- Australia

- /

- Metals and Mining

- /

- ASX:SCN

3 ASX Penny Stocks With Market Caps Under A$500M To Watch

Reviewed by Simply Wall St

The ASX200 recently closed up 0.19% at 8,555 points, nearing its all-time high as investor optimism grows ahead of the Reserve Bank of Australia's upcoming rate decision. In this context, penny stocks—though an older term—remain a relevant investment area for those interested in smaller or newer companies. These stocks can offer growth potential and affordability when backed by strong financials, presenting intriguing opportunities in today's market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.57 | A$66.88M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.485 | A$300.77M | ★★★★★☆ |

| IVE Group (ASX:IGL) | A$2.21 | A$342.3M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$2.08 | A$338.66M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.875 | A$103.72M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.98 | A$247.08M | ★★★★★★ |

| Bisalloy Steel Group (ASX:BIS) | A$3.40 | A$162.87M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.02 | A$95.29M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.53 | A$104.08M | ★★★★★★ |

Click here to see the full list of 1,033 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Asset Vision Co (ASX:ASV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Asset Vision Co Limited offers enterprise asset management solutions to public sector and enterprise clients in Australia and internationally, with a market cap of A$23.66 million.

Operations: Asset Vision Co generates revenue primarily from its Staffing & Outsourcing Services segment, which amounts to A$4.09 million.

Market Cap: A$23.66M

Asset Vision Co, with a market cap of A$23.66 million, primarily generates revenue from its Staffing & Outsourcing Services segment totaling A$4.09 million. Despite being unprofitable, the company has managed to reduce losses by 51.2% annually over the past five years and maintains a cash runway exceeding three years due to positive free cash flow. The stock trades significantly below estimated fair value but exhibits high volatility compared to other Australian stocks. While short-term liabilities slightly exceed short-term assets, Asset Vision Co remains debt-free and has not diluted shareholders recently.

- Click to explore a detailed breakdown of our findings in Asset Vision Co's financial health report.

- Gain insights into Asset Vision Co's historical outcomes by reviewing our past performance report.

Kogan.com (ASX:KGN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kogan.com Ltd is an online retailer operating in Australia with a market capitalization of A$458.81 million.

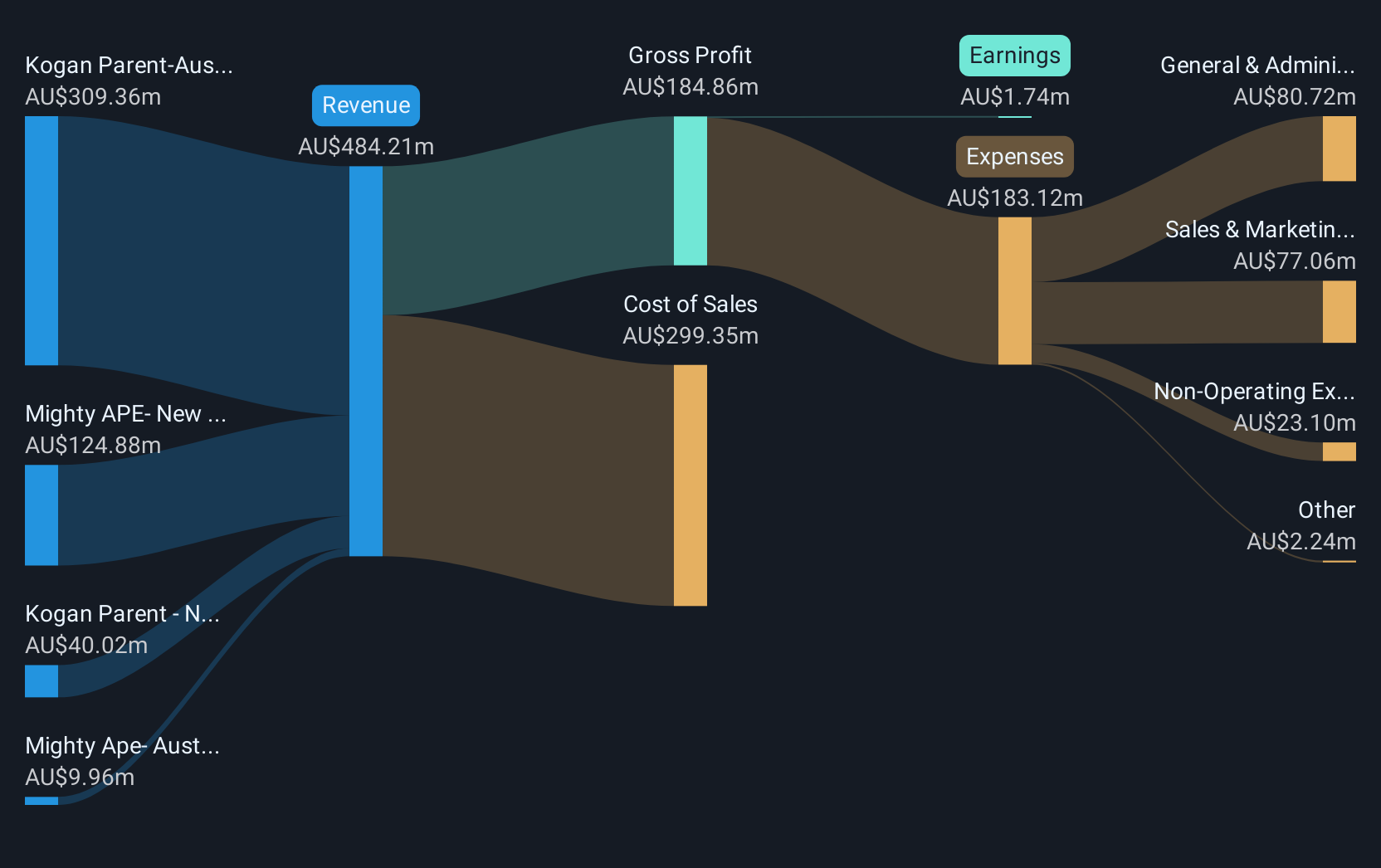

Operations: The company's revenue segments include Mighty Ape in Australia with A$11.20 million, Kogan Parent in Australia with A$277.82 million, Mighty Ape in New Zealand with A$135.34 million, and Kogan Parent in New Zealand with A$35.35 million.

Market Cap: A$458.81M

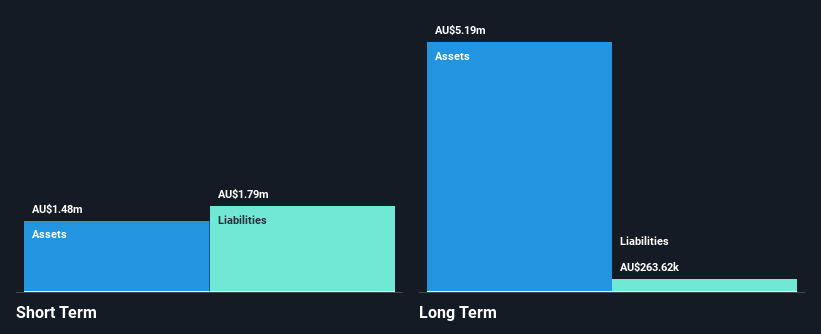

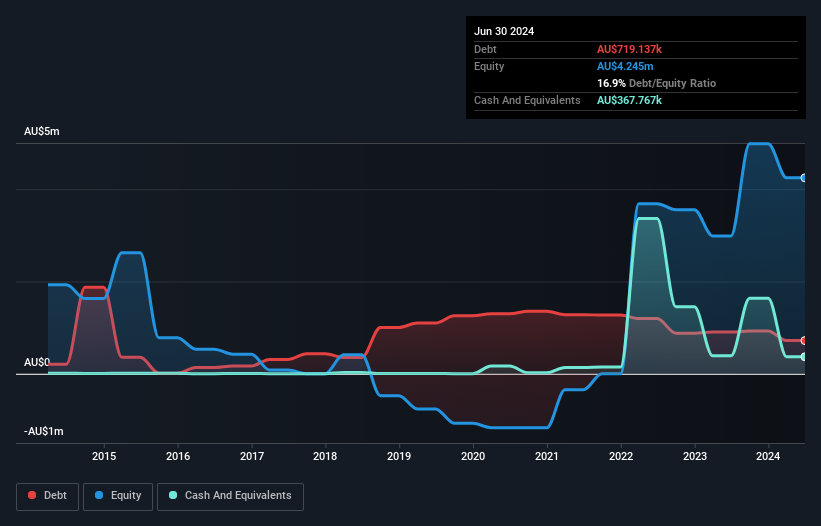

Kogan.com, with a market cap of A$458.81 million, has recently turned profitable and shows potential for future growth with earnings forecasted to rise by 32.08% annually. The company operates without debt, which simplifies its financial management and reduces risk exposure. Its short-term assets of A$125.2 million cover both short-term and long-term liabilities comfortably, indicating solid financial health. Although the Return on Equity is low at 0.07%, the absence of significant shareholder dilution in the past year is positive for investor confidence. However, its dividend yield of 3.26% lacks sufficient earnings coverage, suggesting caution for income-focused investors.

- Jump into the full analysis health report here for a deeper understanding of Kogan.com.

- Gain insights into Kogan.com's future direction by reviewing our growth report.

Scorpion Minerals (ASX:SCN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Scorpion Minerals Limited is involved in the exploration and development of mineral resources in Australia, with a market cap of A$11.35 million.

Operations: Scorpion Minerals Limited has not reported any revenue segments.

Market Cap: A$11.35M

Scorpion Minerals Limited, with a market cap of A$11.35 million, operates as a pre-revenue entity focused on mineral exploration and development. The company recently filed for a follow-on equity offering worth A$1.5 million, indicating efforts to bolster its financial position amidst limited cash runway and high volatility in share price. While the board is experienced with an average tenure of four years, the management team is relatively new with less than two years' experience on average. Scorpion's satisfactory net debt to equity ratio contrasts its negative return on equity due to unprofitability and insufficient short-term asset coverage for liabilities.

- Get an in-depth perspective on Scorpion Minerals' performance by reading our balance sheet health report here.

- Assess Scorpion Minerals' previous results with our detailed historical performance reports.

Turning Ideas Into Actions

- Explore the 1,033 names from our ASX Penny Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SCN

Scorpion Minerals

Engages in the exploration and development of mineral resources in Australia.

Medium-low risk with mediocre balance sheet.

Market Insights

Community Narratives