- Australia

- /

- Specialty Stores

- /

- ASX:NCK

These 4 Measures Indicate That Nick Scali (ASX:NCK) Is Using Debt Safely

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Nick Scali Limited (ASX:NCK) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Nick Scali

How Much Debt Does Nick Scali Carry?

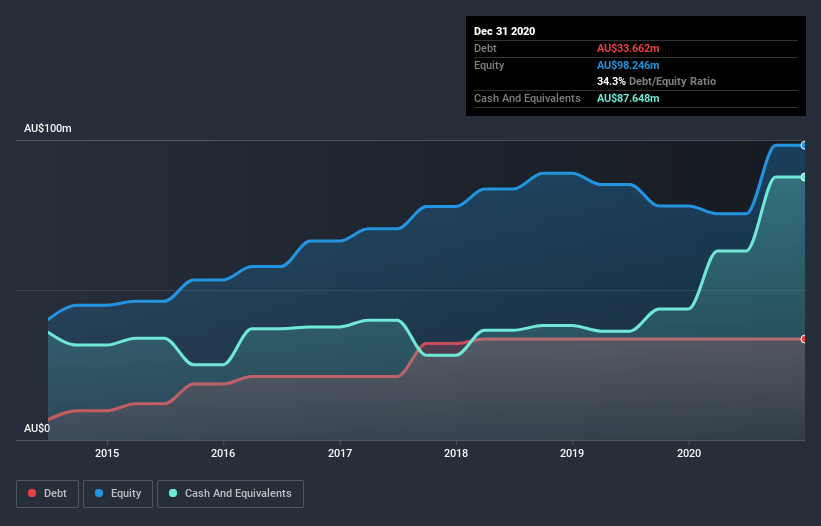

The chart below, which you can click on for greater detail, shows that Nick Scali had AU$33.7m in debt in December 2020; about the same as the year before. However, its balance sheet shows it holds AU$87.6m in cash, so it actually has AU$54.0m net cash.

How Strong Is Nick Scali's Balance Sheet?

According to the last reported balance sheet, Nick Scali had liabilities of AU$120.5m due within 12 months, and liabilities of AU$189.2m due beyond 12 months. Offsetting these obligations, it had cash of AU$87.6m as well as receivables valued at AU$1.18m due within 12 months. So it has liabilities totalling AU$220.9m more than its cash and near-term receivables, combined.

Nick Scali has a market capitalization of AU$823.0m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. While it does have liabilities worth noting, Nick Scali also has more cash than debt, so we're pretty confident it can manage its debt safely.

On top of that, Nick Scali grew its EBIT by 61% over the last twelve months, and that growth will make it easier to handle its debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Nick Scali can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. Nick Scali may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. During the last three years, Nick Scali generated free cash flow amounting to a very robust 99% of its EBIT, more than we'd expect. That puts it in a very strong position to pay down debt.

Summing up

Although Nick Scali's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of AU$54.0m. The cherry on top was that in converted 99% of that EBIT to free cash flow, bringing in AU$111m. So is Nick Scali's debt a risk? It doesn't seem so to us. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 2 warning signs for Nick Scali (1 is a bit unpleasant) you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you’re looking to trade Nick Scali, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Nick Scali might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:NCK

Nick Scali

Engages in the sourcing and retailing of household furniture and related accessories in Australia, New Zealand, and the United Kingdom.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion