- Australia

- /

- Specialty Stores

- /

- ASX:CTT

Cettire (ASX:CTT) Valuation in Focus After S&P/ASX Index Inclusion Spurs Market Interest

Reviewed by Kshitija Bhandaru

Cettire (ASX:CTT) is suddenly front and center for Australian investors after the company was added to the S&P/ASX Emerging Companies Index. Inclusion in a major index often shines a spotlight on a business, drawing both institutional capital and everyday market watchers who may have overlooked it before. For anyone paying close attention to where growth might emerge in the retail sector, this move could be a timely signal to revisit Cettire’s story.

This surge in attention comes after a mixed period for the stock. Shares have rebounded over the past month, climbing more than 40%, and nearly doubled over three months, yet are still down over the past year. Volatility aside, the fresh momentum, combined with last year’s negative return, suggests the market’s perception of risk and growth prospects for Cettire may be evolving. The company has also posted strong net income growth over the latest year, which raises the stakes for how investors might value its future potential.

So after this wave of renewed attention and price swings, is Cettire a buy now that it’s in the index, or is the market already looking ahead to what comes next?

Most Popular Narrative: 5.1% Overvalued

Analysts believe Cettire’s current share price runs slightly ahead of its calculated fair value. This is based on future earnings growth and profit margin forecasts, using a discount rate grounded in recent analyst reports.

Ongoing investment in proprietary technology and platform capabilities (even as OpEx is optimized elsewhere) fosters enhanced user experience and operational efficiency. This enables improved conversion rates and scalable growth at higher operating leverage, which could potentially boost net margins over time.

Curious how Cettire’s digital edge and strategic platform bets could sway its future profits? The most popular narrative leans on bolder analyst forecasts for both expansion and operational leverage. But what exactly do these projections mean for the company’s bottom line? Economic assumptions and margin targets play a starring role. Want the full picture? Unpack the narrative’s core financial logic to see what’s driving this above-market valuation.

Result: Fair Value of $0.69 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing weakness in global luxury demand and Cettire’s reliance on third-party suppliers could limit revenue growth and pose challenges to its long-term profitability outlook.

Find out about the key risks to this Cettire narrative.Another View: What About Cash Flow?

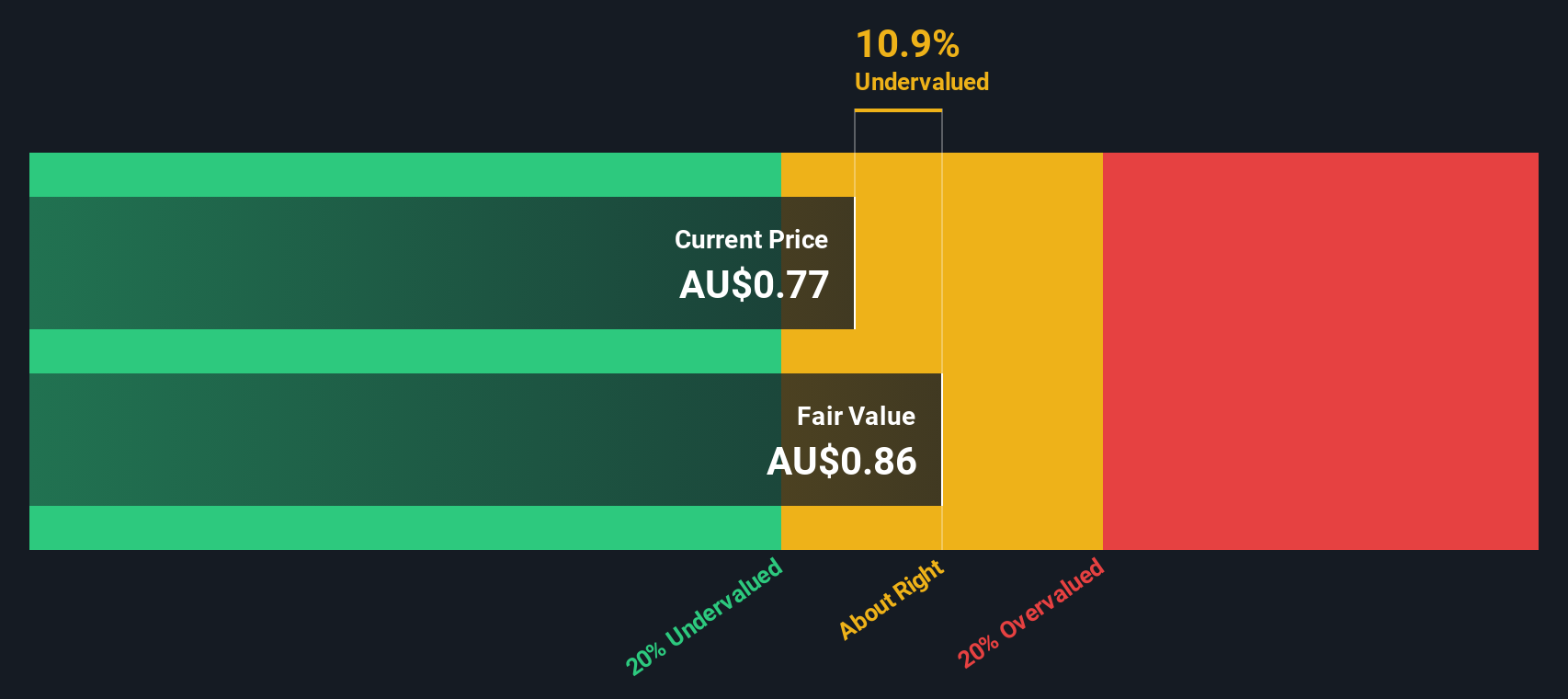

Taking a different angle, our DCF model suggests the market might actually be underestimating Cettire’s intrinsic value. Instead of focusing on forecast multiples, this approach weighs future cash flows. Which view seems more convincing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Cettire Narrative

If you're not convinced by these takes or prefer digging into the details on your own, you can shape a personalised narrative in just a few minutes by using Do it your way.

A great starting point for your Cettire research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let exciting opportunities pass you by. Put your curiosity to work. There are dynamic investment strategies you can explore right now using Simply Wall Street’s smart screeners.

- Unlock game-changing potential by browsing AI penny stocks, which are driving innovation in artificial intelligence and reshaping global industries.

- Tap into income opportunities by checking out dividend stocks with yields > 3%, featuring companies with strong cash flow and attractive yields above 3%.

- Spot undervalued gems before the market catches on by using undervalued stocks based on cash flows and reveal stocks trading below their intrinsic value based on solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CTT

Cettire

Engages in the online luxury goods retailing business in Australia, the United States, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives