- Australia

- /

- Metals and Mining

- /

- ASX:MIN

ASX Growth Companies With High Insider Ownership For October 2025

Reviewed by Simply Wall St

As the Australian market shows signs of a modest upswing, buoyed by geopolitical developments and commodity price movements, investors are keenly observing potential growth opportunities. In this environment, companies with high insider ownership often attract attention as they may indicate strong confidence from those closest to the business, making them intriguing prospects for those seeking growth in the current economic climate.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 12.6% | 89.9% |

| Titomic (ASX:TTT) | 11.3% | 74.9% |

| Polymetals Resources (ASX:POL) | 37.7% | 108% |

| Pointerra (ASX:3DP) | 19% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| IRIS Metals (ASX:IR1) | 21.6% | 144.4% |

| Findi (ASX:FND) | 33.6% | 91.2% |

| Echo IQ (ASX:EIQ) | 19.1% | 49.9% |

| BlinkLab (ASX:BB1) | 35.5% | 101.4% |

| Adveritas (ASX:AV1) | 17.3% | 96.8% |

Here's a peek at a few of the choices from the screener.

Catapult Sports (ASX:CAT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Catapult Sports Ltd is a sports science and analytics company that develops and supplies technologies to enhance athlete and team performance across various regions including Australia, Europe, the Middle East, Africa, the Asia Pacific, and the Americas with a market cap of A$2.11 billion.

Operations: The company's revenue is derived from three main segments: Tactics & Coaching ($36.66 million), and Performance & Health ($63.47 million).

Insider Ownership: 14.5%

Catapult Sports, recently added to the S&P/ASX 200 Index, has completed a follow-on equity offering of A$130 million. The company is forecast to achieve earnings growth of 68.69% annually and become profitable within three years, outpacing the average market growth. While revenue growth at 15% per year is slower than desired for high-growth entities, it still surpasses the Australian market's average rate. The company's recent acquisition discussions and insider ownership could drive strategic advantages.

- Get an in-depth perspective on Catapult Sports' performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Catapult Sports' current price could be inflated.

Mineral Resources (ASX:MIN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mineral Resources Limited, with a market cap of A$8.84 billion, offers mining services across Australia, Asia, and internationally through its subsidiaries.

