- Australia

- /

- Oil and Gas

- /

- ASX:PCL

ASX Penny Stocks To Watch In April 2025

Reviewed by Simply Wall St

The Australian market has shown resilience, with the ASX200 closing up 0.36% at 7,997 points, driven by gains in the Energy and IT sectors. The term 'penny stocks' might feel like a relic of past market eras, but the potential they represent is as real as ever. Typically referring to smaller or relatively new companies, these stocks can provide a mix of affordability and growth potential when paired with strong financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.63 | A$131.29M | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.50 | A$70.76M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.46 | A$379.29M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.60 | A$115.38M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.33 | A$2.66B | ✅ 4 ⚠️ 1 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.45 | A$163.7M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$1.835 | A$616.86M | ✅ 4 ⚠️ 3 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.715 | A$840.49M | ✅ 5 ⚠️ 3 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.61 | A$1.19B | ✅ 5 ⚠️ 1 View Analysis > |

| LaserBond (ASX:LBL) | A$0.375 | A$44.12M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 989 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Adairs (ASX:ADH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Adairs Limited is a specialty retailer offering home furnishings, furniture, and decoration products across Australia and New Zealand, with a market cap of A$406.51 million.

Operations: The company's revenue is derived from three segments: Focus, generating A$125.34 million; Mocka, contributing A$53.57 million; and Adairs, which accounts for A$423.56 million.

Market Cap: A$406.51M

Adairs Limited, with a market cap of A$406.51 million, shows mixed signals for penny stock investors. Recent earnings reported sales of A$310.51 million and net income of A$19.38 million, reflecting growth from the previous year despite a 6.7% annual decline over five years. The company's debt is well managed with operating cash flow covering it at 114.3%, but short-term assets do not cover liabilities, posing potential liquidity concerns. Adairs trades significantly below estimated fair value and offers dividends, though its track record is unstable; however, forecasted earnings growth appears promising at 15.97% annually.

- Click here to discover the nuances of Adairs with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Adairs' future.

Jupiter Mines (ASX:JMS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jupiter Mines Limited is an independent mining company based in Australia, with a market capitalization of A$294.16 million.

Operations: The company generates revenue from its manganese operations in South Africa, amounting to A$9.49 million.

