- Australia

- /

- Specialty Stores

- /

- ASX:SSG

Volatility 101: Should Shaver Shop Group (ASX:SSG) Shares Have Dropped 13%?

While not a mind-blowing move, it is good to see that the Shaver Shop Group Limited (ASX:SSG) share price has gained 14% in the last three months. But that doesn't change the fact that the returns over the last year have been less than pleasing. In fact, the price has declined 13% in a year, falling short of the returns you could get by investing in an index fund.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Check out our latest analysis for Shaver Shop Group

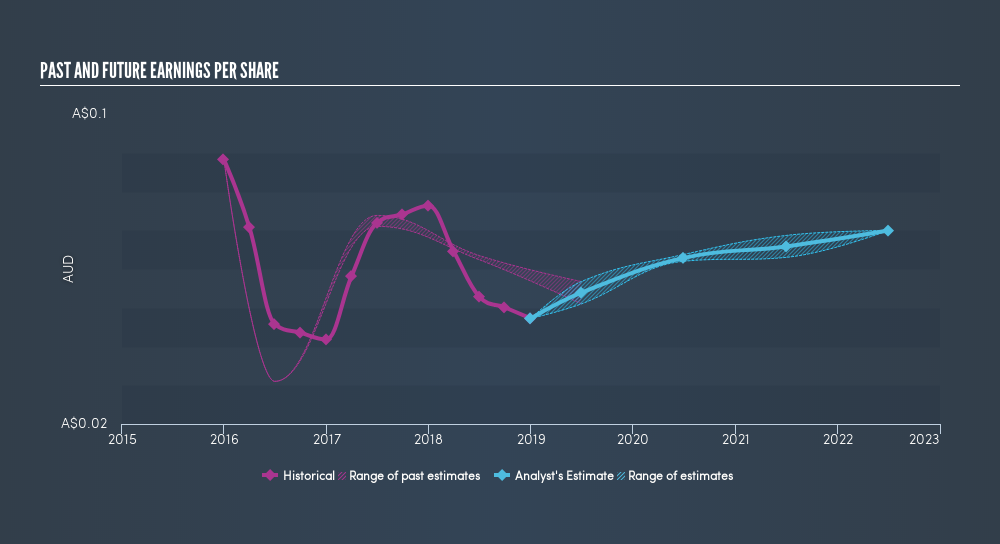

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Unfortunately Shaver Shop Group reported an EPS drop of 38% for the last year. The share price fall of 13% isn't as bad as the reduction in earnings per share. It may have been that the weak EPS was not as bad as some had feared.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into Shaver Shop Group's key metrics by checking this interactive graph of Shaver Shop Group's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Shaver Shop Group's TSR for the last year was -2.9%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While Shaver Shop Group shareholders are down 2.9% for the year (even including dividends), the market itself is up 11%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Putting aside the last twelve months, it's good to see the share price has rebounded by 14%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. If you would like to research Shaver Shop Group in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:SSG

Shaver Shop Group

Shaver Shop Group Limited retails personal care and grooming products in Australia and New Zealand.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives