- Australia

- /

- Specialty Stores

- /

- ASX:NCK

3 ASX Dividend Stocks Yielding Up To 7.6% For Your Portfolio

Reviewed by Simply Wall St

As the Australian market prepares for a positive open, with ASX 200 futures indicating a rise despite global trade tensions, investors are keeping an eye on dividend stocks as a potential source of steady income. In such fluctuating conditions, selecting stocks with strong dividend yields can be an effective strategy to enhance portfolio stability and generate reliable returns.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Fortescue (ASX:FMG) | 9.94% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 7.42% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.39% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.33% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 5.74% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 3.81% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.91% | ★★★★★☆ |

| Santos (ASX:STO) | 6.94% | ★★★★☆☆ |

| Ricegrowers (ASX:SGLLV) | 5.14% | ★★★★☆☆ |

| Australian United Investment (ASX:AUI) | 3.54% | ★★★★☆☆ |

Click here to see the full list of 32 stocks from our Top ASX Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Nick Scali (ASX:NCK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nick Scali Limited, with a market cap of A$1.48 billion, is involved in sourcing and retailing household furniture and related accessories across Australia, the United Kingdom, and New Zealand.

Operations: Nick Scali Limited generates its revenue through the sourcing and retailing of household furniture and related accessories in Australia, the United Kingdom, and New Zealand.