Market Cap: A$294.16M

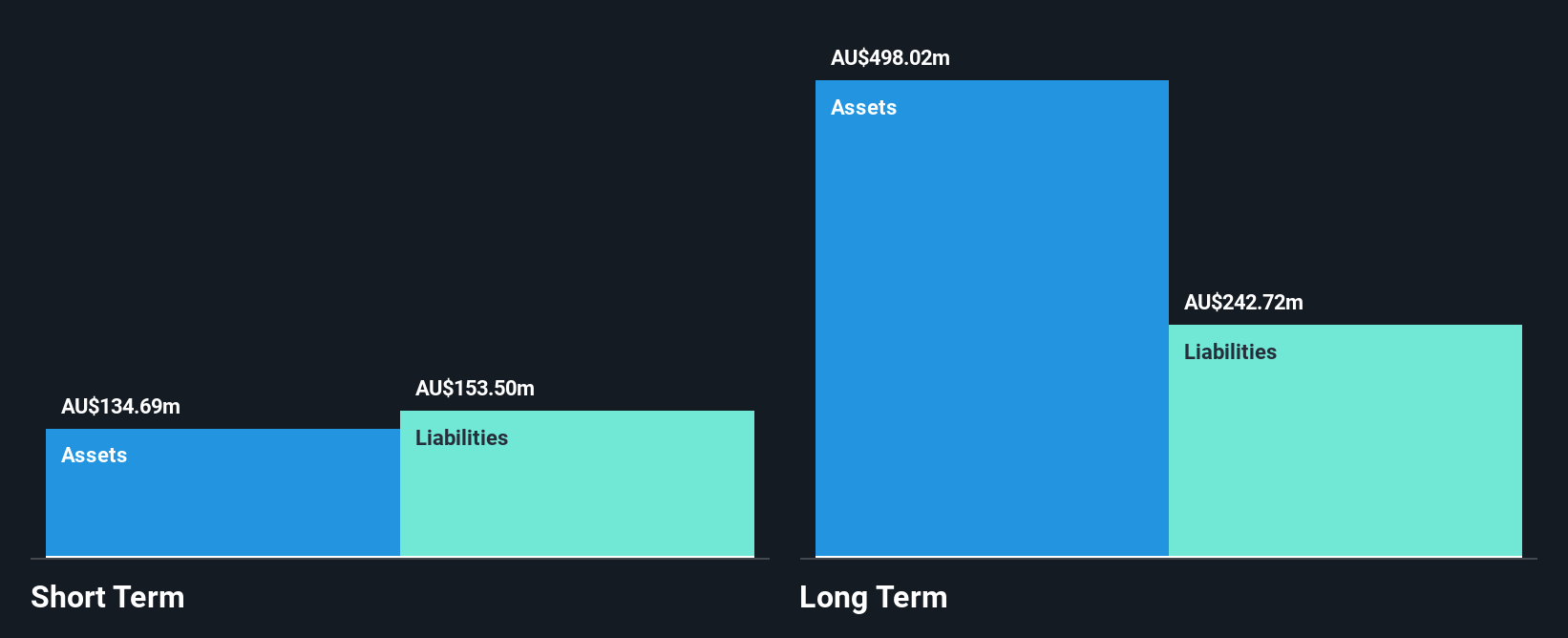

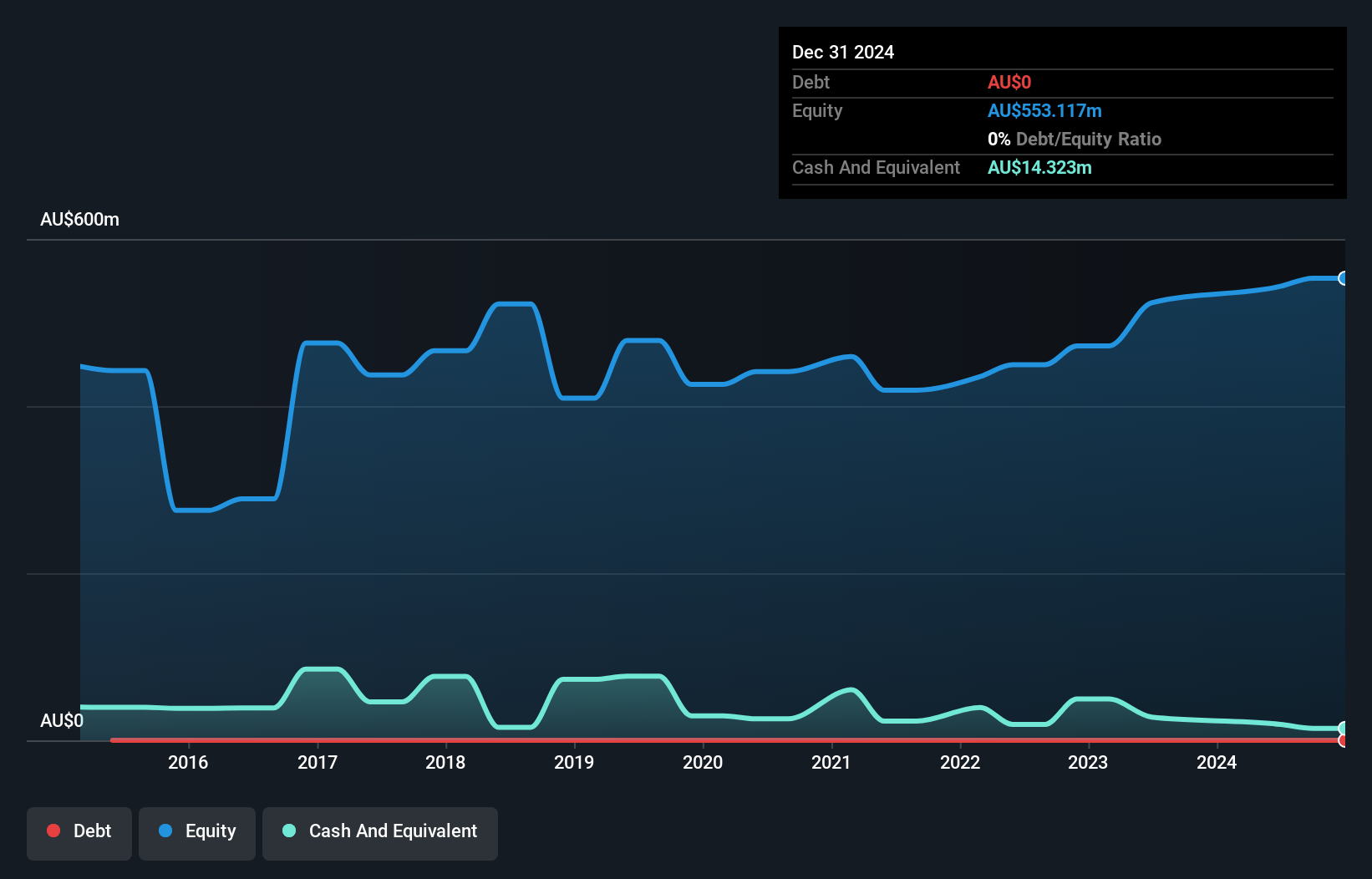

Jupiter Mines, with a market cap of A$294.16 million, presents a mixed picture for penny stock investors. The company is debt-free and its short-term assets exceed both short-term and long-term liabilities, indicating financial stability. However, earnings have declined by 11.6% annually over five years and recent profit margins are lower than the previous year. Despite trading at 35.9% below estimated fair value, its return on equity remains low at 7%. Recent board changes include the appointment of Kiho Han as Director in April 2025, reflecting ongoing management restructuring amidst these challenges.

- Dive into the specifics of Jupiter Mines here with our thorough balance sheet health report.

- Assess Jupiter Mines' future earnings estimates with our detailed growth reports.

Pancontinental Energy (ASX:PCL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pancontinental Energy NL focuses on the exploration of oil and gas properties in Namibia and Australia, with a market cap of A$65.09 million.

Operations: Currently, the company does not report any revenue segments.

Market Cap: A$65.09M

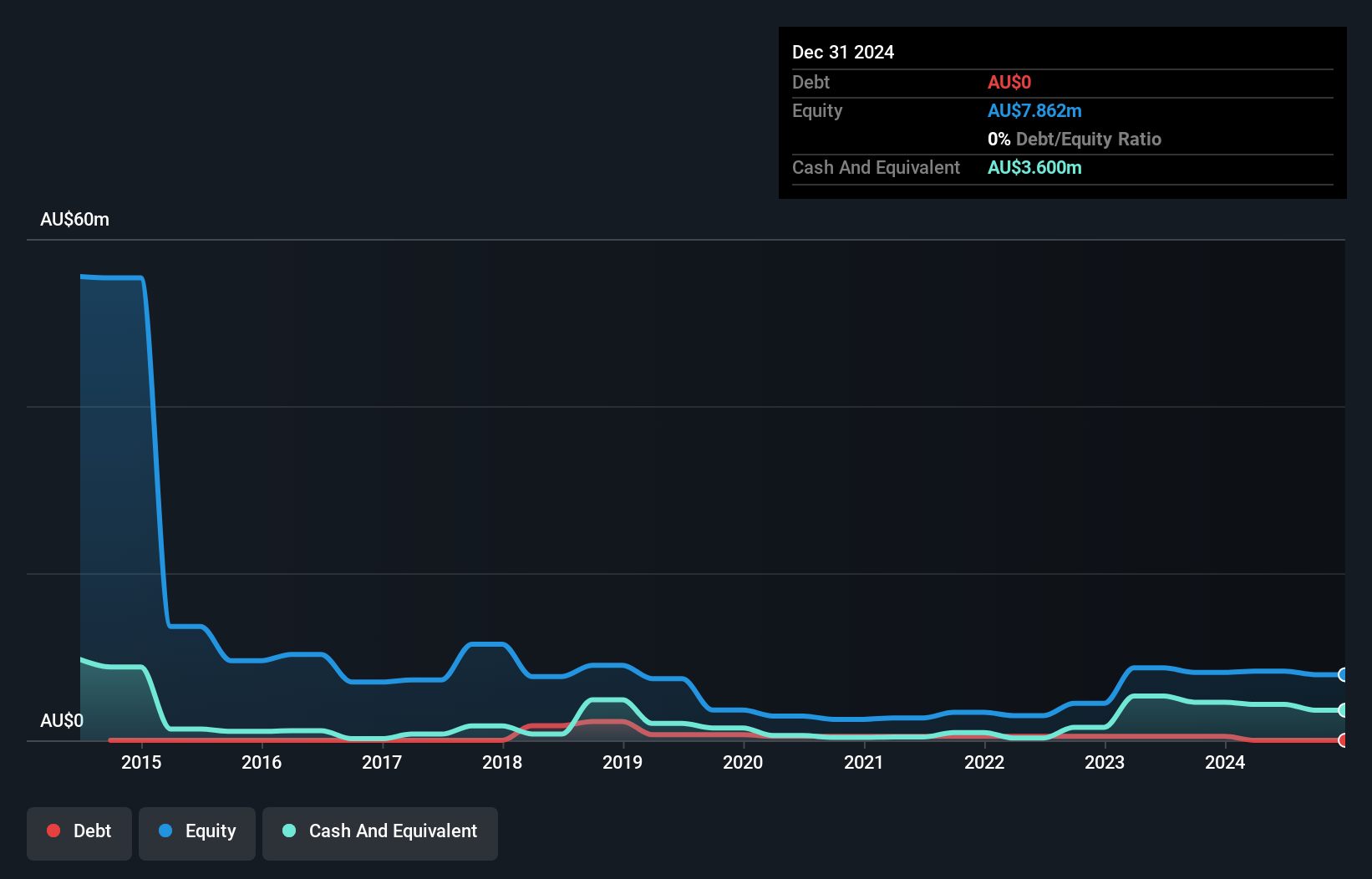

Pancontinental Energy, with a market cap of A$65.09 million, is pre-revenue and currently unprofitable but has shown progress by reducing losses at a rate of 6.4% per year over the past five years. The company remains debt-free, with short-term assets of A$3.7 million comfortably covering both its short-term and long-term liabilities. Despite increased weekly volatility from 16% to 26%, shareholders haven't faced significant dilution recently, and the firm maintains a cash runway exceeding one year based on current free cash flow trends. Its seasoned board boasts an average tenure of 16.3 years, indicating strong governance stability amidst ongoing challenges in profitability improvement efforts.

- Click to explore a detailed breakdown of our findings in Pancontinental Energy's financial health report.

- Learn about Pancontinental Energy's historical performance here.

Next Steps

- Investigate our full lineup of 989 ASX Penny Stocks right here.

- Want To Explore Some Alternatives? These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PCL

Pancontinental Energy

Engages in the exploration of oil and gas properties in Namibia and Australia.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives