- Australia

- /

- Specialty Stores

- /

- ASX:SSG

Be Sure To Check Out Shaver Shop Group Limited (ASX:SSG) Before It Goes Ex-Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Shaver Shop Group Limited (ASX:SSG) is about to trade ex-dividend in the next four days. Typically, the ex-dividend date is one business day before the record date which is the date on which a company determines the shareholders eligible to receive a dividend. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. Meaning, you will need to purchase Shaver Shop Group's shares before the 4th of September to receive the dividend, which will be paid on the 19th of September.

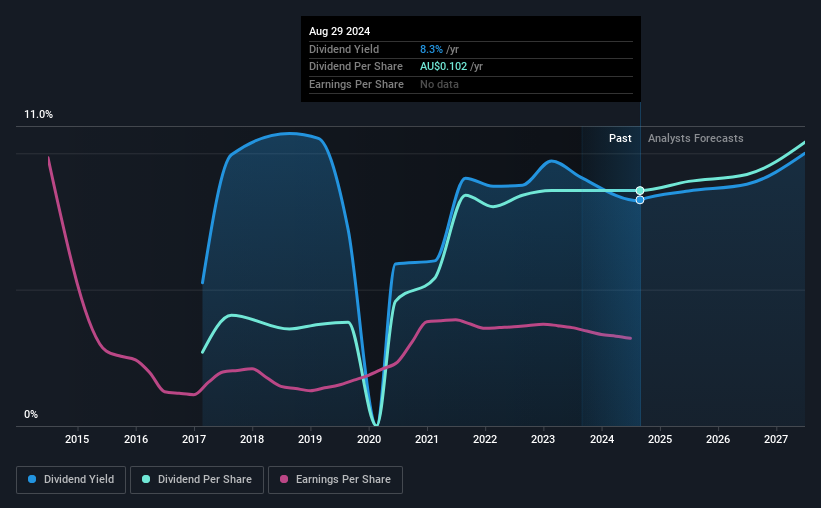

The company's next dividend payment will be AU$0.055 per share, and in the last 12 months, the company paid a total of AU$0.10 per share. Based on the last year's worth of payments, Shaver Shop Group stock has a trailing yield of around 8.3% on the current share price of AU$1.23. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. We need to see whether the dividend is covered by earnings and if it's growing.

Check out our latest analysis for Shaver Shop Group

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. It paid out 87% of its earnings as dividends last year, which is not unreasonable, but limits reinvestment in the business and leaves the dividend vulnerable to a business downturn. We'd be concerned if earnings began to decline. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. Fortunately, it paid out only 38% of its free cash flow in the past year.

It's positive to see that Shaver Shop Group's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. Fortunately for readers, Shaver Shop Group's earnings per share have been growing at 16% a year for the past five years. The company paid out most of its earnings as dividends over the last year, even though business is booming and earnings per share are growing rapidly. Higher earnings generally bode well for growing dividends, although with seemingly strong growth prospects we'd wonder why management are not reinvesting more in the business.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Shaver Shop Group has delivered 16% dividend growth per year on average over the past eight years. Both per-share earnings and dividends have both been growing rapidly in recent times, which is great to see.

To Sum It Up

Should investors buy Shaver Shop Group for the upcoming dividend? Shaver Shop Group's growing earnings per share and conservative payout ratios make for a decent combination. We also like that it paid out a lower percentage of its cash flow. Shaver Shop Group looks solid on this analysis overall, and we'd definitely consider investigating it more closely.

On that note, you'll want to research what risks Shaver Shop Group is facing. Our analysis shows 1 warning sign for Shaver Shop Group and you should be aware of it before buying any shares.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SSG

Shaver Shop Group

Engages in retailing personal care and grooming products in Australia and New Zealand.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026