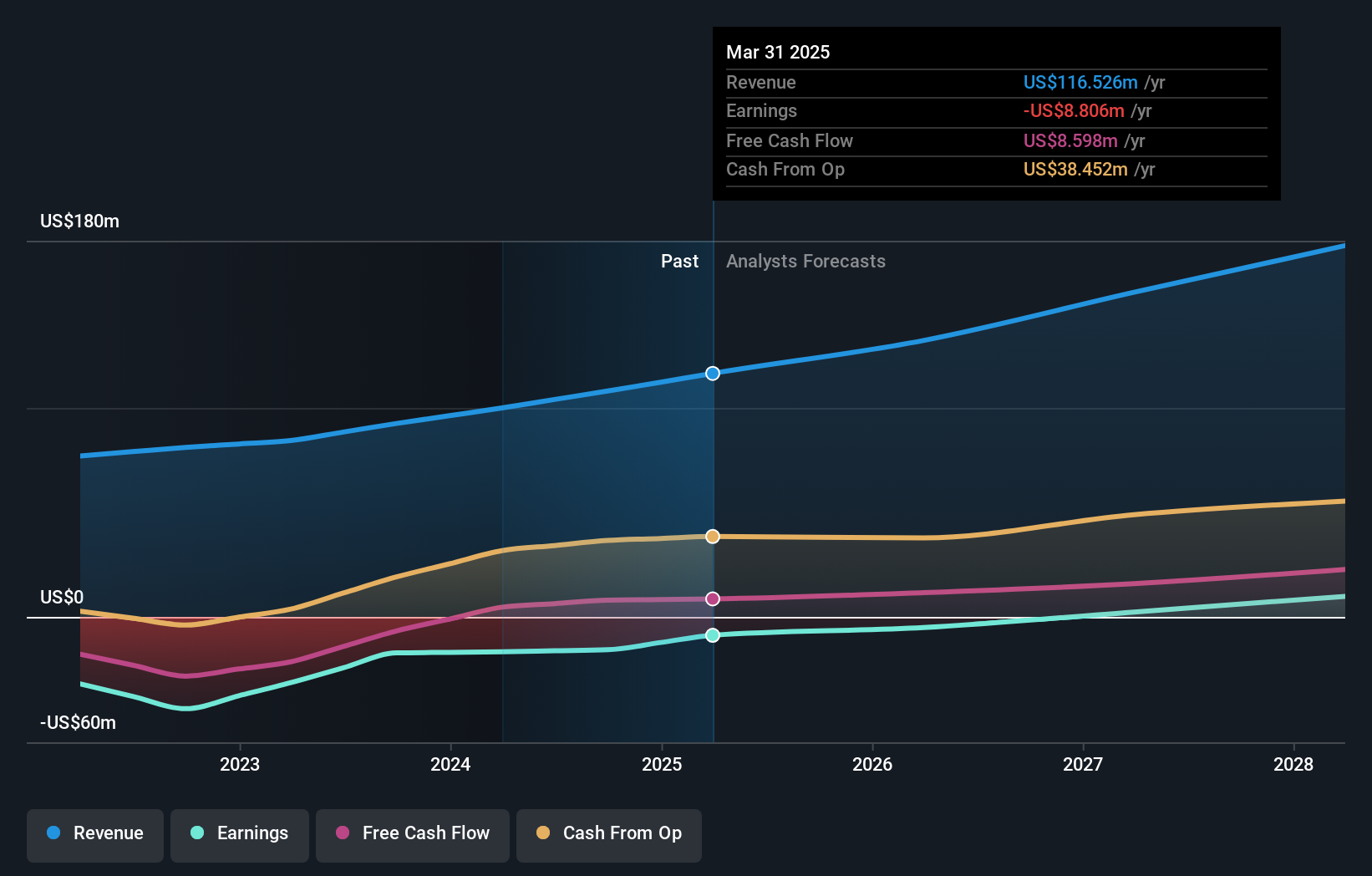

Operations: The company's revenue segments include A$601 million from Lithium, A$2.33 billion from Iron Ore, and A$3.30 billion from Mining Services.

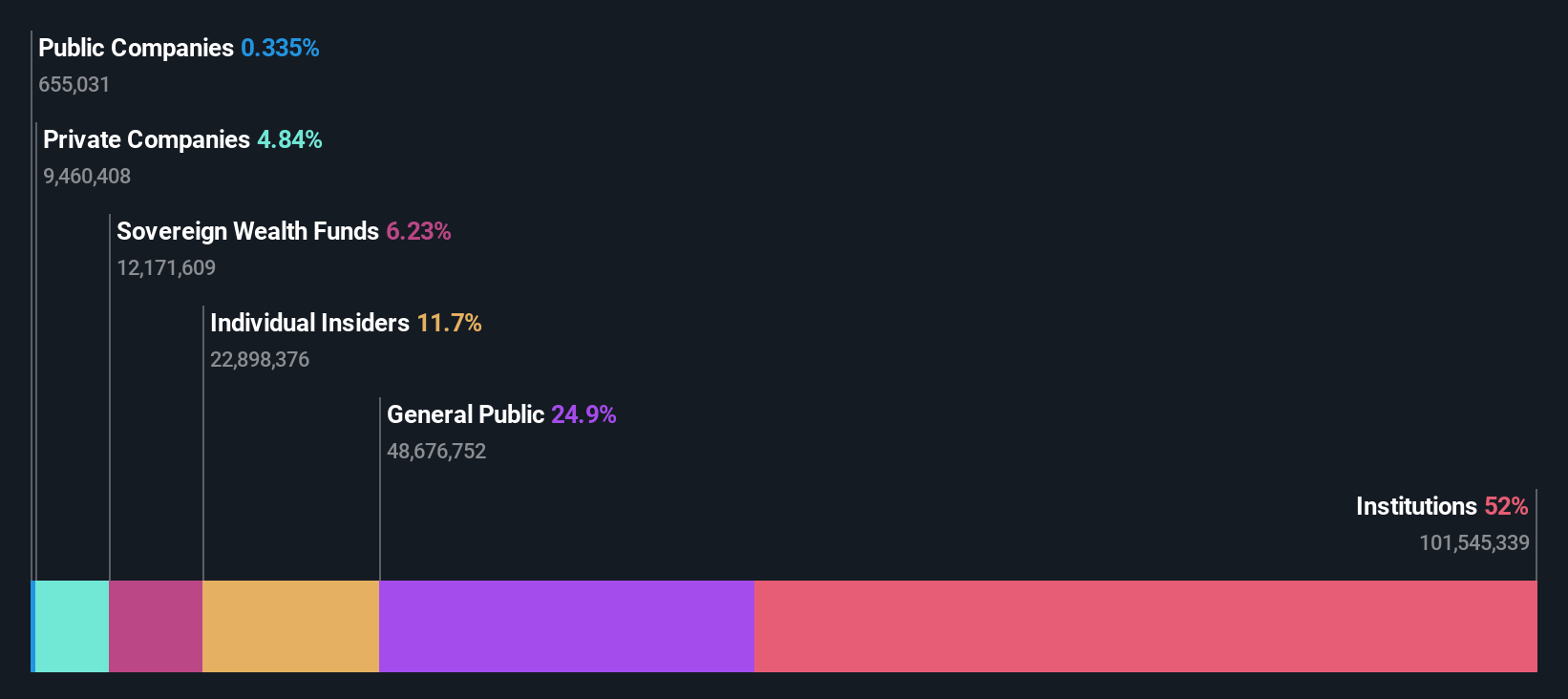

Insider Ownership: 11.4%

Mineral Resources is poised for significant earnings growth, with profits expected to rise 63.57% annually, surpassing the Australian market's average. Despite a challenging financial year with a A$904 million loss and substantial debt of A$5.3 billion, no major insider selling occurred recently. The company plans asset sales to improve its balance sheet while new board appointments aim to bolster governance expertise. Trading at favorable valuations compared to peers enhances its investment appeal amidst these strategic changes.