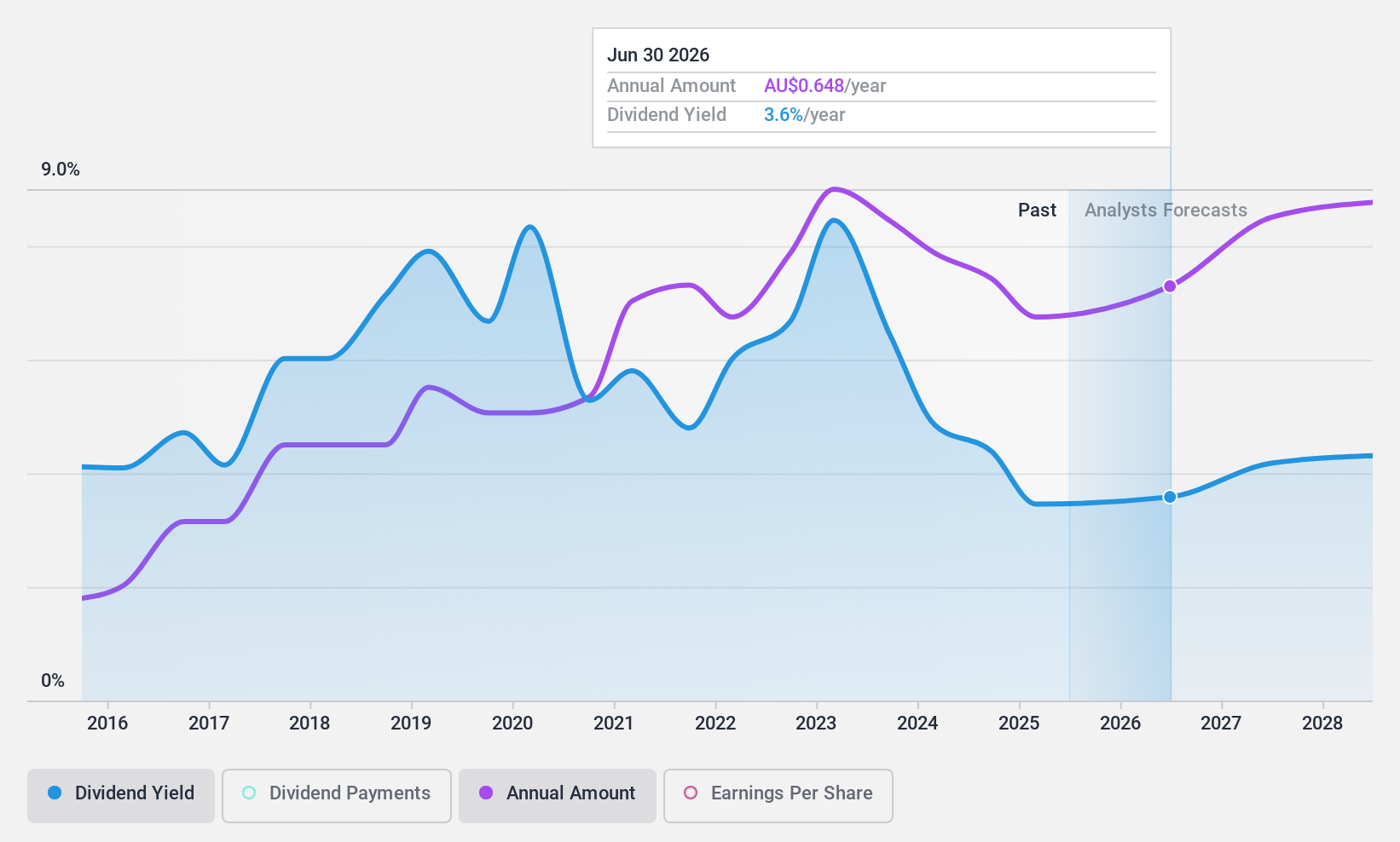

Dividend Yield: 3.8%

Nick Scali's dividend profile is characterized by stable and growing payments over the past decade, supported by a sustainable payout ratio of 68.9% from earnings and 55% from cash flows. However, recent financial results show a decline in net income to A$30.04 million for the half year ended December 31, 2024, leading to a reduced interim dividend of A$0.30 per share compared to A$0.35 last year. Despite this decrease, dividends remain reliable with minimal volatility historically but offer a yield lower than top-tier Australian dividend stocks at 3.81%.

- Click to explore a detailed breakdown of our findings in Nick Scali's dividend report.

- In light of our recent valuation report, it seems possible that Nick Scali is trading beyond its estimated value.

Steadfast Group (ASX:SDF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Steadfast Group Limited operates as a general insurance brokerage service provider across Australasia, Asia, and Europe, with a market cap of A$6.27 billion.

Operations: Steadfast Group Limited generates revenue from its Insurance Intermediary segment at A$1.55 billion and Premium Funding at A$113 million.

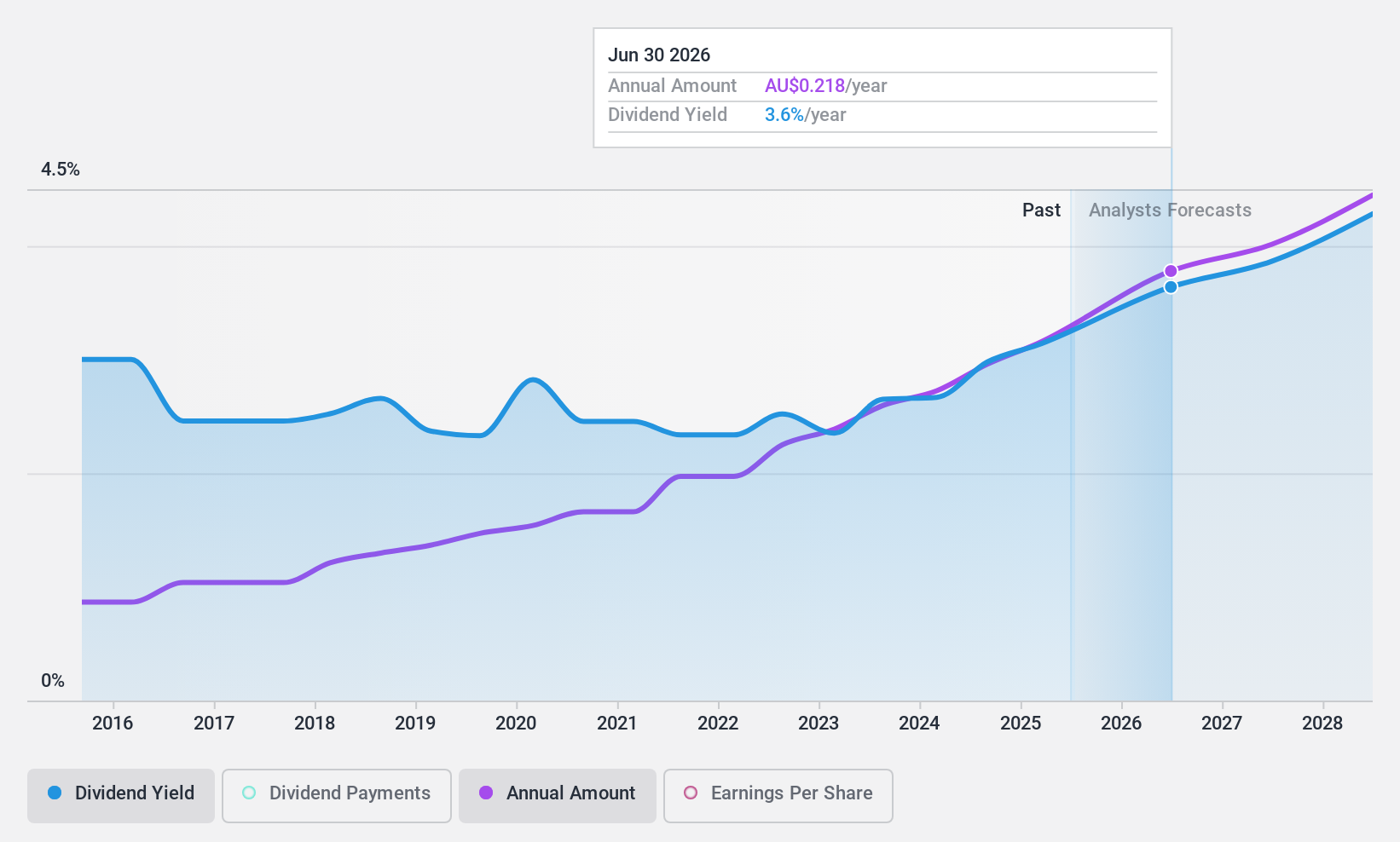

Dividend Yield: 3%

Steadfast Group's dividend payments are covered by earnings with a payout ratio of 80.7% and a cash payout ratio of 65.6%, indicating sustainability despite past volatility. The stock trades at a discount to its estimated fair value, but its dividend yield of 3.01% is below the top quartile in Australia. While dividends have grown over the last decade, insider selling raises concerns about future stability amidst executive changes focused on business solutions leadership.

- Click here to discover the nuances of Steadfast Group with our detailed analytical dividend report.

- The analysis detailed in our Steadfast Group valuation report hints at an inflated share price compared to its estimated value.

Shaver Shop Group (ASX:SSG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shaver Shop Group Limited is a retailer of personal care and grooming products operating in Australia and New Zealand, with a market cap of A$174.90 million.

Operations: The company's revenue primarily comes from retail store sales of specialist personal grooming products, totaling A$219.37 million.

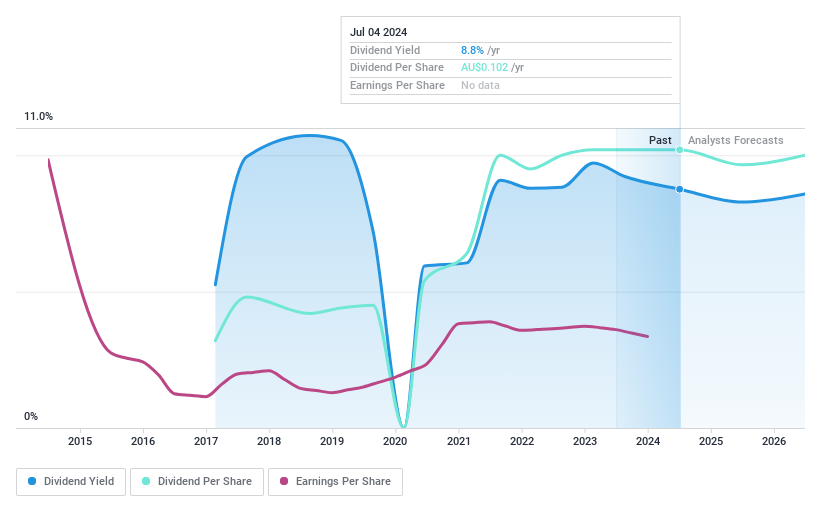

Dividend Yield: 7.6%

Shaver Shop Group's dividends are covered by earnings with a payout ratio of 87% and a cash payout ratio of 48.1%, suggesting sustainability despite an unstable track record over the past eight years. Trading significantly below its fair value estimate, it offers an attractive dividend yield of 7.64%, placing it in the top quartile in Australia. However, recent insider selling and volatility in dividend payments may concern investors seeking reliability.

- Navigate through the intricacies of Shaver Shop Group with our comprehensive dividend report here.

- The analysis detailed in our Shaver Shop Group valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Unlock more gems! Our Top ASX Dividend Stocks screener has unearthed 29 more companies for you to explore.Click here to unveil our expertly curated list of 32 Top ASX Dividend Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nick Scali might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NCK

Nick Scali

Engages in sourcing and retailing of household furniture and related accessories in Australia, the United Kingdom, and New Zealand.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives