- Australia

- /

- Specialty Stores

- /

- ASX:AX1

Accent Group Limited's (ASX:AX1) Stock Has Seen Strong Momentum: Does That Call For Deeper Study Of Its Financial Prospects?

Accent Group (ASX:AX1) has had a great run on the share market with its stock up by a significant 16% over the last three months. We wonder if and what role the company's financials play in that price change as a company's long-term fundamentals usually dictate market outcomes. Specifically, we decided to study Accent Group's ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

View our latest analysis for Accent Group

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Accent Group is:

18% = AU$77m ÷ AU$429m (Based on the trailing twelve months to June 2021).

The 'return' refers to a company's earnings over the last year. One way to conceptualize this is that for each A$1 of shareholders' capital it has, the company made A$0.18 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

A Side By Side comparison of Accent Group's Earnings Growth And 18% ROE

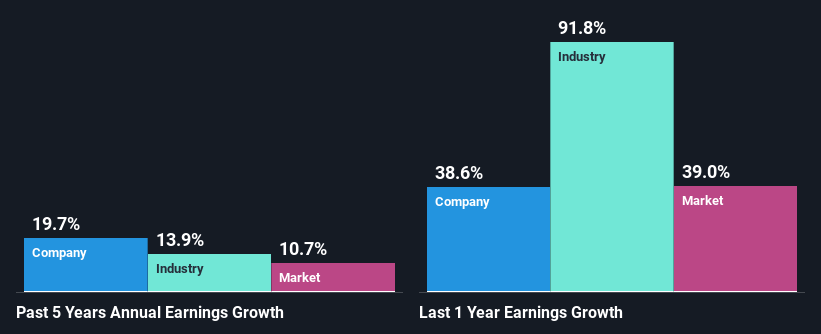

At first glance, Accent Group seems to have a decent ROE. Even so, when compared with the average industry ROE of 24%, we aren't very excited. However, the moderate 20% net income growth seen by Accent Group over the past five years is definitely a positive. We reckon that there could be other factors at play here. Such as - high earnings retention or an efficient management in place. However, not to forget, the company does have a decent ROE to begin with, just that it is lower than the industry average. So this also does lend some color to the fairly high earnings growth seen by the company.

Next, on comparing with the industry net income growth, we found that Accent Group's growth is quite high when compared to the industry average growth of 14% in the same period, which is great to see.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. What is AX1 worth today? The intrinsic value infographic in our free research report helps visualize whether AX1 is currently mispriced by the market.

Is Accent Group Using Its Retained Earnings Effectively?

Accent Group has a significant three-year median payout ratio of 85%, meaning that it is left with only 15% to reinvest into its business. This implies that the company has been able to achieve decent earnings growth despite returning most of its profits to shareholders.

Moreover, Accent Group is determined to keep sharing its profits with shareholders which we infer from its long history of paying a dividend for at least ten years. Our latest analyst data shows that the future payout ratio of the company over the next three years is expected to be approximately 80%. Regardless, the future ROE for Accent Group is predicted to rise to 22% despite there being not much change expected in its payout ratio.

Summary

On the whole, we do feel that Accent Group has some positive attributes. Especially the substantial growth in earnings backed by a decent ROE. Despite the company reinvesting only a small portion of its profits, it still has managed to grow its earnings so that is appreciable. With that said, the latest industry analyst forecasts reveal that the company's earnings growth is expected to slow down. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:AX1

Accent Group

Engages in the retail, distribution, and franchise of lifestyle footwear, apparel, and accessories in Australia and New Zealand.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026