- Australia

- /

- Specialty Stores

- /

- ASX:JBH

JB Hi-Fi (ASX:JBH) Faces Financial Challenges Despite Strong Sales Growth and Strategic Acquisitions

Reviewed by Simply Wall St

JB Hi-Fi (ASX:JBH) is navigating a dynamic environment marked by both opportunities and challenges. Recent highlights include a strategic acquisition of e&s and strong sales growth, juxtaposed against a decline in gross profit and increased operational costs. In the discussion that follows, we will explore JB Hi-Fi's core advantages, financial challenges, growth opportunities, and market volatility to provide a comprehensive overview of the company's current business situation.

Dive into the specifics of JB Hi-Fi here with our thorough analysis report.

Core Advantages Driving Sustained Success for JB Hi-Fi

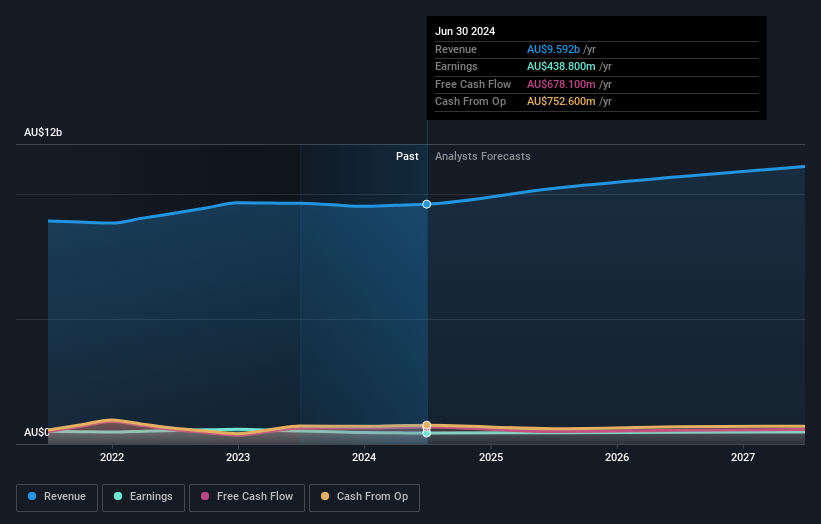

Sales growth remains a notable strength, with JB Australia reporting a 1% increase to $6.61 billion, driven by continued customer demand for technology and consumer electronic products. Operating cash flows and cash conversion have been strong, underscoring financial health. The company's large, engaged, and diversified customer base across its brands enhances its market position, allowing suppliers to execute promotions and new product launches at scale. Sustainability initiatives also play a crucial role, as the company focuses on long-term growth and positive impacts on the community and environment. The strategic acquisition of e&s, which complements existing brands, further strengthens JB Hi-Fi's market presence. Trust from customers continues to support sales growth, reflecting the company's strong brand reputation.

Challenges Constraining JB Hi-Fi's Potential

JB Hi-Fi faces several financial challenges. Gross profit decreased by 0.9% to $1.47 billion, with the gross profit margin down 42 basis points to 22.2%. Earnings before interest and taxes (EBIT) fell by 11% to $491.2 million, and the EBIT margin dropped by 100 basis points to 7.4%. The cost of doing business increased to 12.6%, growing 5.5% in absolute terms. Performance issues in New Zealand also persist, with EBIT at negative NZD 2.3 million, down NZD 6.7 million. Additionally, JB Hi-Fi is currently trading above its estimated fair value of A$78.55, with a Price-To-Earnings Ratio of 20.2x, making it expensive compared to industry and peer averages.

Areas for Expansion and Innovation for JB Hi-Fi

Future growth opportunities are abundant. The company plans to open five new stores in FY '25, indicating a commitment to expansion. Market trends suggest potential for further market share gains. The anticipated growth in AI devices is expected to positively impact the computer category. The acquisition of e&s offers prospects for national growth beyond Victoria. Enhancing sales channels, including phone, chat, and video, aims to meet evolving customer shopping needs. These strategic moves are poised to bolster JB Hi-Fi's market position and capitalize on emerging opportunities.

Market Volatility Affecting JB Hi-Fi's Position

Competitive pressures remain a significant threat, with the need for aggressive promotions during tough times. Economic factors also play a role, as consumers are highly price-conscious and seek value. Market risks are evident, with a more balanced weekday and weekend sales portfolio potentially impacting overall performance. Operational risks are highlighted by the company's high internal standards and accountability. These external factors pose challenges to JB Hi-Fi's growth and market share, necessitating vigilant management and strategic adjustments.

To gain deeper insights into JB Hi-Fi's historical performance, explore our detailed analysis of past performance. To dive deeper into how JB Hi-Fi's valuation metrics are shaping its market position, check out our detailed analysis of JB Hi-Fi's Valuation.Conclusion

JB Hi-Fi's sustained success is driven by its strong sales growth, financial health, and strategic acquisitions, which enhance its market position and customer trust. However, the company faces significant financial challenges, including declining gross profit and EBIT, as well as increased operational costs and underperformance in New Zealand. While there are promising opportunities for expansion and innovation, such as new store openings and enhanced sales channels, competitive pressures and economic factors pose risks. Notably, JB Hi-Fi's current trading price above its estimated fair value of A$78.55, with a Price-To-Earnings Ratio of 20.2x, suggests that the market may be pricing in these future growth prospects, potentially limiting immediate upside. This balance of strengths and challenges will shape JB Hi-Fi's future performance and strategic decisions.

Summing It All Up

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

If you're looking to trade JB Hi-Fi, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About ASX:JBH

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives