- Australia

- /

- Specialty Stores

- /

- ASX:CTT

What You Can Learn From Cettire Limited's (ASX:CTT) P/S After Its 29% Share Price Crash

Unfortunately for some shareholders, the Cettire Limited (ASX:CTT) share price has dived 29% in the last thirty days, prolonging recent pain. Longer-term, the stock has been solid despite a difficult 30 days, gaining 14% in the last year.

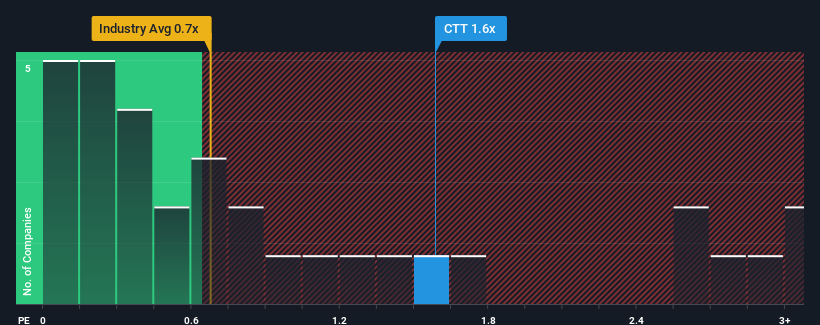

In spite of the heavy fall in price, given close to half the companies operating in Australia's Specialty Retail industry have price-to-sales ratios (or "P/S") below 0.7x, you may still consider Cettire as a stock to potentially avoid with its 1.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Cettire

What Does Cettire's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Cettire has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Cettire.How Is Cettire's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Cettire's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 105% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 36% per year during the coming three years according to the five analysts following the company. With the industry only predicted to deliver 7.7% each year, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Cettire's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Cettire's P/S Mean For Investors?

There's still some elevation in Cettire's P/S, even if the same can't be said for its share price recently. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Cettire maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Specialty Retail industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware Cettire is showing 1 warning sign in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:CTT

Cettire

Engages in the online luxury goods retailing business in Australia, the United States, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion