Get an in-depth perspective on all 1,035 ASX Penny Stocks by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SXE

Southern Cross Electrical Engineering

Provides electrical, instrumentation, communications, security, and maintenance services and products to resources, commercial, and infrastructure sectors in Australia.

Flawless balance sheet, good value and pays a dividend.