We've lost count of how many times insiders have accumulated shares in a company that goes on to improve markedly. On the other hand, we'd be remiss not to mention that insider sales have been known to precede tough periods for a business. So shareholders might well want to know whether insiders have been buying or selling shares in Servcorp Limited (ASX:SRV).

Do Insider Transactions Matter?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, such insiders must disclose their trading activities, and not trade on inside information.

We would never suggest that investors should base their decisions solely on what the directors of a company have been doing. But it is perfectly logical to keep tabs on what insiders are doing. For example, a Columbia University study found that 'insiders are more likely to engage in open market purchases of their own company’s stock when the firm is about to reveal new agreements with customers and suppliers'.

See our latest analysis for Servcorp

The Last 12 Months Of Insider Transactions At Servcorp

Over the last year, we can see that the biggest insider purchase was by Founder Alfred Moufarrige for AU$1.4m worth of shares, at about AU$2.80 per share. That means that an insider was happy to buy shares at around the current price of AU$3.23. That means they have been optimistic about the company in the past, though they may have changed their mind. We do always like to see insider buying, but it is worth noting if those purchases were made at well below today's share price, as the discount to value may have narrowed with the rising price. Happily, the Servcorp insiders decided to buy shares at close to current prices. We note that Alfred Moufarrige was both the biggest buyer and the biggest seller.

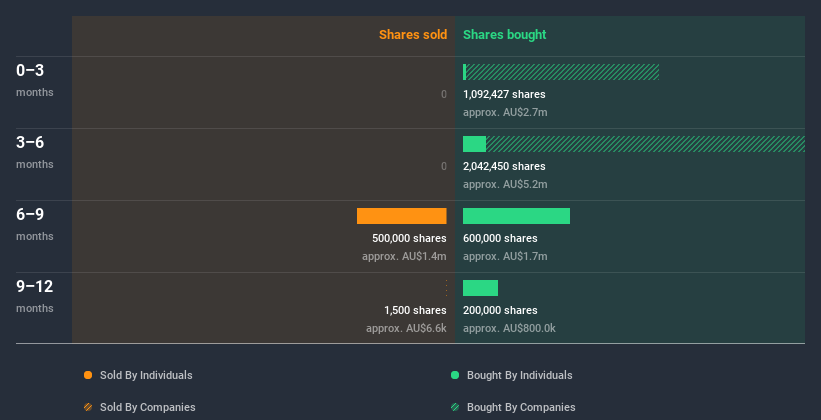

In the last twelve months insiders purchased 953.45k shares for AU$2.9m. But they sold 500.00k shares for AU$1.4m. In the last twelve months there was more buying than selling by Servcorp insiders. The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

Servcorp is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Servcorp Insiders Bought Stock Recently

There was some insider buying at Servcorp over the last quarter. Independent Non-Executive Director Tony McGrath purchased AU$56k worth of shares in that period. We like it when there are only buyers, and no sellers. But in this case the amount purchased means the recent transaction may not be very meaningful on its own.

Does Servcorp Boast High Insider Ownership?

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Insiders own 2.3% of Servcorp shares, worth about AU$7.1m, according to our data. However, it's possible that insiders might have an indirect interest through a more complex structure. Overall, this level of ownership isn't that impressive, but it's certainly better than nothing!

So What Does This Data Suggest About Servcorp Insiders?

The recent insider purchase is heartening. And an analysis of the transactions over the last year also gives us confidence. While the overall levels of insider ownership are below what we'd like to see, the history of transactions imply that Servcorp insiders are reasonably well aligned, and optimistic for the future. While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. For example - Servcorp has 3 warning signs we think you should be aware of.

Of course Servcorp may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading Servcorp or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:SRV

Servcorp

Provides executive serviced and virtual offices, coworking and IT, communications, and secretarial services in Australia, New Zealand, Southeast Asia, the United States, Europe, the Middle East, North Asia, and internationally.

Outstanding track record, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026