- Take a closer look at Mineral Resources' potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Mineral Resources shares in the market.

Supply Network (ASX:SNL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Supply Network Limited supplies aftermarket parts for the commercial vehicle market in Australia and New Zealand, with a market cap of A$1.62 billion.

Operations: The company's revenue segment is primarily from the provision of aftermarket parts for the commercial vehicle market, generating A$349.46 million.

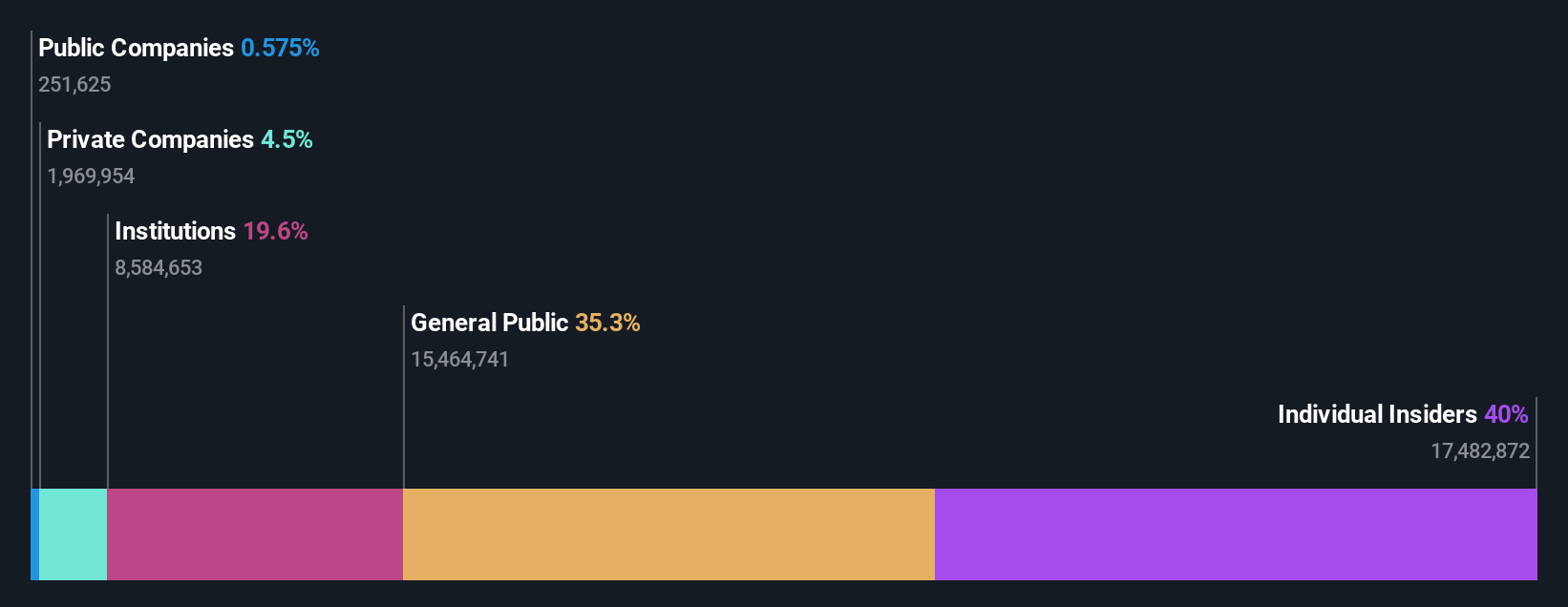

Insider Ownership: 40%

Supply Network's recent inclusion in the S&P Global BMI Index underscores its solid market position. The company reported robust financial performance, with sales reaching A$348.83 million and net income of A$40.02 million for the year ended June 2025. Forecasted earnings growth at 14.34% annually outpaces the Australian market average, while insider ownership remains stable with no significant selling activity recently observed. The appointment of Karen Phin as a director enhances board independence and expertise in capital management strategies.

- Delve into the full analysis future growth report here for a deeper understanding of Supply Network.

- Insights from our recent valuation report point to the potential overvaluation of Supply Network shares in the market.

Next Steps

- Discover the full array of 96 Fast Growing ASX Companies With High Insider Ownership right here.

- Ready To Venture Into Other Investment Styles? These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MIN

Mineral Resources

Together with subsidiaries, provides mining services in Australia, Asia, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives