- Australia

- /

- Specialty Stores

- /

- ASX:TPW

Temple & Webster Group Ltd's (ASX:TPW) P/S Is Still On The Mark Following 29% Share Price Bounce

Temple & Webster Group Ltd (ASX:TPW) shares have continued their recent momentum with a 29% gain in the last month alone. The last month tops off a massive increase of 222% in the last year.

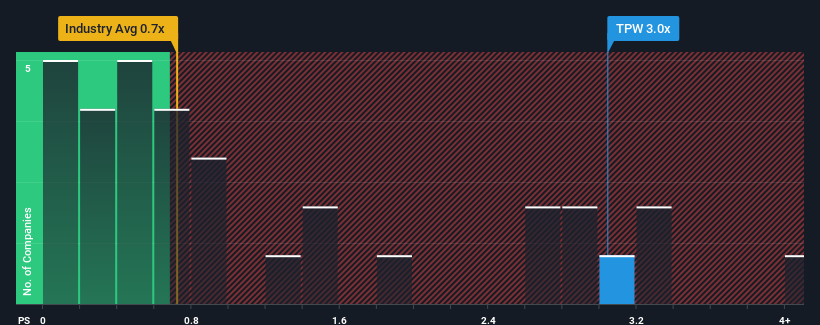

After such a large jump in price, when almost half of the companies in Australia's Specialty Retail industry have price-to-sales ratios (or "P/S") below 0.7x, you may consider Temple & Webster Group as a stock not worth researching with its 3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Temple & Webster Group

How Temple & Webster Group Has Been Performing

Recent times haven't been great for Temple & Webster Group as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Temple & Webster Group.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Temple & Webster Group's to be considered reasonable.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. Pleasingly, revenue has also lifted 68% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue should grow by 24% per annum over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 6.8% each year, which is noticeably less attractive.

With this information, we can see why Temple & Webster Group is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Temple & Webster Group's P/S Mean For Investors?

Shares in Temple & Webster Group have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Temple & Webster Group maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Specialty Retail industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Temple & Webster Group with six simple checks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Temple & Webster Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:TPW

Temple & Webster Group

Engages in the online retail of furniture, homewares, and home improvement products through its online platform in Australia.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026