- Australia

- /

- Real Estate

- /

- ASX:SRV

Is Servcorp Limited's (ASX:SRV) Recent Performancer Underpinned By Weak Financials?

With its stock down 11% over the past week, it is easy to disregard Servcorp (ASX:SRV). Given that stock prices are usually driven by a company’s fundamentals over the long term, which in this case look pretty weak, we decided to study the company's key financial indicators. In this article, we decided to focus on Servcorp's ROE.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

Check out our latest analysis for Servcorp

How Do You Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Servcorp is:

9.8% = AU$20m ÷ AU$203m (Based on the trailing twelve months to December 2021).

The 'return' is the profit over the last twelve months. Another way to think of that is that for every A$1 worth of equity, the company was able to earn A$0.10 in profit.

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of Servcorp's Earnings Growth And 9.8% ROE

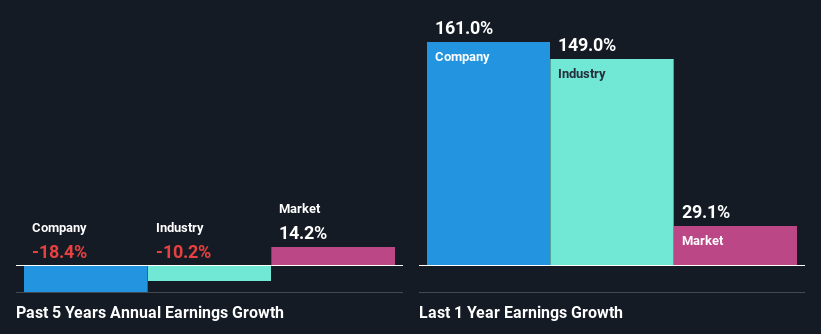

When you first look at it, Servcorp's ROE doesn't look that attractive. However, the fact that the company's ROE is higher than the average industry ROE of 7.4%, is definitely interesting. But seeing Servcorp's five year net income decline of 18% over the past five years, we might rethink that. Remember, the company's ROE is a bit low to begin with, just that it is higher than the industry average. So that could be one of the factors that are causing earnings growth to shrink.

Next, when we compared with the industry, which has shrunk its earnings at a rate of 10% in the same period, we still found Servcorp's performance to be quite bleak, because the company has been shrinking its earnings faster than the industry.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. Is Servcorp fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Servcorp Making Efficient Use Of Its Profits?

With a three-year median payout ratio as high as 111%,Servcorp's shrinking earnings don't come as a surprise as the company is paying a dividend which is beyond its means. Paying a dividend beyond their means is usually not viable over the long term.

In addition, Servcorp has been paying dividends over a period of at least ten years suggesting that keeping up dividend payments is way more important to the management even if it comes at the cost of business growth. Existing analyst estimates suggest that the company's future payout ratio is expected to drop to 66% over the next three years. As a result, the expected drop in Servcorp's payout ratio explains the anticipated rise in the company's future ROE to 15%, over the same period.

Conclusion

Overall, we would be extremely cautious before making any decision on Servcorp. While its ROE is pretty moderate, the company is retaining very little of its profits, meaning very little of its profits are being reinvested into the business. This explains the lack or absence of growth in its earnings. That being so, the latest industry analyst forecasts show that the analysts are expecting to see a huge improvement in the company's earnings growth rate. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SRV

Servcorp

Provides executive serviced and virtual offices, coworking and IT, communications, and secretarial services in Australia, New Zealand, Southeast Asia, the United States, Europe, the Middle East, North Asia, and internationally.

Outstanding track record, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026